KFF has carried out this annual survey of employer-sponsored well being advantages since 1999. Since 2020, KFF has employed Davis Analysis LLC (Davis) to subject the survey. From January to July 2025, Davis interviewed enterprise house owners in addition to human useful resource and advantages managers at 1,862 companies.

SURVEY TOPICS

The survey includes questions on the cost of health insurance, offer rates, coverage, eligibility, plan type enrollment, premium contributions, employee cost sharing, prescription drug coverage, retiree health benefits, and wellness programs.

Firms that offer health benefits are asked about the attributes of their largest HMO, PPO, POS and HDHP/SO plans. Exclusive provider organizations (EPOs) are grouped with HMOs, and conventional (or indemnity) plans are grouped with PPOs.

Plan Definitions:

- HMO (Health Maintenance Organization): A plan that does not cover non-emergency services provided out of network.

- PPO (Preferred Provider Organization): A plan that allows use of both in-network and out-of-network providers, with lower cost sharing for in-network services and no requirement for a primary care referral.

- POS (Point-of-Service Plan): A plan with lower cost sharing for in-network services, but that requires a primary care gatekeeper for specialist or hospital visits.

- HDHP/SO (High-Deductible Health Plan with a Savings Option): A plan with a deductible of at least $1,000 for single coverage or $2,000 for family coverage, paired with either a health reimbursement arrangement (HRA) or a health savings account (HSA). While HRAs can be offered with non-HDHPs, the survey collects data only on HRAs paired with HDHPs. (See the introduction to Section 8 for more detail on HDHPs, HRAs, and HSAs.)

To reduce respondent burden, questions on cost sharing for office visits, hospitalization, outpatient surgery, and prescription drugs are limited to the firm’s largest plan. Firms offering multiple plan types report premium contributions and deductibles for their two largest plans. Within each plan type, respondents are asked about the plan with the highest enrollment.

Firms report attributes of their current plans as of the time of the interview. While the survey fielding begins in January, many firms have plan years that do not align with the calendar year. In some cases, firms may report data based on the prior year’s plan. As a result, some reported attributes—such as HSA deductible thresholds—may not align with current regulatory requirements. Additionally, plan decisions may have been made months prior to the interview.

SAMPLE DESIGN

The sample for the annual KFF Employer Health Benefits Survey includes private firms and nonfederal government employers with ten or more employees. The universe is defined by the U.S. Census’ 2021 Statistics of U.S. Businesses (SUSB) for private firms and the 2022 Census of Governments (COG) for non-federal public employers. At the time of sample design (December 2024), this data represented the most current information on the number of public and private firms. The sample size is determined based on the number of firms needed to achieve a target number of completes across five firm-size categories and whether the firm was located in California.

We attempted to re-interview prior survey respondents who participated in either the 2023 or 2024 survey, or both. In total,* 186 firms participated in 2023,* 423 firms participated in 2024, and* 693 firms participated in both years.

Non-panel firms were randomly selected within size and industry groups.

Since 2010, the sample has been drawn from a Dynata list (based on a census compiled by Dun & Bradstreet) of the nation’s private employers, and from the COG for public employers. Starting in 2025, we included an augmented sample of 50 firms from the Forbes America’s Largest Private Companies list. This list includes U.S.-based firms with annual revenue of $2 billion or more and is intended to complement the Dynata sample frame.

To increase precision, the sample is stratified by ten industry categories and six size categories. Education is treated as a separate category for sampling but included in the “Service” category for weighting.

For more information on changes to sampling methods over time, please consult the extended methods (https://kff.org/ehbs) which describes modifications made in annually’s survey.

RESPONSE RATE

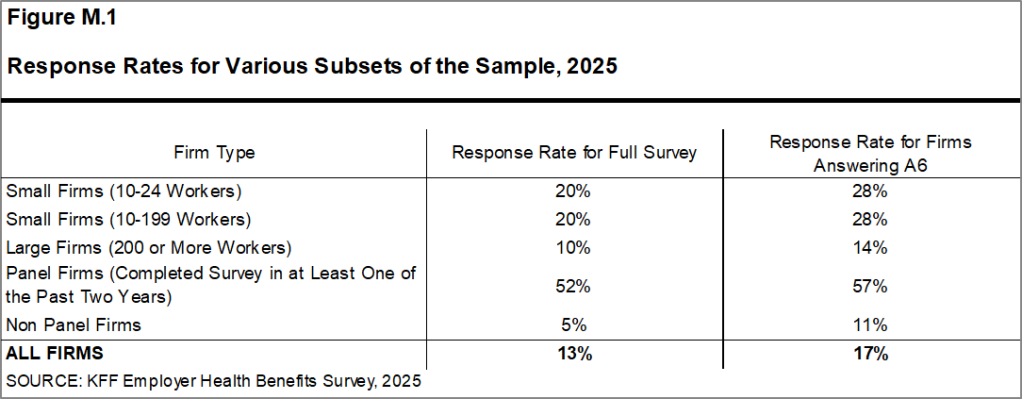

Response rates are calculated using a CASRO method, which accounts for firm eligibility in the study. The rate is computed by dividing the number of completes by the sum of refusals and the estimated number of eligible firms among those with unknown eligibility. The overall response rate is 13% [Figure M.1]. As in prior years, the response fee for panel companies is larger than for non-panel companies.

Much like different employer and family surveys, response charges have declined over time. Since 2017, we’ve got tried to extend the variety of completes by increasing the variety of non-panel companies within the pattern. Whereas this technique improves the precision of estimates—significantly for subgroups—it tends to cut back the general response fee.

Most survey questions are requested solely of companies that supply well being advantages. A complete of 1,610 of the 1,862 companies responding to the complete survey indicated that they provide well being advantages.

We requested one query of all companies we contacted by telephone, even when they declined to finish the complete survey: “Does your organization supply a medical insurance program as a profit to any of your workers?” A complete of two,560 companies responded to this query, together with 1,862 full survey respondents and 698 companies who responded to this query solely.

These responses are included within the estimates of the share of companies providing well being advantages offered in Chapter 2. The response fee for this query is 17.4% [Figure M.1].

Determine M.1: Response Charges for Varied Subsets of the Pattern, 2025

Whereas response charges have decreased, parts of the survey design restrict the potential influence of a response bias. Most main statistics are weighted by the variety of lined employees at a agency. Collectively, 3,600,000 of the 67,600,000 employees lined by their very own employer’s well being advantages nationwide have been employed at companies that accomplished the survey. A very powerful statistic weighted by the variety of employers is the supply fee. Corporations that don’t full the complete survey are nonetheless requested whether or not they supply well being advantages, making certain a bigger pattern. As in earlier years, most responding companies are very small. Consequently, fluctuations within the supply fee for these small companies considerably affect the general supply fee.

FIRM SIZES AND KEY DEFINITIONS

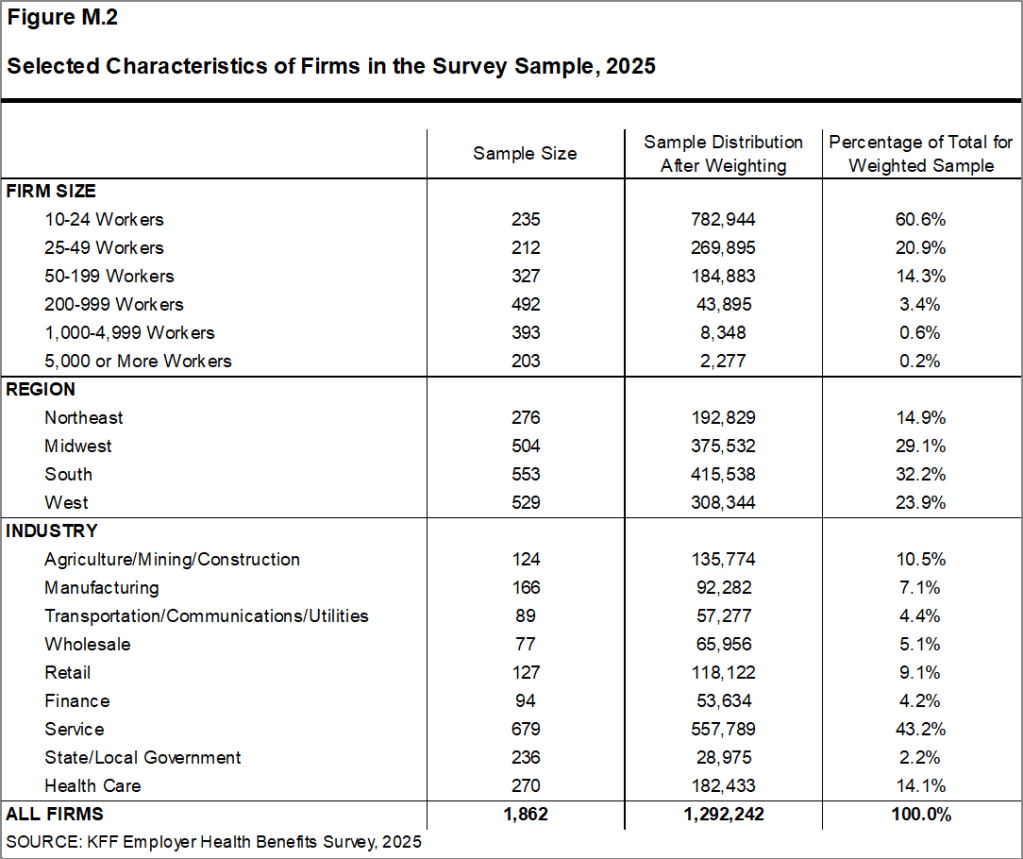

Throughout the report, we present data by firm size, region, and industry; [Figure M.2] shows chosen traits of the pattern. Until in any other case famous, agency measurement is outlined as follows: small companies have 10-199 employees, and huge companies have 200 or extra employees.

