Medicare Half D is a voluntary outpatient prescription drug profit for folks with Medicare supplied via non-public plans that contract with the federal authorities. Beneficiaries can select to enroll in both a stand-alone prescription drug plan (PDP) to complement conventional Medicare or a Medicare Advantage drug plan (MA-PD) that features drug protection and all different Medicare-covered advantages. This temporary gives an summary of the Medicare Half D program, plan availability, enrollment, and spending and financing, based mostly on KFF evaluation of knowledge from the Facilities for Medicare & Medicaid Providers (CMS) and different sources. It additionally gives an summary of modifications to the Half D profit based mostly on provisions in the Inflation Reduction Act. (A separate KFF analysis gives extra element about Half D plan availability, premiums, and value sharing.)

Takeaways

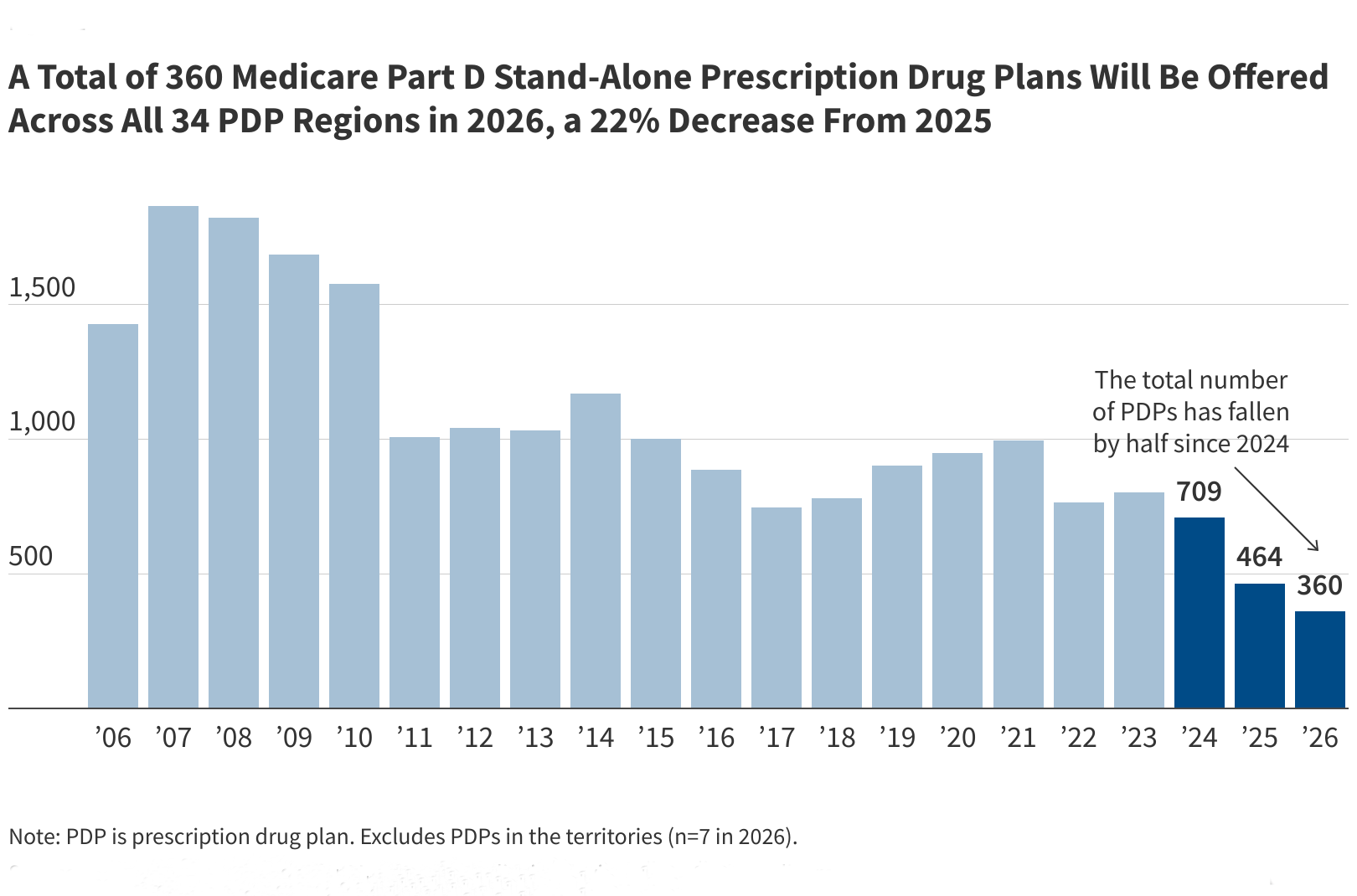

- In 2026, beneficiaries in every state can have a selection of between 8 and 12 Medicare Half D stand-alone prescription drug plans, plus many Medicare Benefit drug plans. A complete of 360 PDPs will likely be supplied by 17 totally different father or mother organizations throughout the 34 PDP areas nationwide (excluding 7 PDPs within the territories), a 22% lower in PDPs from 2025 and a couple of fewer father or mother organizations.

- Roughly the identical variety of PDPs will likely be obtainable for enrollment of Half D Low-Revenue Subsidy (LIS) beneficiaries for no premium (“benchmark” plans) in 2026, various from 1 to 4 PDPs throughout states. A complete of 88 PDPs will likely be benchmark plans in 2026, 2 fewer than in 2025.

- A number of modifications to the Medicare Half D profit beneath the Inflation Discount Act have taken impact, together with a cap on out-of-pocket drug spending, which will likely be set at $2,100 in 2026; a rise within the share of drug prices above the cap paid for by Half D plans and drug producers; and a discount in Medicare’s share of those prices.

- In 2025, 54.8 million of the 68.8 million Medicare beneficiaries in complete are enrolled in Medicare Half D plans, together with employer-only group plans; amongst Half D enrollees, 58% are enrolled in MA-PDs and 42% are enrolled in stand-alone PDPs. As of Might 2025, 13.9 million Part D enrollees obtain premium and cost-sharing help via the LIS program.