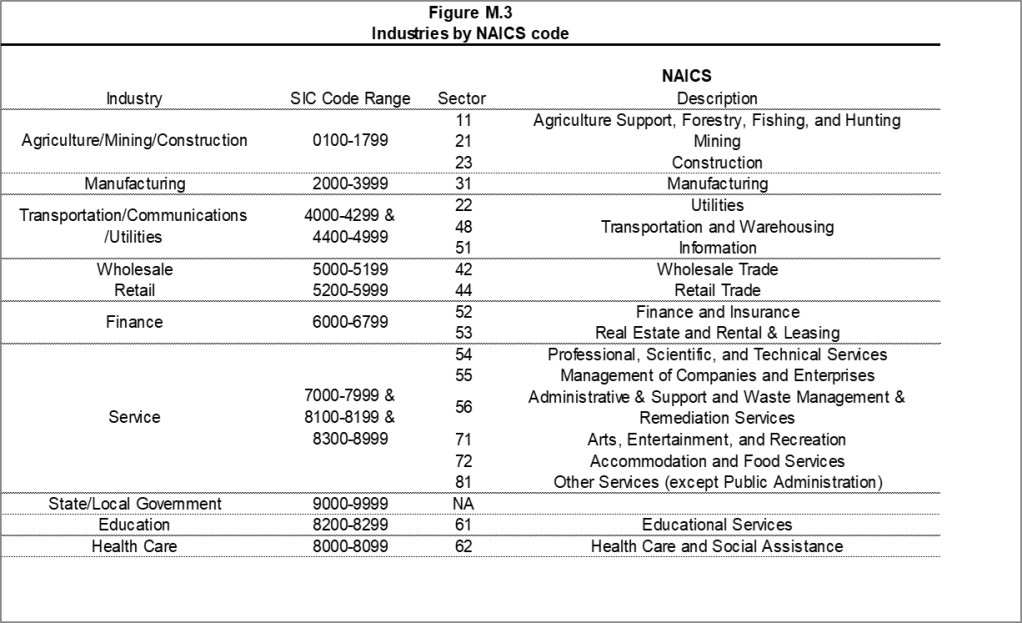

A agency’s major trade classification relies on Dynata’s designation, which in flip is derived from the U.S. Census Bureau’s North American Business Classification System (NAICS) [Figure M.3]. Agency possession kind, common wage degree, and workforce age are primarily based on respondents’ self-reported info.

Whereas there may be appreciable overlap between companies categorized as “State/Native Authorities” within the trade classification and people recognized as publicly owned, the 2 classes usually are not an identical. For instance, public faculty districts are included within the “Service” trade class, though they’re publicly owned.

Household protection is outlined as medical insurance protection for a household of 4.

Determine M.2: Chosen Traits of Corporations within the Survey Pattern, 2025

Determine M.3: Industries by NAICS code

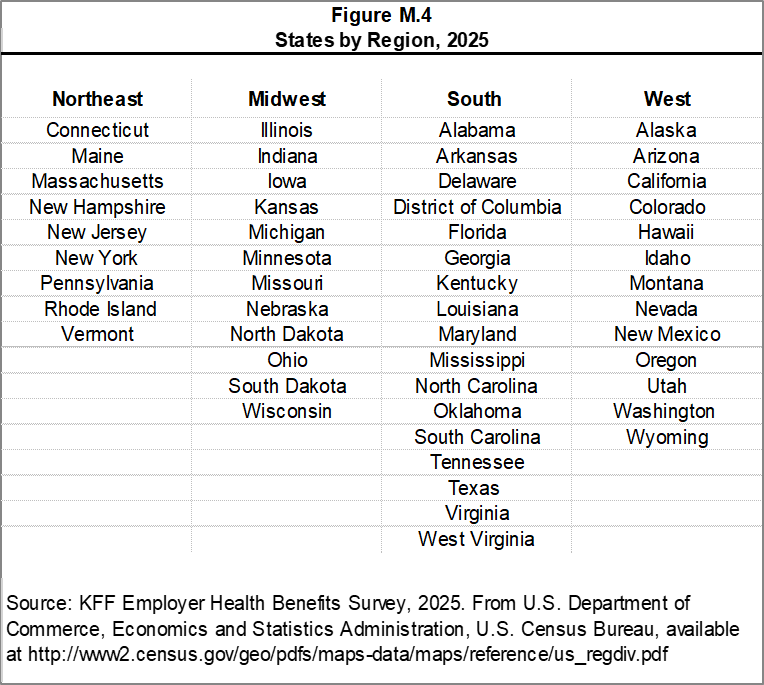

[Figure M.4] exhibits the categorization of states into areas, primarily based on the U.S. Census Bureau’s regional definitions. State-level knowledge usually are not reported attributable to restricted pattern sizes in lots of states and since the survey collects info solely on a agency’s major location—not the place workers could also be primarily based. Some mid-size and huge employers function in a number of states, so the placement of a agency’s headquarters might not correspond to the placement of the well being plan for which premium info was collected.

Determine M.4: States by Area, 2025

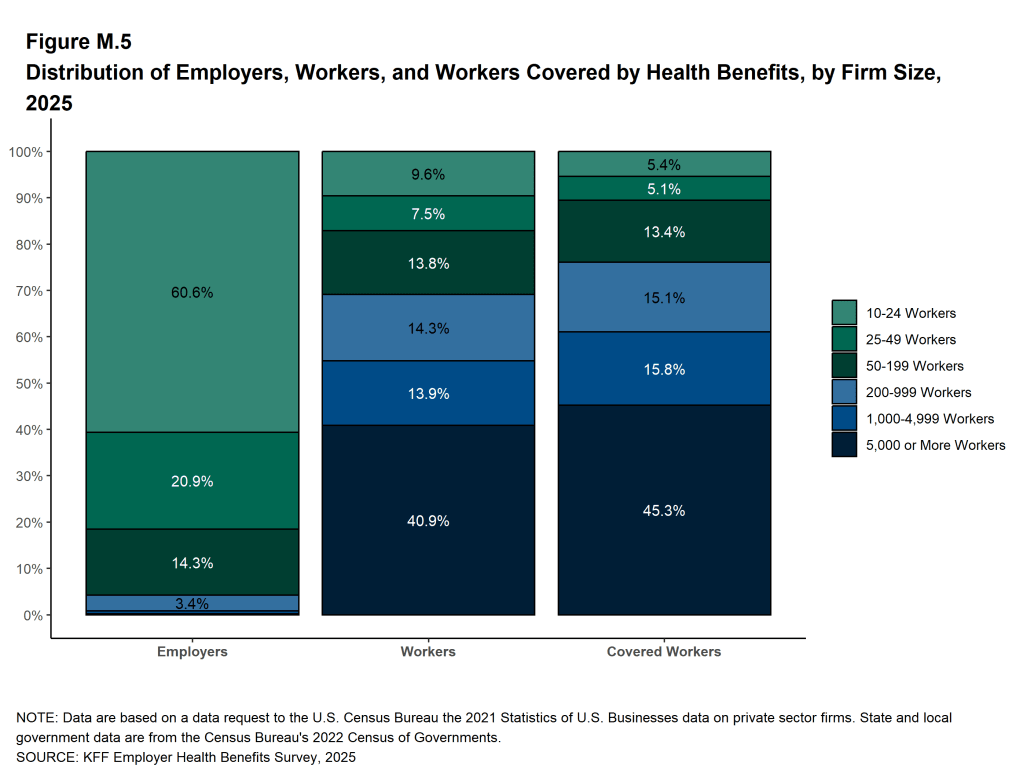

[Figure M.5] shows the distribution of the nation’s companies, employees, and lined employees (workers receiving well being protection from their employer). Starting in 2025, companies with fewer than 10 workers have been excluded from the survey universe. Though most companies in the US are small, most employees lined by well being advantages are employed at massive companies: 76% of the lined employee weight is managed by companies with 200 or extra workers. Conversely, companies with 10-199 workers characterize 96% p.c of the employer weight.

As a result of small companies make up the overwhelming majority of all companies, they closely affect statistics weighted by the variety of employers. Because of this, most firm-level statistics are reportedc by agency measurement. In distinction, massive companies—particularly these with 1,000 or extra employees—have the best affect on statistics associated to lined employees. Even with the massive agency class (these with 200 or extra employees), 81% of the employer weight is pushed by companies with 200-999 workers.

Statistics for small companies and employer-weighted measures are inclined to exhibit higher variability.

Determine M.5: Distribution of Employers, Staff, and Staff Coated by Well being Advantages, by Agency Dimension, 2025

The survey asks companies what proportion of their workers earn roughly than a specified quantity with a view to establish the portion of the workforce that has comparatively decrease or larger wages. This 12 months, the earnings threshold is $37,000 or much less per 12 months for lower-wage employees and $80,000 or extra for higher-wage employees. These thresholds are primarily based on the twenty fifth and seventy fifth percentile of employees’ earnings as reported by the Bureau of Labor Statistics utilizing knowledge from the Occupational Employment Statistics (OES) (2023). The cutoffs have been inflation-adjusted and rounded to the closest thousand.

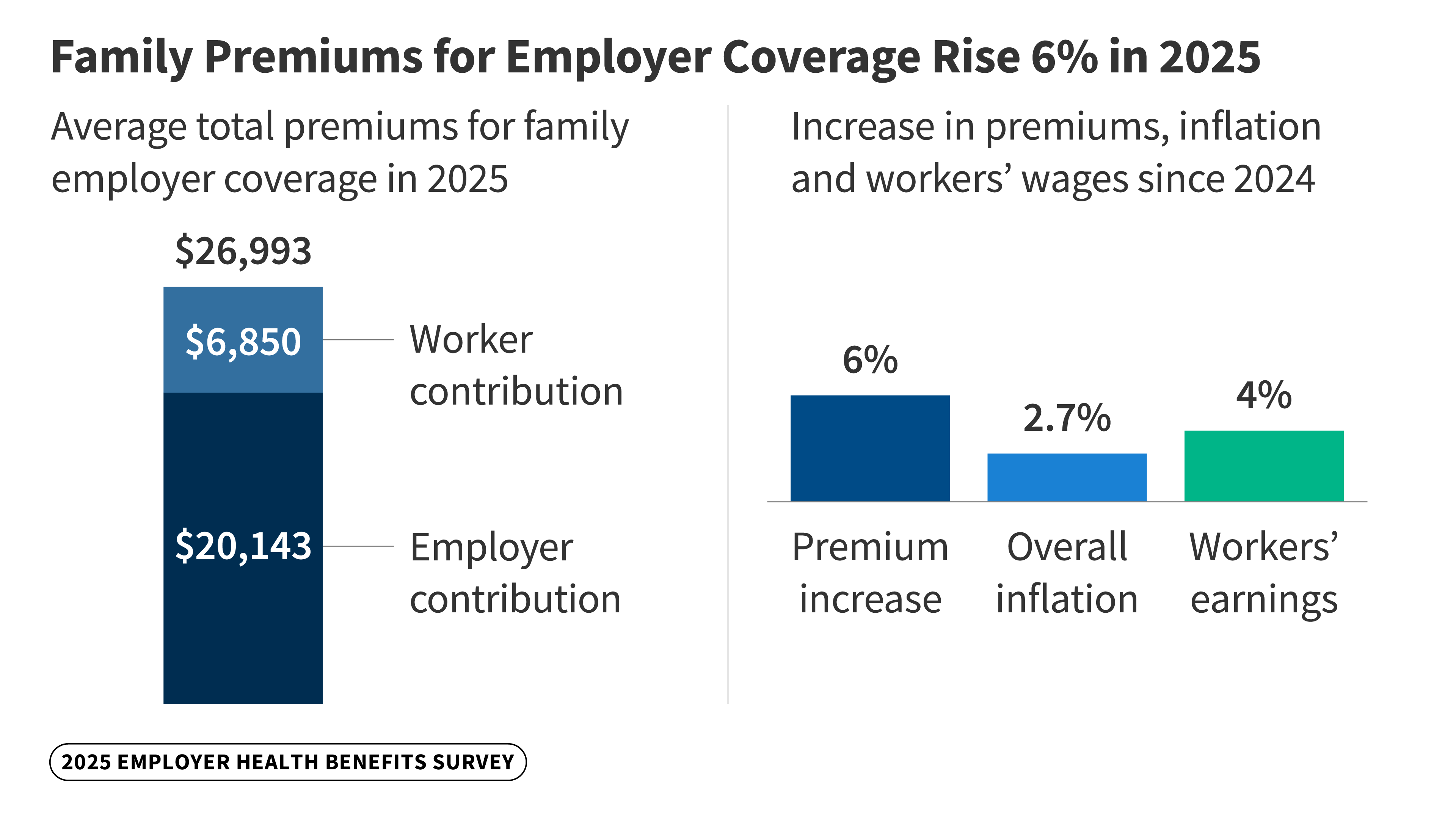

Annual inflation estimates are calculated as a median of the primary three months of the 12 months. The 12 month proportion change for this era was 2.7%. Knowledge offered is nominal until indicated particularly in any other case.

ROUNDING AND IMPUTATION

Some figures may not sum to totals due to rounding. While overall totals and totals by firm size and industry are statistically valid, some breakdowns are not reported due to limited sample sizes or high relative standard errors. Where the unweighted sample size is fewer than 30 observations, figures are labeled “NSD” (Not Sufficient Data). Estimates with high relative standard errors are reviewed and, in some cases, suppressed. Many subset estimates may have large standard errors, meaning that even large differences between groups may not be statistically significant.

To improve readability, values below 3% are not shown in graphical figures. The underlying data for all estimates presented in graphs are available in Excel files accompanying each section at https://kff.org/ehbs.

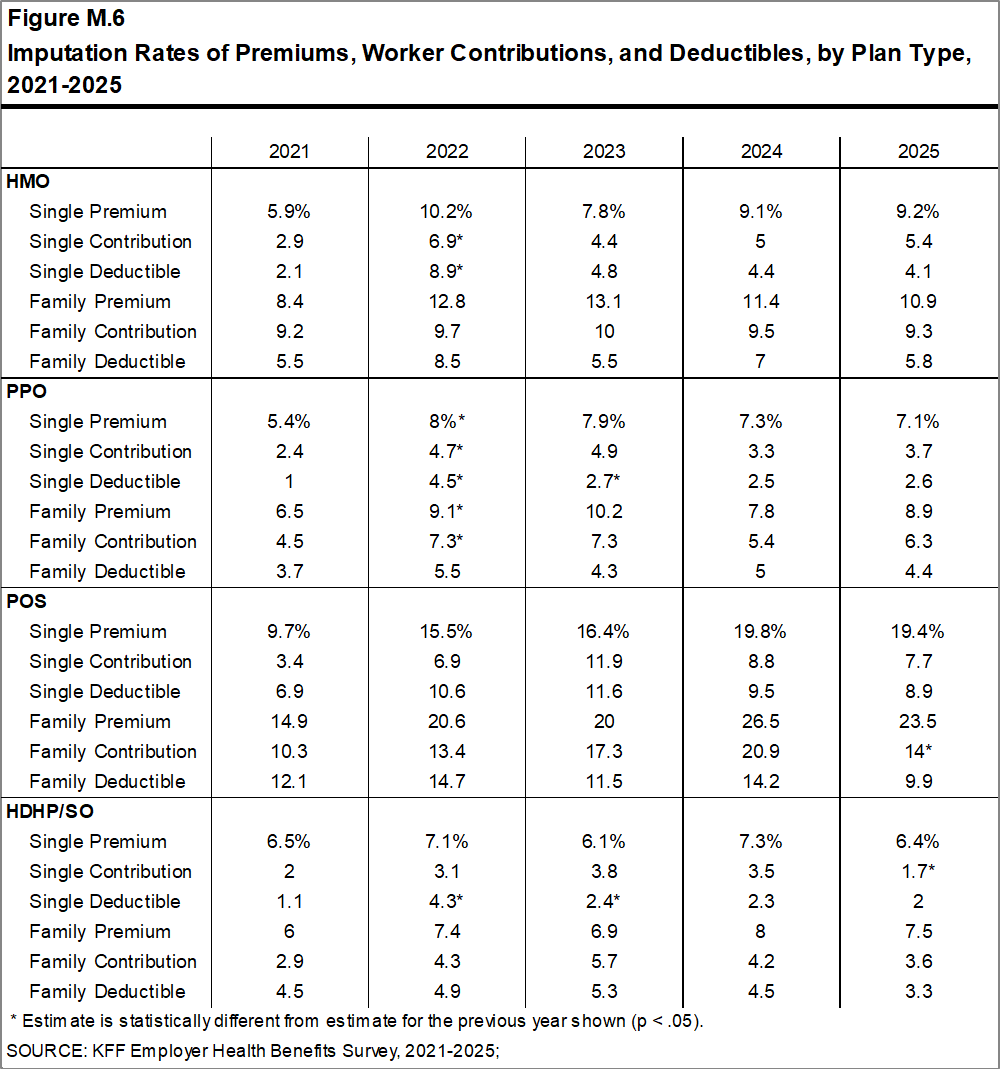

To regulate for merchandise nonresponse bias, we impute lacking values for many variables. On common, 10% of observations are imputed. All variables—besides single protection premiums—are imputed utilizing a hotdeck methodology, which replaces lacking values with noticed values from an analogous agency (primarily based on measurement and trade).

When each single and household protection premiums are lacking for a agency, the only protection premium is first predicted utilizing a random forest algorithm primarily based on different identified plan and agency traits. This predicted worth is then used to impute associated variables, similar to household premiums and employee contributions, utilizing the hotdeck strategy. Some variables are hotdecked primarily based on their relationship to a different variable. For instance, if a agency experiences a household employee contribution however not a household premium, we impute a ratio between the 2 after which calculate the lacking premium.

In 2025, there have been forty-six variables the place the imputation fee exceeded 20%, most of which have been associated to plan-level statistics. When establishing combination estimates throughout all plans, the imputation fee is usually a lot decrease. A couple of variables usually are not imputed—these are often instances the place a “don’t know” response is taken into account legitimate.

To make sure knowledge high quality, we conduct a number of critiques of outliers and illogical responses. Annually, a number of hundred companies are recontacted to confirm or appropriate their responses. In some instances, responses are edited primarily based on open-ended feedback or established logic guidelines.

Determine M.6: Imputation Charges of Premiums, Employee Contributions, and Deductibles, by Plan Kind, 2021-2025

WEIGHTING

Because we select firms randomly, it is possible through the use of weights to extrapolate results to national (as well as firm size, regional, and industry) averages. These weights allow us to present findings based on the number of workers covered by health plans, the number of workers, and the number of firms. In general, findings in dollar amounts (such as premiums, worker contributions, and cost sharing) are weighted by covered workers. Other estimates, such as the offer rate, are weighted by firms.

The employer weight was determined by calculating the firm’s probability of selection. This weight was trimmed of overly influential weights and calibrated to U.S. Census Bureau’s 2021 Statistics of U.S. Businesses for firms in the private sector, and the 2022 Census of Governments totals. The worker weight was calculated by multiplying the employer weight by the number of workers at the firm and then following the same weight adjustment process described above. The covered-worker weight and the plan-specific weights were calculated by multiplying the percentage of workers enrolled in each of the plan types by the firm’s worker weight. These weights allow analyses of workers covered by health benefits and of workers in a particular type of health plan.

The trimming procedure follows the following steps: First, we grouped firms into size and offer categories of observations. Within each strata, we calculated the trimming cut point as the median plus six times the interquartile range (M + [6 * IQR]). Weight values larger than this cut point are trimmed. In all instances, very few weight values were trimmed.

To account for design effects, the statistical computing package R version 4.5.1 (2025-06-13 ucrt) and the library “survey” version 4.4.8 were used to calculate standard errors.

STATISTICAL SIGNIFICANCE AND LIMITATIONS

All statistical tests are performed at the 0.05 confidence level. For figures spanning multiple years, comparisons are made between each year and the previous year shown, unless otherwise noted. No statistical tests are conducted for years prior to 1999.

Subgroup comparisons are made against all other firm sizes not included in the specified group. For example, firms in the Northeast are compared to an aggregate of firms in the Midwest, South, and West. For plan type comparisons (e.g., average premiums in PPOs), results are tested against the “All Plans” estimate. In some cases, plan-specific estimates are also compared to similar estimates for other plan types (e.g., single and family premiums in HDHP/SOs vs. HMO, PPO, and POS plans); such comparisons are noted in the text.

Two statistical tests are used: the t-test and the Wald test. A small number of observations for certain variables can result in large variability around point estimates. Readers should be cautious of these when interpreting year-to-year changes, as large shifts may not be statistically significant. Standard errors for selected estimates are available in a technical supplement at http://ehbs.kff.org.

Because of the complexity of many employer well being profit applications, the survey might not seize all parts of any given plan. As an example, employers might supply intricate and ranging prescription drug advantages, premium contributions, or wellness incentives. Interviews have been carried out with the person most educated concerning the agency’s well being advantages, although some respondents might not have full info on all features of the plan. Whereas the survey collects knowledge on the variety of employees enrolled in protection, it doesn’t seize the traits of these provided or enrolled in particular plans.

DATA COLLECTION AND SURVEY MODE

Starting in 2022, we expanded the use of computer assisted web interview (CAWI), offering most respondents the opportunity to complete the survey using an online questionnaire rather a telephone interview. In 2025, fifty-seven percent of survey responses were completed via telephone interview, and the remainder were completed online. Previous analysis has found that survey mode had little impact on major statistics such as annual premiums, contributions, and deductibles.