- Medicare’s actuaries estimate that spending on Half D advantages (web of premiums paid by enrollees) will complete $140 billion in 2026, representing 11% of complete spending on all Medicare-covered advantages. Funding for Half D comes from federal authorities contributions (75%), beneficiary premiums (13%), and state contributions (12%).

- Medicare’s funds to Half D plans to subsidize the price of primary Half D advantages per enrollee are projected to account for roughly three-fourths of Medicare’s complete reimbursement per enrollee in 2026, whereas reinsurance funds (to subsidize a portion of drug spending for enrollees with excessive drug prices) will equal one-fourth. It is a reversal from 2024, when reinsurance accounted for three-fourths of complete reimbursement per enrollee. This alteration displays the elevated generosity of the usual Half D profit with the addition of an out-of-pocket spending cap in 2025, together with the discount in Medicare’s legal responsibility for catastrophic drug prices from 80% in 2024 to twenty% for manufacturers and 40% for generics in 2025. Half D plans and drug producers now bear larger accountability for catastrophic protection prices.

Medicare Prescription Drug Plan Availability in 2026

In 2026, a complete of 360 PDPs will likely be supplied by 17 totally different father or mother organizations throughout the 34 PDP areas nationwide (excluding the territories), a 22% lower in PDPs from 2025 (and almost half as many as in 2024) and a couple of fewer father or mother organizations (Determine 1). Whereas the provision of stand-alone PDPs has been trending downward over time, the availability of Medicare Advantage drug plans has expanded in recent times, and extra folks in Medicare are now getting Part D drug coverage through Medicare Advantage plans.

Regardless of a discount within the variety of PDPs total, beneficiaries in every state can have a selection of between 8 and 12 stand-alone PDPs supplied by between 4 and 6 father or mother organizations in every state (Determine 2, Appendix Determine 1). As well as, beneficiaries will be capable to select from amongst many MA-PDs obtainable on the county degree.