Preferred Reporting Items for Complex Sample Survey Analysis (PRICSSA)

In their Journal of Survey Statistics and Methodology article, Seidenberg, Moser, and West (2023) propose a checklist for survey administrators and sponsoring organizations to help external researchers quickly understand the methods used to create a complex sample dataset. The Preferred Reporting Items for Complex Sample Survey Analysis (PRICSSA) recommends a standard format to enumerate data collection and analysis techniques across a variety of different surveys. KFF has adopted this checklist to increase transparency for our readership and also to promote reproducibility among external researchers granted access to our public use files.

- 1.1 Data collection dates: January 27, 2025-July 23, 2025.

- 1.2 Data collection mode(s): fifty-seven percent computer-assisted telephone interviewing (CATI), and the remainder completed with computer assisted web interview (CAWI).

- 1.3 Target population: Private firms as well as state and local government employers with ten or more employees in 50 US states and Washington DC.

- 1.4 Sample design: A sample stratified by ten industry categories and six size categories drawn from a Dynata list (based on a census assembled by Dun and Bradstreet) of the nation’s private employers and the Census of Governments for public employers.

- 1.5 Full Survey response rate: 13 percent (CASRO method).

- 2.1 Missingness rates: On average, 10% of observations are imputed.

- 2.2 Observation deletion: Observations found to be duplicated firms, out of business, or no longer exisiting in the sample universe.

- 2.3 Sample sizes: 1,862 firms completed the entire survey, 2,560 completed at least the offer question, out of 30,150 initially sampled firms, generalizing to a total of about one million firms.

- 2.4 Confidence intervals / standard errors: All statistical tests are performed at the .05 confidence level.

- 2.5 Weighting:

empwt(firms),empwt_a6(firms, including those answering only the offer question),wkrwt(workers),covwt(policyholders),hmowt,ppowt,poswt, andhdpwt(plan weights) - 2.6 Variance estimation: Taylor Series Linearization with

newcellused as the stratum variable but no PSU variable. - 2.7 Subpopulation analysis: The R

surveypackage toolkit such assvybyand a complex sample design’ssubsetmethod allowed for most analysis of subdomains. - 2.8 Suppression rules: Where the unweighted sample size is fewer than 30 observations, figures include the notation “NSD” (Not Sufficient Data). Estimates with high relative standard errors are reviewed and in some cases not published.

- 2.9 Software and code: All design-based analyses were performed using R version 4.5.1 (2025-06-13 ucrt) and

surveylibrary version 4.4.8.

2025 SURVEY

The 2025 survey includes new questions on primary care, menopause benefits, direct contracting, specialty networks, and transparency, among other topics. As in previous years, modifications were also made to existing questions to improve clarity and reflect changes in the health care marketplace.

California Oversample

In 2025, we fielded an oversample of California-based employers to generate separate state-level estimates for the CHCF/KFF California Employer Health Benefits Survey (CHBS). KFF and the California Health Care Foundation (CHCF) have previously included California-specific questions and an oversample of firms located in the state. The 2025 California Employer Health Benefits Survey will produce estimates comparable to those in the 2022 CHBS. Firms with workers in California are included in both the 2025 EHBS and CHBS. To ensure statistical reliability at both the national and state levels, firm weights for the California sample were calibrated to state-specific targets from the U.S. Census Bureau’s Statistics of U.S. Businesses (SUSB). All firms were asked about the characteristics of their workforce nationwide and if applicable in California.

Augmented Sample

Firms with 70,000 or more employees account for 14% of workers in the United States. As a result, the accuracy of estimates depends heavily on the participation of these large employers. In recent years, however, participation among the largest firms has declined. In 2014, survey respondents included firms of this size employing about 9% of the nation’s covered workforce; by 2024, this share had fallen to 4%. While the total number of responding firms has remained relatively stable, the survey now includes fewer firms that have large workforces. Although there are likely multiple reasons for the decline in participation among large firms, one potential concern is that these firms may be underrepresented in the sample frame.

To address this issue, beginning in 2025, we implemented an augmented sample drawn from the Forbes America’s Largest Private Companies list, which includes U.S.-based firms with annual revenues of $2 billion or more. This supplemental sample was designed to enhance representation of the largest employers and complement the primary Dynata sample frame. For this augmented sample, Davis Research conducted outreach to multiple individuals at each firm, targeting staff with human resources-related titles.

Exclusion of Firms with Fewer than 10 Employees

Beginning in 2025, the survey will no longer include firms with 3 to 9 employees. This change reflects longstanding challenges in surveying the smallest firms and their limited influence on national estimates. Although there are 1.95 million such firms in the U.S., they employ a very small share of the workforce and present significant methodological difficulties.

In 2024, only 151 firms in this size range responded to the survey, and just 29 reported offering health benefits. Due to their small numbers, each responding firm carried substantial weight in employer-level estimates—on average, offering firms with 3-9 employees were weighted 58 times more heavily than larger firms. As a result, a small number of responses have disproportionate influence on employer-weighted estimates, even though these firms often had more limited knowledge of their health plans. The response rate for offering firms in this group was also significantly lower than the overall rate (6.5% vs. 14%).

At the same time, these firms have minimal impact on most covered worker-weighted estimates, such as premiums, contributions, deductibles and other cost-sharing. For example, the average family premium when including versus excluding 3-9 employee firms in 2024 differed by only $13 because they account for just 3.7% of all covered workers. For more information on the sample distribution and responses rates including firms with 3 to 9 employees see the 2024 methods section.

Given these components — low response charges, excessive variability, and restricted affect on key nationwide estimates — companies with fewer than 10 workers have been faraway from the pattern universe beginning in 2025.

This modification most instantly impacts the agency supply fee. In 2024, the supply fee amongst companies with 10 or extra workers was 65% in comparison with 54% amongst companies with 3 or extra workers. Whereas this adjustment reduces perception into the smallest companies, it improves the precision and reliability of estimates for the remaining pattern universe.

Decline in Single-Query A6 Agency Counts

After fielding the 2025 survey, we discovered a skip pattern mistake that led to a sharp reduction in the number of firms refusing the full survey but responding to the question “Does your company offer a health insurance program as a benefit to any of your employees?” In the past few years, more than 2,000 firms have answered only this question but not the full survey; however, the error reduced this segment’s 2025 unweighted sample to only about 700 firms. Although this oversight decreased the precision of our 2025 offer rate estimates, we reviewed the questionnaire pathways and do not believe to have introduced bias in the manner of data collection. Both including and excluding these additional firms yielded the same percentage point estimates both last year and this year: 65% in 2024 and 61% in 2025. This oversight also reduced our 2025 combined response rate to 17% compared to 30% last year, since fewer eligible firms were given an opportunity to answer this standalone question. (The 2024 Table M.1 shows 31% including firms with 3-9 employees.) We expect to remedy this issue in the 2026 setup and hope to collect single-question information from a larger pool of firms as consistent with recent years.

OTHER RESOURCES

Additional information about the Employer Health Benefits Survey is available at https://kff.org/ehbs, together with a Well being Affairs article, an interactive graphic, and historic experiences. Researchers may additionally request entry to a public use dataset at https://www.kff.org/contact-us/.

The Survey Design and Strategies part on our web site contains an prolonged methodology doc that’s not out there within the PDF or printed variations of this report. Readers involved in extra detailed info on survey strategies ought to seek the advice of the web version.

Printed: October 22, 2025. Final Up to date: October 16, 2025.

HISTORICAL DATA

Data in this report focus primarily on findings from surveys conducted and authored by KFF since 1999. Between 1999 and 2017, the Health Research & Educational Trust (HRET) co-authored this survey. HRET’s divestiture had no impact on our survey methods, which remain the same as years past. Prior to 1999, the survey was conducted by the Health Insurance Association of America (HIAA) and KPMG using a similar survey instrument, but data are not available for all the intervening years. Following the survey’s introduction in 1987, the HIAA conducted the survey through 1990, but some data are not available for analysis. KPMG conducted the survey from 1991-1998. However, in 1991, 1992, 1994, and 1997, only larger firms were sampled. In 1993, 1995, 1996, and 1998, KPMG interviewed both large and small firms. In 1998, KPMG divested itself of its Compensation and Benefits Practice, and part of that divestiture included donating the annual survey of health benefits to HRET.

This report uses historical data from the 1993, 1996, and 1998 KPMG Surveys of Employer-Sponsored Health Benefits and the 1999-2017 Kaiser/HRET Survey of Employer-Sponsored Health Benefits. For a longer-term perspective, we also use the 1988 survey of the nation’s employers conducted by the HIAA, on which the KPMG and KFF surveys are based. The survey designs for the three surveys are similar.

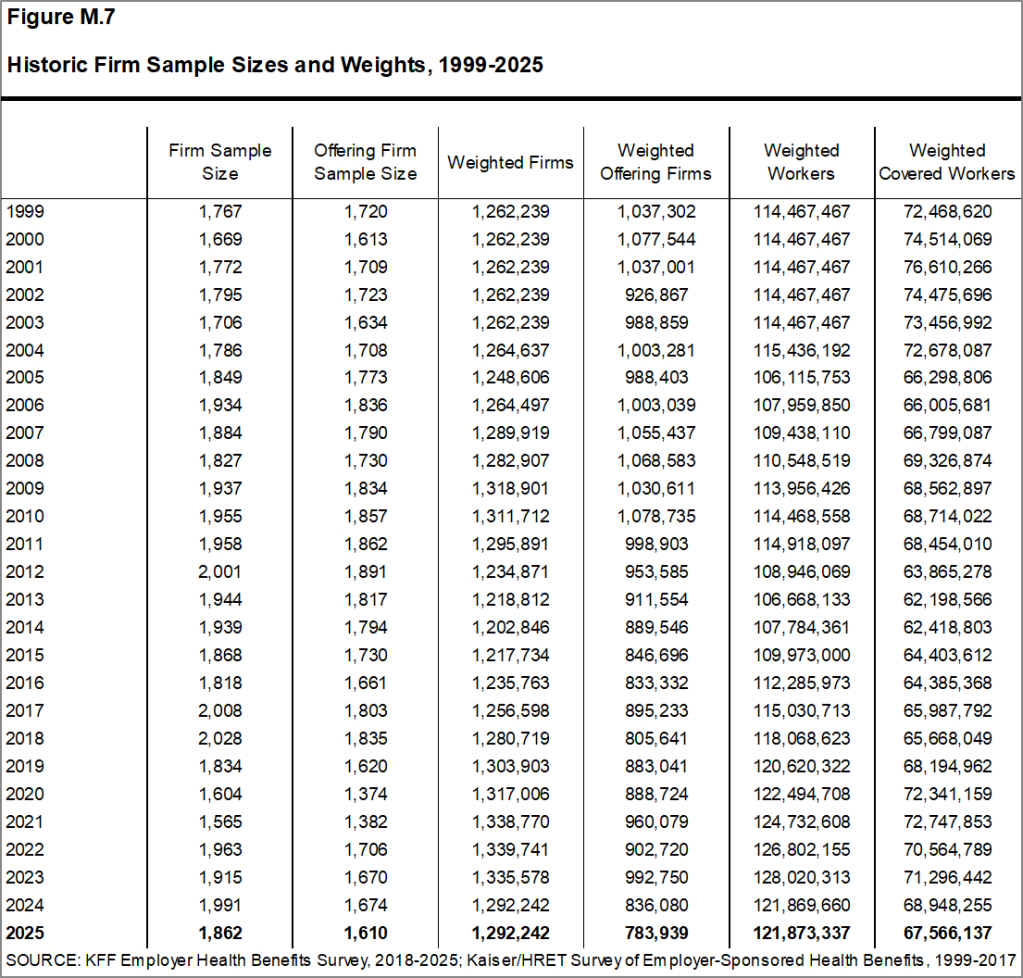

[Figure M.7] shows the historic pattern sizes and weights of companies, employees, and lined employees (workers receiving protection from their employer).

Determine M.7: Historic Agency Pattern Sizes and Weights, 1999-2025

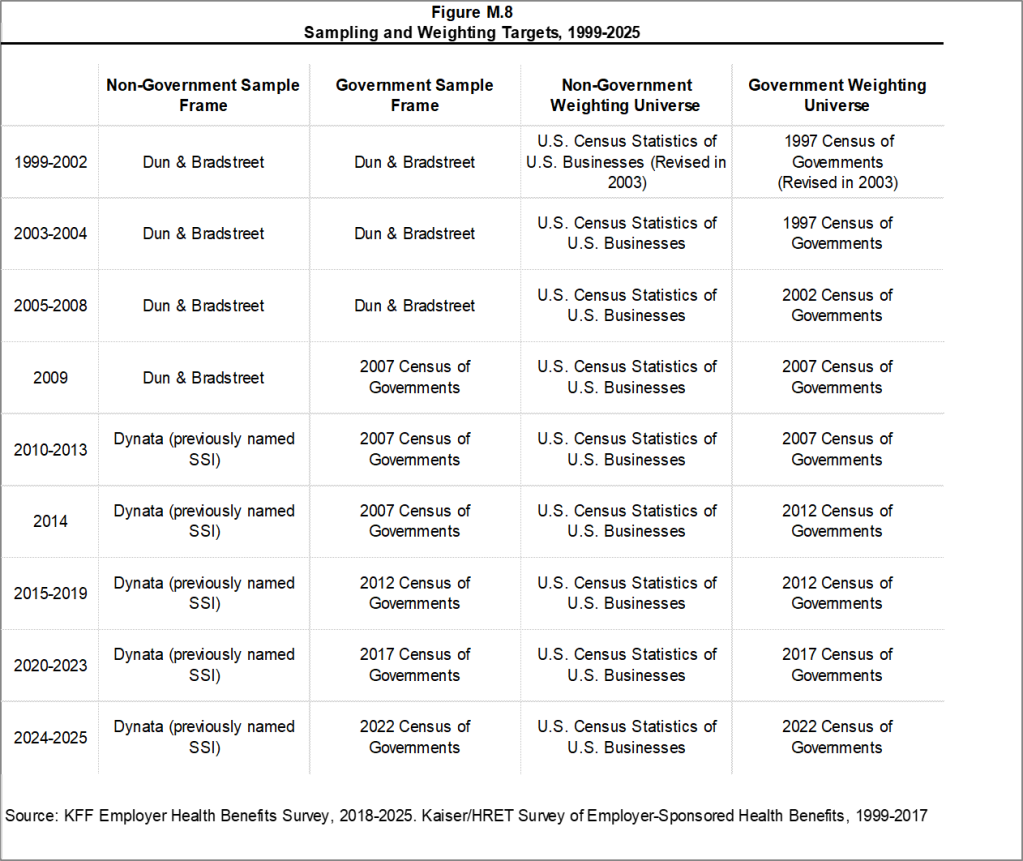

[Figure M.8] shows the historic pattern frames and weighting universes.

Determine M.8: Sampling and Weighting Targets, 1999-2025

1999

The Kaiser Household Basis and The Well being Analysis and Instructional Belief (Kaiser/HRET) started sponsoring the survey of employer-sponsored well being advantages supported for a few years by KPMG Peat Marwick LLP, a world consulting and accounting agency. In 1998, KPMG divested itself of its Compensation and Advantages Follow, and donated the annual survey of well being advantages to HRET, a non-profit analysis group affiliated with the American Hospital Affiliation. From 1999 till 2017, the survey was carried out underneath a partnership between HRET and The Kaiser Household Basis, a well being care philanthropy and coverage analysis group that’s not affiliated with Kaiser Permanente or Kaiser Industries. Beginning in 1999, survey continued a core set of questions from prior KPMG surveys, however was expanded to incorporate small employers and a wide range of policy-oriented questions. Some experiences embrace knowledge from the 1993, 1996 and 1998 KPMG Surveys of Employer-Sponsored Well being Advantages. For a longer-term perspective, we additionally use the 1988 survey of the nation’s employers carried out by the Well being Insurance coverage Affiliation of America (HIAA), on which the KPMG, Kaiser/HRET, and Kaiser Household Basis surveys have been primarily based. Most of the questions within the HIAA, KPMG, Kaiser/HRET, and Kaiser Household Basis surveys are an identical, as is the pattern design. Since Level-of-Service (POS) plans didn’t exist in 1988, experiences don’t embrace statistics for this plan kind in that 12 months. Beginning in 1999, Kaiser/HRET drew its pattern from a Dun & Bradstreet listing of the nation’s personal and public employers with three or extra employees. To extend precision, Kaiser/HRET stratified the pattern by trade and the variety of employees within the agency. Kaiser/HRET tried to repeat interviews with lots of the 2,759 companies interviewed in 1998 and changed non-responding companies with one other agency from the identical trade and agency measurement. Consequently, 1,377 companies within the 1999 complete pattern of 1,939 companies participated in each the 1998 and 1999 surveys.

For extra element concerning the 1999 survey, see the Survey Methodology section of that year’s report.

2000

Kaiser/HRET tried to repeat interviews with lots of the 1,939 companies interviewed in 1999 and changed non-responding companies with different companies of the identical trade and agency measurement. Consequently, 982 companies within the 2000 survey’s complete pattern of 1,887 companies participated in each the 1999 and 2000 surveys. The general response fee was 45% down from 60% in 1999. Contributing to the declining response fee was the choice to not re-interview any companies with 3-9 employees who participated within the 1999 survey. In 1999, the survey weights had as a substitute been adjusted to regulate for the truth that companies with 3-9 employees which are within the panel (responded in both 1998 or 1999) are biased in favor of providing a well being plan. The response fee in 2000 for companies with 3-9 employees was 30%.

For extra element concerning the 2000 survey, see the Survey Methodology section of that year’s report.

2001

For extra element concerning the 2001 survey, see the Survey Methodology section of that year’s report.

2002

The listing of imputed variables was significantly expanded in 2002 to additionally embrace self-insurance standing, degree of advantages, prescription drug cost-sharing, copay and coinsurance quantities for prescribed drugs, and agency workforce traits similar to common earnings, age and part-time standing. On common, 2% of those observations are imputed for any given variable. The imputed values are decided primarily based on the distribution of the reported values inside stratum outlined by agency measurement and area.

For extra element concerning the 2002 survey, see the Survey Methodology section of that year’s report.

2003

The calculation of the weights adopted an analogous strategy to earlier years, however with a number of notable modifications in 2003. First, as in years previous, the fundamental weight was decided, adopted by a nonresponse adjustment added this 12 months to mirror the truth that small companies that don’t take part within the full survey are much less prone to supply well being advantages and, consequently, are unlikely to reply the only supply fee query. To make this adjustment, Kaiser/HRET carried out a follow-up survey of all companies with 3-49 employees that didn’t take part within the full survey. Every of those 1,744 companies was requested the only query, “Does your organization supply or contribute to a medical insurance program as a profit to its workers?” The primary distinction between this follow-up survey and the unique survey is that within the follow-up survey the primary one that answered the phone was requested whether or not the agency provided well being advantages, whereas within the authentic survey the query was requested of the one who was recognized as most educated concerning the agency’s well being advantages. Conducting the follow-up survey completed two goals. First, statistical methods (a McNemar evaluation which was confirmed by a chi-squared check) demonstrated that the change in method-speaking with the particular person answering the telephone somewhat than a advantages manager-did not bias the outcomes of the follow-up survey. Analyzing companies who responded to the supply query twice, in each the unique and follow-up survey, proved that there was no distinction within the chance {that a} agency affords protection primarily based on which worker answered the query about whether or not a agency affords well being advantages. Second, the follow-up survey demonstrated that very small companies not providing well being advantages to their employees are much less prone to reply the one survey query about protection. Kaiser/HRET analyzed the group of companies that solely responded to the follow-up survey and carried out a t-test between the companies who had responded to the preliminary survey in addition to the follow-up, and those that solely responded to the follow-up. Checks confirmed the speculation that the companies that didn’t reply the only supply fee query within the authentic survey have been much less prone to supply well being advantages. To regulate the supply fee knowledge for this discovering a further non-response adjustment was utilized to extend the load of companies within the pattern that don’t supply protection. The second change to the weighting methodology in 2003 was to trim the weights with a view to scale back the affect of weight outliers. From time to time one or two companies will, by means of the weighting course of, characterize a extremely disproportionate variety of companies or lined employees. Relatively than excluding these observations from the pattern, a set lower level that might reduce the variances of a number of key variables (similar to premium change and supply fee) was decided. The extra weight represented by outliers is then unfold among the many different companies in the identical sampling cell. Lastly, a post-stratification adjustment was utilized. Previously, Kaiser/HRET was poststratified again to the Dun & Bradstreet frequency counts. Concern over volatility of counts lately led to the usage of an alternate supply for info on agency and trade knowledge. This 12 months the survey makes use of the not too long ago launched Statistics of U.S. Companies carried out by the U.S. Census as the idea for the post-stratification adjustment. These Census knowledge point out the share of the nation’s companies with 3-9 employees is 59% somewhat than the upper percentages (e.g., 76% in 2002) derived from Dun & Bradstreet’s nationwide database. This modification has little influence on worker-based estimates, since companies with 3-9 employees accounted for lower than 10% of the nation’s workforce. The influence on estimates expressed as a proportion of employers (e.g., the p.c of companies providing protection), nonetheless, could also be vital. Because of these modifications, Kaiser/HRET recalculated the weights for survey years 1999-2002 and modified estimates revealed within the survey the place acceptable. The overwhelming majority of those estimates usually are not statistically completely different. Nonetheless, please observe that the survey knowledge revealed beginning in 2003 varies barely from beforehand revealed experiences.