Low-Revenue Subsidy Plan Availability in 2026

Beneficiaries with low incomes and modest property are eligible for help (“extra help”) with Half D plan premiums and value sharing. By way of the Half D Low-Revenue Subsidy (LIS) program, extra premium and cost-sharing help is offered for Half D enrollees with low incomes (lower than 150% of poverty, or $23,475 for people/$31,725 for married {couples} in 2025) and modest property (as much as $17,600 for people/$35,1300 for {couples} in 2025). Individuals who qualify for the LIS program pay modest copayments for pharmaceuticals, no drug deductible, and no premium for drug protection in premium-free “benchmark” plans.

In 2026, roughly the identical variety of plans will likely be obtainable for enrollment of LIS beneficiaries for no premium (benchmark plans) in comparison with 2025 – 88 plans (2 fewer than in 2025), however the lowest variety of benchmark plans obtainable since Half D began (Determine 3). Total, one quarter (24%) of PDPs in 2026 are benchmark plans.

On the PDP area degree, the variety of PDP selections total stays extra strong than the variety of premium-free benchmark PDPs. In 2026, the variety of premium-free PDPs ranges throughout states from 1 plan in 2 states (Florida and Texas) to 4 plans in 15 states (Determine 4, Appendix Determine 1). LIS enrollees can choose any plan supplied of their space, but when they’re enrolled in a non-benchmark plan, they could be required to pay some portion of their plan’s month-to-month premium.

Adjustments to Half D Beneath the Inflation Discount Act

The Inflation Reduction Act of 2022 contained several provisions to lower prescription drug spending by Medicare and beneficiaries, together with main modifications to the Medicare Half D program, which began to take impact in 2023. These modifications have been designed to deal with a number of considerations, together with the shortage of a tough cap on out-of-pocket spending for Half D enrollees; the shortcoming of the federal authorities to barter drug costs with producers; a big improve in Medicare “reinsurance” spending for Half D enrollees with excessive drug prices; costs for a lot of Half D lined medicine rising quicker than the speed of inflation; and the comparatively weak monetary incentives confronted by Half D plan sponsors to regulate excessive drug prices. Provisions within the regulation embrace:

- Limiting the value of insulin merchandise to not more than $35 per 30 days in all Half D plans and makes grownup vaccines lined beneath Half D obtainable without spending a dime, as of 2023.

- Requiring drug producers to pay a rebate to the federal authorities if costs for medicine lined beneath Half D and Half B improve quicker than the speed of inflation, with the preliminary interval for measuring Half D drug worth will increase working from October 2022-September 2023.

- Increasing eligibility for full advantages beneath the Half D Low-Revenue Subsidy program in 2024.

- Including a tough cap on out-of-pocket drug spending beneath Half D by eliminating the 5% coinsurance requirement for catastrophic protection in 2024 and capping out-of-pocket spending at $2,000 in 2025 (rising to $2,100 in 2026).

- Shifting extra of the accountability for catastrophic protection prices to Half D plans and drug producers, beginning in 2025.

- Authorizing the Secretary of the Division of Well being and Human Providers to negotiate the price of some drugs covered under Medicare, with negotiated costs first obtainable for 10 Half D medicine in 2026.

Half D Plan Premiums and Advantages in 2026

Premiums

The 2026 Half D base beneficiary premium – which is predicated on bids submitted by each PDPs and MA-PDs and isn’t weighted by enrollment – is $38.99, a 6% improve from 2025. Annual development within the base beneficiary premium is capped at 6% resulting from a provision within the Inflation Discount Act. As a result of the bottom premium is a mean throughout each kinds of plans and displays the price of primary advantages solely, this quantity doesn’t equal what a Half D enrollee can pay for protection in any given Half D plan.

As a result of the month-to-month quantity that Half D enrollees pay for particular person Half D plans is totally different from the bottom beneficiary premium, enrollees may even see their premium improve by kind of than 6%, and even lower, in the event that they keep in the identical plan for 2026. A Part D premium stabilization demonstration for PDPs can also be serving to to average premium will increase that Half D enrollees may in any other case have confronted in 2026, as insurers proceed to regulate to larger prices related to the brand new out-of-pocket spending cap and elevated legal responsibility for drug prices above the cap. The Half D premium demonstration was established in 2024 by the Biden administration forward of the main redesign of the Half D profit that took impact in 2025. For the primary 12 months of the demonstration, the federal authorities supplied taking part PDPs with an across-the-board month-to-month premium subsidy of as much as $15 and restricted the month-to-month premium improve for 2025 to $35, together with a narrowing of the risk corridors to mitigate the danger of losses for taking part PDPs. For 2026, the Trump administration diminished the month-to-month premium subsidy from $15 to $10, raised the restrict on the PDP month-to-month premium improve to $50, and eradicated the danger hall part of the demonstration.