For extra element concerning the 2003 survey, see the Survey Methodology section of that year’s report.

2004

For extra element concerning the 2004 survey, see the Survey Methodology section of that year’s report.

2005

In 2005, the Kaiser/HRET survey added two further sections to the questionnaire to gather details about high-deductible well being plans (HDHP) which are provided together with a well being reimbursement account (HRA) or are well being financial savings account (HSA) certified. Questions in these sections have been requested of all companies providing these plan sorts, no matter enrollment. Particular weights have been additionally created to investigate the HDHP plans which are provided together with HRAs or are HSA certified. These weights characterize the proportion of workers enrolled in every of those preparations.

We up to date our knowledge to mirror the 2002 Census of Governments. We additionally eliminated federal authorities worker counts from our post-stratification.

For extra element concerning the 2005 survey, see the Survey Methodology section of that year’s report.

2006

For the primary time in 2006, Kaiser/HRET requested questions concerning the highest enrollment HDHP/SO as a separate plan kind, equal to the opposite plan sorts. In prior years, knowledge on HDHP/SO plans have been collected as a part of one of many different sorts of plans. Subsequently, the elimination of HDHP/SOs from the opposite plan sorts might have an effect on the 12 months to 12 months comparisons for the opposite plan sorts. Given the decline in typical well being plan enrollment and the addition of HDHP/SO as a plan kind possibility, Kaiser/HRET eradicated almost all questions pertaining to standard protection from the survey instrument. We proceed to ask companies whether or not or not they provide a standard well being plan and, in that case, how a lot their premium for typical protection elevated within the final 12 months, however respondents usually are not requested further questions concerning the attributes of the standard plans they provide. As a result of we’ve got restricted details about typical well being plans, we should make changes in calculating all plan averages or distributions. In instances the place a agency affords solely typical well being plans, no info from that respondent is included in all plan averages. The exception is for the speed of premium progress, for which we’ve got info. If a agency affords a standard well being plan and a minimum of one different plan kind, for categorical variables we assign the values from the well being plan with the biggest enrollment (apart from the standard plan) to the employees within the typical plan. Within the case of steady variables, lined employees in typical plans are assigned the weighted common worth of the opposite plan sorts within the agency.

The survey newly distinguished between plans which have an combination deductible quantity through which all relations’ out-of-pocket bills rely towards the deductible and plans which have a separate quantity for every member of the family, usually with a restrict on the variety of relations required to achieve that quantity.

In 2006, Kaiser/HRET started asking employers if they’d a well being plan that was an unique supplier group (EPO). We deal with EPOs and HMOs collectively as one plan kind and report the knowledge underneath the banner of “HMO”; if an employer sponsors each an HMO and an EPO, they’re requested concerning the attributes of the plan with the bigger enrollment.

Kaiser/HRET made a slight change to one of many trade teams: we eliminated Wholesale from the group that additionally included Agriculture, Mining and Building. The 9 trade classes now reported are: Agriculture/Mining/Building, Manufacturing, Transportation/Communications/Utilities, Wholesale, Retail, Finance, Service, State/Native Authorities, and Well being Care.

Beginning in 2006, we made an essential change to the best way we check the subgroups of knowledge inside a 12 months. Statistical assessments for a given subgroup (companies with 25-49 employees, as an example) are examined in opposition to all different agency sizes not included in that subgroup (all agency sizes NOT together with companies with 25-49 employees on this instance). Checks are accomplished equally for area and trade: Northeast is in comparison with all companies NOT within the Northeast (an combination of companies within the Midwest, South, and West). Statistical assessments for estimates in contrast throughout plan sorts (for instance, common premiums in PPOs) are examined in opposition to the “All Plans” estimate. In some instances, we additionally check plan particular estimates in opposition to comparable estimates for different plan sorts (for instance, single and household premiums for HDHP/SOs in opposition to single and household premiums in HMO, PPO, and POS plans). These are famous particularly within the textual content. This 12 months, we additionally modified the kind of Chi-square check from the Chi-square check for goodness-of-fit to the Pearson Chi-square check. Subsequently, in 2006, the 2 sorts of statistical assessments carried out are the t-test and the Pearson Chi-square check.

For extra element concerning the 2006 survey, see the Survey Methodology section of that year’s report.

2007

Kaiser/HRET drew its pattern from a Survey Sampling Included listing (primarily based on an authentic Dun and Bradstreet listing) of the nation’s personal and public employers with three or extra employees.

In prior years, many variables have been imputed following a hotdeck strategy, whereas others adopted a distributional strategy (the place values have been randomly decided from the variable’s distribution, assuming a standard distribution). This 12 months, all variables are imputed following a hotdeck strategy. This imputation methodology doesn’t depend on a standard distribution assumption and replaces lacking values with noticed values from a agency with comparable traits, on this case, measurement and trade. Because of the low imputation fee for many variables, the change in methodology will not be anticipated to have a serious influence on the outcomes. In some instances, attributable to small pattern measurement, imputed outliers are excluded. There are a couple of variables that Kaiser/HRET has determined shouldn’t be imputed; these are usually variables the place “don’t know” is taken into account a legitimate response possibility (for instance, companies’ opinions about effectiveness of assorted methods to regulate medical insurance prices).

The survey now comprises a couple of questions on worker value sharing which are requested solely of companies that point out in a earlier query that they’ve a sure cost-sharing provision. For instance, the copayment quantity for prescribed drugs is requested solely of those who report they’ve copayments for prescribed drugs. As a result of the composite variables are reflective of solely these plans with the supply, separate weights for the related variables have been created with a view to account for the truth that not all lined employees have such provisions.

For extra element concerning the 2007 survey, see the Survey Methodology section of that year’s report.

2008

Nationwide Analysis, LLC (NR), our Washington, D.C.-based survey analysis agency, launched a brand new CATI (Pc Assisted Phone Interview) system on the finish of 2007, and, attributable to a number of delays within the subject, obtained fewer responses than anticipated. Consequently, an incentive of $50 was provided in the course of the closing two and a half weeks the survey was within the subject. Kaiser/HRET in contrast the distribution of key variables between companies receiving the inducement and companies not receiving the inducement to find out any potential bias. Chi-square check outcomes weren’t vital, suggesting minimal to no bias.

In 2008, we modified the tactic used to report the annual proportion premium enhance. In prior years, the reported proportion was primarily based on a collection of questions that requested responding companies the share enhance or lower in premiums from the earlier 12 months to the present 12 months for a household of 4 within the largest plan of every plan kind (e.g., HMO, PPO). The reported premium enhance was the typical of the reported proportion modifications (i.e., 6.1% for 2007) weighted by lined employees. This 12 months, we calculate the general proportion enhance in premiums from 12 months to 12 months for household protection utilizing the typical of the premium greenback quantities for a household of 4 within the largest plan of every plan kind reported by respondents and weighted by lined employees (i.e., $12,106 for 2007 and $12,680 for 2008, a rise of 5%). A principal benefit of utilizing the premium greenback quantities to calculate the annual change in premiums is that we’re higher in a position to seize modifications in the price of medical insurance for these companies which are newly out there or that change plan sorts, particularly those who transfer to plans with very completely different premium ranges. For instance, within the first 12 months {that a} agency affords a plan of a brand new plan kind, similar to a consumer-directed plan, the agency can report the extent of the premium they paid, however utilizing the earlier methodology could be unable to report the speed of change from the earlier 12 months for the reason that plan was not beforehand provided. If the premium for the brand new plan is comparatively low in comparison with different premiums out there, the comparatively low premium quantity that the agency experiences will are inclined to decrease the weighted common premium greenback quantity reported within the survey, however the agency responses wouldn’t present any info to the share premium enhance query. One other benefit of utilizing premium greenback quantities to look at traits is that these knowledge instantly relate to the opposite findings within the survey and higher deal with a principal public coverage concern (i.e., what was the change in the price of insurance coverage over some previous interval). Many customers famous, for instance, that the share change calculated from the reported premium greenback quantities between two years didn’t instantly match the reported common premium enhance for a similar interval. There are a number of explanation why we might not anticipate these questions to supply an identical outcomes: 1) they’re separate questions topic to various levels of reporting error, 2) companies may report a premium greenback quantity for a plan kind they won’t have provided within the earlier 12 months, due to this fact, contributing info to 1 measure however not the opposite, or 3) companies may report a premium greenback quantity for a plan that was not the biggest plan of that kind within the earlier 12 months. Though the 2 approaches have generated comparable outcomes by way of the long-term progress fee of total household premiums, there are higher discrepancies in traits for subgroups like small employers and self-funded companies. Specializing in the greenback quantity modifications over time will present a extra dependable and constant measure of premium change that is also extra delicate to companies providing new plan choices.

As we’ve got in previous years, this 12 months we collected info on the cost-sharing provisions for hospital admissions and outpatient surgical procedure that’s along with any common annual plan deductible. Nonetheless, for the 2008 survey, we modified the construction of the query and now embrace “separate annual deductible or hospital admissions” as a response possibility somewhat than amassing the knowledge by means of a separate query. We proceed to look at and typically modify the questions on hospital and outpatient surgical procedure value sharing as a result of this generally is a advanced element of well being profit plans. For instance, for some plans it’s troublesome to tell apart a separate hospital deductible from one categorized as a common annual deductible, the place workplace visits and preventive care are lined and the deductible solely applies to hospital use. As a result of this continues to be some extent of confusion, we proceed to refine the collection of questions with a view to clearly convey the knowledge we try to gather from respondents.

As in 2007, we requested companies if they provide well being advantages to opposite-sex or same-sex home companions. Nonetheless, this 12 months, we modified the response choices as a result of throughout early assessments of the 2008 survey, a number of companies famous that they’d not encountered the difficulty but, indicating that the responses of “sure,” “no,” and “don’t know” have been inadequate. Subsequently, this 12 months we added the response possibility “not relevant/not encountered” to raised seize the variety of companies that report not having a coverage on the difficulty.

For extra element concerning the 2008 survey, see the Survey Methodology section of that year’s report.

2009

Within the fall of 2008, with steering from specialists in survey strategies and design from NORC, we reviewed the strategies used for the survey. On account of this overview, a number of essential modifications have been made to the 2009 survey, together with the pattern design and questionnaire. For the primary time, this 12 months we decided the pattern necessities primarily based on the universe of companies obtained from the U.S. Census somewhat than Dun and Bradstreet. Previous to the 2009 survey, the pattern necessities have been primarily based on the full counts supplied by Survey Sampling Included (SSI) (which obtains knowledge from Dun and Bradstreet). Over time, we’ve got discovered the Dun and Bradstreet frequency counts to be risky due to duplicate listings of companies, or companies which are not in enterprise. These inaccuracies range by agency measurement and trade. In 2003, we started utilizing the extra constant and correct counts supplied by the Census Bureau’s Statistics of U.S. Companies and the Census of Governments as the idea for post-stratification, though the pattern was nonetheless drawn from a Dun and Bradstreet listing. In an effort to additional deal with this concern on the time of sampling, we now additionally use Census knowledge as the idea for the pattern. This modification resulted in shifts within the pattern of companies required in some measurement and trade classes.

This 12 months, we additionally outlined Training as a separate sampling class, somewhat than as a subgroup of the Service class. Previously, Training companies have been a disproportionately massive share of Service companies. Training is managed for throughout post-stratification, and adjusting the sampling body to additionally management for Training permits for a extra correct illustration of each Training and Service industries.

In previous years, each personal and authorities companies have been sampled from the Dun and Bradstreet database. For the 2009 pattern, Authorities companies have been sampled in-house from the 2007 Census of Governments. This modification was made to get rid of the overlap of state companies that have been ceaselessly sampled from the Dun and Bradstreet database. Annually the survey makes an attempt to repeat interviews with respondents from previous years (see “Response Charge” part under), and with a view to preserve authorities companies that had accomplished the survey prior to now (companies which have accomplished the survey prior to now are often known as panel companies), authorities companies from the 2008 survey have been matched to the Census of Governments to establish telephone numbers. All panel authorities companies have been included within the pattern (leading to an oversample). As well as, the pattern of personal companies is screened for companies which are associated to state/ native governments, and if these companies are recognized within the Census of Governments, they’re reclassified as authorities companies and a personal agency is randomly drawn to interchange the reclassified agency. These modifications to the pattern body resulted in an anticipated slight discount within the total response fee, since there have been shifts within the variety of companies wanted by measurement and trade. Subsequently, the info used to find out the 2009 Employer Well being Advantages pattern body embrace the U.S. Census’ 2005 Statistics of U.S. Companies and the 2007 Census of Governments. On the time of the pattern design (December 2008), these knowledge represented essentially the most present info on the variety of private and non-private companies nationwide with three or extra employees. As prior to now, the post- stratification relies on essentially the most up-to-date Census knowledge out there (the 2006 replace to the Census of U.S. Companies was bought in the course of the survey subject interval) and the 2007 Census of Governments. The Census of Governments is carried out each 5 years, and that is the primary 12 months the info from the 2007 Census of Governments have been out there to be used.

Primarily based on suggestions from cognitive researchers at NORC and inside evaluation of the survey instrument, a variety of questions have been revised to enhance the readability and stream of the survey with a view to reduce survey burden. For instance, with a view to higher seize the prevalence of combos of inpatient and outpatient surgical procedure value sharing, the survey was modified to ask a collection of sure or no questions. Beforehand, the query requested respondents to pick out one response from a listing of sorts of value sharing, similar to separate deductibles, copayments, coinsurance, and per diem funds (for hospitalization solely). Now we have additionally expanded the variety of questions for which respondents can present both the variety of employees or the share of employees. Beforehand, after acquiring the full variety of workers, nearly all of questions requested concerning the proportion of employees with sure traits. Now, for questions similar to the share of employees making $23,000 a 12 months or much less or the enrollment of employees in every plan kind, respondents are in a position to reply with both the quantity or the share of employees. Few of those modifications have had any noticeable influence on responses.

For extra element concerning the 2009 survey, see the Survey Methodology section of that year’s report.

2010

New matters within the 2010 survey embrace questions on eligibility for dependent protection, protection for care obtained at retail clinics, well being plan modifications on account of the Psychological Well being Parity and Habit Fairness Act of 2008, and illness administration. As in previous years, this 12 months’s survey included questions on the price of medical insurance, supply charges, protection, eligibility, enrollment patterns, premiums, worker value sharing, prescription drug advantages, retiree well being advantages, wellness advantages, and employer opinions.

Corporations within the pattern with 3-49 employees that didn’t full the complete survey are contacted and requested (or re-asked within the case of companies that beforehand responded to just one query about providing advantages) whether or not or not the agency affords well being advantages. As a part of the method, we conduct a McNemar check to confirm that the outcomes of the follow-up survey are similar to the outcomes from the unique survey. If the check signifies that the outcomes are comparable, a nonresponse adjustment is utilized to the weights used when calculating agency supply charges. This 12 months, for the primary time since we started conducting the follow-up survey, the check indicated that the outcomes from these answering the one query about providing well being advantages within the authentic survey and people answering the follow-up survey have been completely different (statistically vital distinction on the p<0.05 degree between the 2 surveys), suggesting the outcomes usually are not comparable. Subsequently, we didn’t use the outcomes of this follow-up survey to regulate the weights as we’ve got prior to now. Previously, the nonresponse adjustment lowered the supply fee for smaller companies by one to a few proportion factors, so not making the adjustment this 12 months makes the supply fee look considerably larger when making comparisons to prior years. For 2010, we noticed a really massive and sudden enhance within the supply fee (from 60 p.c in 2009 to 69 p.c in 2010) total and significantly for companies with 3 to 9 employees (from 46 p.c in 2009 to 59 p.c in 2010). Whereas not making the adjustment this 12 months added to the scale of the change, there would have been a big and troublesome to clarify change even when a nonresponse adjustment similar to earlier years had been made.

For extra element concerning the 2010 survey, see the Survey Methodology section of that year’s report.

2011

New matters within the 2011 survey embrace questions on stoploss protection for self-funded plans, value sharing for preventive care, plan grandfathering ensuing from the Inexpensive Care Act (ACA), and employer consciousness of tax credit approved underneath the ACA.

This 12 months, we grew to become conscious that the best way we’ve got been utilizing the info from the Census Bureau for calibration was incorrect and resulted in an over-count of the particular variety of companies within the nation. Particularly, companies working in a couple of trade have been counted greater than as soon as in computing the full agency rely by trade, and companies with institutions have been counted greater than as soon as in computing the full agency rely by state (which impacts the regional rely). As a result of smaller companies are much less prone to function in a couple of trade or state, the miscounts occurred largely for bigger from sizes. The error impacts solely statistics which are weighted by the variety of companies (such because the p.c of companies providing well being advantages or sponsoring a illness administration plan). Statistics which are weighted by the variety of employees or lined employees (similar to common premiums, contributions, or deductibles) weren’t affected. We addressed this concern by proportionally distributing the proper nationwide complete rely of companies inside every agency measurement as supplied by the U.S. Census Bureau throughout trade and state primarily based on the noticed distribution of employees. This successfully weights every agency inside every class (trade or state) in proportion to its share of employees in that class. The tip result’s an artificial rely of companies throughout trade and state that sums to the nationwide totals. Agency-weighted estimates ensuing from this modification present solely small modifications from earlier estimates, as a result of smaller companies have way more affect on nationwide estimates. For instance, the estimate of the share of companies providing protection was decreased by about .05 proportion factors in annually (in some years no change is clear attributable to rounding). Estimates of the share of huge companies providing retiree advantages have been decreased by a considerably bigger quantity (about 2 proportion factors). Historic estimates used within the 2011 survey launch have been up to date following this similar course of. As famous above, worker-weighted estimates from prior years weren’t affected by the miscount and stay the identical.

For extra element concerning the 2011 survey, see the Survey Methodology section of that year’s report.

2012

New matters within the 2012 survey embrace the usage of biometric screening, home associate advantages, and emergency room value sharing. As well as, lots of the questions on well being reform included within the 2011 survey have been retained, together with stoploss protection for self-funded plans, value sharing for preventive care, and plan grandfathering ensuing from the Inexpensive Care Act (ACA).

There are a number of variables through which lacking knowledge is calculated primarily based on respondents’ solutions to different questions (for instance, when lacking employer contributions to premiums is calculated from the respondent’s premium and the ratio of contributions to premiums). In 2012 the tactic to calculate lacking premiums and contributions was revised; if a agency gives a premium for single protection or household protection, or a employee contribution for single protection or household protection, that info was used within the imputation. For instance, if a agency supplied a employee contribution for household protection however no premium info, a ratio between the household premium and household contribution was imputed after which the household premium was calculated. As well as, in instances the place premiums or contributions for each household and single protection have been lacking, the hotdeck process was revised to attract all 4 responses from a single agency. The change within the imputation methodology didn’t make a major influence on the premium or contribution estimates.

In 2012, the tactic for calculating the scale of the pattern was adjusted. Relatively than utilizing a mixed response fee for panel and non-panel companies, separate response charges have been used to calculate the variety of companies to be chosen in every strata. As well as, the mining stratum was collapsed into the agriculture and building trade grouping. In sum, modifications to the sampling methodology required extra companies to be included and should have decreased the response fee with a view to present extra balanced energy inside every strata.

To account for design results, the statistical computing bundle R and the library bundle “survey” have been used to calculate normal errors. All statistical assessments are carried out on the .05 degree, until in any other case famous. For figures with a number of years, statistical assessments are carried out for annually in opposition to the earlier 12 months proven, until in any other case famous. No statistical assessments are carried out for years previous to 1999. In 2012 the tactic to check the distinction between distributions throughout years was modified to make use of a Wald check which accounts for the advanced survey design. Typically this methodology was extra conservative than the strategy utilized in prior years.

In 2012, common coinsurance charges for prescribed drugs, major care workplace visits, specialty workplace visits, and emergency room visits embrace companies which have a minimal and/or most hooked up to the speed. In years previous to 2012 we didn’t ask companies the construction of their coinsurance fee. For many prescription drug tiers, and most providers, the typical coinsurance fee will not be statically completely different relying on whether or not the plan has a minimal or most.

In 2012 the calculation of the response charges was adjusted to be barely extra conservative than earlier years.

For extra element concerning the 2012 survey, see the Survey Methodology section of that year’s report.

2013

Beginning in 2013, info on typical plans was collected underneath the PPO part and due to this fact the lined employee weight was consultant of all plan sorts.

For extra element concerning the 2013 survey, see the Survey Methodology section of that year’s report.

2014

Beginning in 2014, we elected to estimate separate single and household protection premiums for companies that supplied premium quantities as the typical value for all lined employees, as a substitute of differentiating between single and household protection. This methodology extra precisely accounted for the portion that every kind of protection contributes to the full value for the 1 p.c of lined employees who’re enrolled at companies affected by this adjustment.

A number of provisions of the ACA took impact on January 1, 2014 which impacted non-grandfathered plans in addition to plans renewing in calendar 12 months 2014, such because the requirement to have an out of pocket restrict and a ready interval of no more than three months. Consequently, companies with non-grandfathered plans that reported that they didn’t have out-of-pocket limits, or ready durations exceeding three months, have been contacted throughout our data-confirmation calls. We didn’t have info on the month through which a agency’s plan or plans was renewed. Many of those companies indicated that they’d a plan 12 months beginning previous to January 2014, so these ACA provision weren’t but in impact for these plans.

Corporations with 200 or extra employees have been requested: “Does your agency supply well being advantages for present workers by means of a personal or company alternate? A non-public alternate is one created by a consulting agency or an insurance coverage firm, not by both a federal or state authorities. Non-public exchanges enable workers to select from a number of well being profit choices provided on the alternate.” Employers have been nonetheless requested for plan details about their HMO, PPO, POS and HDHP/SO plan no matter whether or not they bought well being advantages by means of a personal alternate or not.

Starting in 2014, we collected whether or not companies with a non-final disposition code (similar to a agency that requested a callback at a later time or date) provided well being advantages. By doing so we try and mitigate any potential non-response bias of companies both providing or not providing well being advantages on the general supply fee statistic.

For extra element concerning the 2014 survey, see the Survey Methodology section of that year’s report.

2015

To extend response charges, companies with 3-9 workers have been provided an incentive of $75 in money or as a donation to a charity of their selection to finish the complete survey.

In 2015, weights weren’t adjusted utilizing the nonresponse adjustment course of described in earlier years’ strategies. As in previous years, Kaiser/HRET carried out a small follow-up survey of these companies with 3 to 49 employees that refused to take part within the full survey. Primarily based on the outcomes of a McNemar check, we weren’t in a position to confirm that the outcomes of the follow-up survey have been similar to the outcomes from the unique survey. In 2010, the outcomes of the McNemar check have been additionally vital and we didn’t conduct a nonresponse adjustment.

The 2015 survey comprises new info in a number of areas, together with on wellness and biometric screening. Generally, info reported on this part will not be comparable with earlier years’ findings. Knowledge offered within the 2015 report mirror the agency’s advantages on the time they accomplished the interview. Some companies might report on a plan which took impact within the prior calendar 12 months. Beginning in 2015, companies have been in a position to have a contribution and deductible in compliance with HSA necessities for the plan 12 months.

Beginning in 2015, employers have been requested what number of full-time equivalents they employed. In instances through which the variety of full-time equivalents was related to the query, interviewer skip patterns might have relied on the variety of FTEs.

In instances the place a agency had a number of plans, they have been requested about their methods for holding the price of specialty medication for the plan with the biggest enrollment.

Beneath the Inexpensive Care Act, non-grandfathered plans are required to have an out-of- pocket most. Non-grandfathered plans who indicated that they didn’t have an out of pocket most have been requested to verify whether or not their plan was grandfathered and whether or not that plan had an out-of-pocket most.

For extra element concerning the 2015 survey, see the Survey Methodology section of that year’s report.

2016

Between 2015 and 2016, we carried out a collection of focus teams that led us to the conclusion that human useful resource and profit managers at companies with between 20 and 49 workers take into consideration medical insurance premiums extra equally to profit managers at smaller companies than bigger companies. Subsequently, beginning in 2016, we altered the medical insurance premium query pathway for companies with between 20-49 workers to match that of companies with 3-19 workers somewhat than companies with 50 or extra workers. This modification affected companies representing 8% of the full lined employee weight. We imagine that these questions produce comparable responses and that this edit doesn’t create a break in pattern.

Beginning in 2016, we made vital revisions to how the survey asks employers about their prescription drug protection. Generally, info reported within the Prescription Drug Advantages part will not be comparable with earlier years’ findings. First, along with the 4 normal tiers of medicine (generics, most well-liked, non-preferred, and way of life), we started asking companies about value sharing for a drug tier that covers solely specialty medication. This new tier pathway within the questionnaire has an impact on the pattern of the 4 normal tiers, since respondents to the 2015 survey may need beforehand categorized their specialty drug tier as one of many different 4 normal tiers. We didn’t modify the query concerning the variety of tiers a agency’s cost-sharing construction has, however in instances through which the best tier lined solely specialty medication we reported it individually. For instance, a agency with three tiers might solely have copays or coinsurances for 2 tiers as a result of their third tier copay or coinsurance is being reported as a specialty tier. Moreover, with a view to scale back survey burden, companies have been requested concerning the plan attributes of solely their plan kind with essentially the most enrollment. Subsequently, normally, we not make comparisons between plan sorts. Lastly, previous to 2016, we required companies’ value sharing tiers to be sequential, which means that the second tier copay was larger than the primary tier, the third tier was larger than the second, and the fourth was larger than the third. As drug formularies have develop into extra intricate, many companies have minimal and maximums hooked up to their copays and coinsurances, main us to imagine it was not acceptable to imagine {that a} agency’s value sharing adopted this sequential logic.

In instances the place a agency had a number of plans, they have been requested about their methods for holding the price of specialty medication for the plan kind with the biggest enrollment. Between 2015 and 2016, we modified the collection of ‘Choose All That Apply’ questions relating to value containment methods for specialty medication. In 2016, we elected to impute companies’ responses to those questions. We eliminated the choice “Separate value sharing tier for specialty medication” and added specialty medication as their very own drug tier questionnaire pathway. We added query choices on mail order medication and prior authorization.

In 2016, we modified our questions on telemedicine to make clear that we have been within the provision of well being care providers, and never merely the alternate of data, by means of telecommunication. We additionally added dependent and spousal inquiries to our well being threat evaluation query pathway.

For extra element concerning the 2016 survey, see the Survey Methodology section of that year’s report.

2017

Whereas the Kaiser/HRET survey just like different employer and family surveys has seen a common lower in response charges over time, the lower between the 2016 and 2017 response charges will not be solely defined by this pattern. In an effort to enhance statistical energy amongst sub-groups, together with small companies and people with a excessive share of low earnings employees, the scale of the pattern was expanded from 5,732 in 2016 to 7,895 in 2017. Consequently, the 2017 survey contains 204 extra completes than the 2016 survey. Whereas this typically will increase the precision of estimates (for instance, a discount in the usual error for the supply fee from 2.2% to 1.8%), it has the impact of decreasing the response fee. In 2017, non-panel companies had a response fee of 17%, in comparison with 62% for companies that had participated in one of many final two years.

To extend response charges, companies with 3-9 workers have been provided an incentive for collaborating within the survey. A 3rd of those companies have been despatched a $5 Starbucks present card within the advance letter, a 3rd have been provided an incentive of $50 in money or as a donation to a charity of their selection after finishing the complete survey, and a 3rd of companies have been provided no incentive in any respect. Our evaluation doesn’t present vital variations in responses to key variables amongst these incentive teams.

In 2017, weights weren’t adjusted utilizing the nonresponse adjustment course of described in earlier years’ strategies. As in previous years, Kaiser/HRET carried out a small follow-up survey of these companies with 3-49 employees that refused to take part within the full survey. Primarily based on the outcomes of a McNemar check, we weren’t in a position to confirm that the outcomes of the follow-up survey have been similar to the outcomes from the unique survey. In 2010 and 2015, the outcomes of the McNemar check have been additionally vital and we didn’t conduct a nonresponse adjustment.

To cut back the size of survey, in a number of areas, together with stoploss protection for self-funded companies and value sharing for hospital admissions, outpatient surgical procedure, and emergency room visits, we revised the questionnaire to ask respondents concerning the attributes of their largest well being plan somewhat than every plan kind they could supply. This expands on the tactic we used for prescription drug protection in 2016. Subsequently, for these matters, combination variables characterize the attributes of the agency’s largest plan kind, and usually are not a weighted common of all the companies plan sorts. In earlier surveys, if a agency had two plan sorts, one with a copayment and one with a coinsurance for hospital admissions, the lined employee weight was allotted proportionally towards the typical copayment and coinsurance primarily based on the variety of lined employees with both characteristic. With of this modification, comparability amongst plans sorts is now a comparability of companies the place any given plan kind is the biggest. The change solely impacts companies which have a number of plan sorts (58% of lined employees). After reviewing the responses and evaluating them to prior years the place we requested about every plan kind, we discover that the knowledge we’re receiving is just like responses from earlier years. Because of this, we are going to proceed to report our outcomes for these questions weighted by the variety of lined employees in responding companies.

Beginning in 2017, respondents have been allowed to volunteer that their plans didn’t cowl outpatient surgical procedure or hospital admissions. Lower than 1% of respondents indicated that their plan didn’t embrace protection for these providers. Price sharing for hospital admissions, outpatient surgical procedure and emergency room visits was imputed by drawing a agency comparable in measurement and trade inside the similar plan kind.

For extra element concerning the 2017 survey, see the Survey Methodology section of that year’s report.

2018

As in previous years, we carried out a small follow-up survey of these companies with 3-49 employees that refused to take part within the full survey. Primarily based on the outcomes of a McNemar check, we weren’t in a position to confirm that the outcomes of the follow-up survey have been similar to the outcomes from the unique survey, and weights weren’t adjusted utilizing the nonresponse adjustment course of described in earlier years’ strategies. In 2010, 2015, and 2017, the outcomes of the McNemar check have been additionally vital and we didn’t conduct a nonresponse adjustment.

In gentle of a variety of regulatory modifications and coverage proposals, we included new questions on the anticipated results of the ACA’s particular person mandate penalty repeal on the agency’s well being advantages choices, and the influence of the delay of the excessive value plan tax, also called the Cadillac tax, on the agency’s well being advantages choices. Additionally new in 2018 are questions asking about smaller companies’ use of level-funded premium plans, another self-funding methodology with built-in cease loss protection and a hard and fast month-to-month premium.

In 2018, we moved the battery of employee demographics questions from close to the start of the survey to the tip of the survey in an effort to enhance the stream. There is no such thing as a proof that this transfer has impacted our survey findings and we are going to proceed to observe any suspected impacts.