Precise month-to-month premiums paid by Half D enrollees in stand-alone PDPs in 2026 will differ significantly, starting from $0 to $100 or extra in most areas. Along with the month-to-month premium, Half D enrollees with larger incomes ($106,000/particular person; $212,000/couple) pay an income-related premium surcharge, starting from $13.70 to $85.80 per 30 days in 2025 (relying on earnings).

Most MA-PD enrollees pay no premium past the month-to-month Half B premium (though high-income MA enrollees are required to pay a premium surcharge). MA-PD sponsors can use rebate dollars from Medicare payments to lower or eliminate their Part D premiums, so the common premium for drug protection in MA-PDs is closely weighted by zero-premium plans. In 2025, the enrollment-weighted common month-to-month portion of the premium for drug protection in MA-PDs is considerably decrease than the common month-to-month PDP premium ($7 versus $39).

Advantages

The Half D outlined customary profit modified considerably in 2025 and now features a cap on out-of-pocket drug spending. The profit has three phases, together with a deductible, an preliminary protection section, and catastrophic protection. For 2026, under the standard benefit, Half D enrollees can pay a deductible of $615 (up from $590 in 2024), and can then pay 25% of their drug prices within the preliminary protection section till their out-of-pocket spending totals $2,100 (Determine 5). At that time, they qualify for catastrophic protection and pay no extra out-of-pocket prices.

Half D plans should provide both the outlined customary profit or an alternate equal in worth (“actuarially equal”) and can even present enhanced advantages. Each primary and enhanced profit plans differ when it comes to their particular profit design, protection, and prices, together with deductibles, cost-sharing quantities, utilization administration instruments (i.e., prior authorization, amount limits, and step remedy), and which medicine are lined on their formularies. Plan formularies should embrace drug courses protecting all illness states, and a minimal of two chemically distinct medicine in every class. Half D plans are required to cowl all medicine in six “protected” courses: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.

Half D plans are additionally required to cover all drugs that have been selected for Medicare drug price negotiation, together with all dosage kinds and strengths. CMS will use the annual formulary evaluate course of to make sure that all Half D plans cowl all dosages and formulations of chosen medicine. Negotiated costs for the first 10 drugs that have been chosen for negotiation will take impact for Medicare beneficiaries on January 1, 2026.

Half D and Low-Revenue Subsidy Enrollment in PDPs and MA-PDs

Enrollment in Medicare Half D plans is voluntary, apart from beneficiaries who’re eligible for each Medicare and Medicaid and sure different low-income beneficiaries who’re routinely enrolled in a PDP if they don’t select a plan on their very own. Beneficiaries face a penalty equal to 1% of the nationwide common premium for every month they delay enrollment until they’ve drug protection from one other supply that’s at the least nearly as good as customary Half D protection (“creditable protection”).

In 2025, 54.8 million Medicare beneficiaries are enrolled in Medicare Half D plans, together with employer-only group plans; of the full, 58% are enrolled in MA-PDs and 42% are enrolled in stand-alone PDPs (Determine 6). One other 0.7 million beneficiaries are estimated to have drug protection via employer-sponsored retiree plans the place the employer receives a subsidy from the federal authorities equal to twenty-eight% of drug bills between $615 and $12,650 per retiree in 2026. A number of million beneficiaries are estimated to produce other sources of drug protection, together with employer plans for lively staff, FEHBP, TRICARE, and Veterans Affairs (VA). Around 11% of people with Medicare are estimated to lack creditable drug protection.

Current years have seen a rising divide within the Half D plan market between stand-alone PDPs, the place the variety of plans has usually been trending downward over time at the side of a discount in PDP enrollment, and MA-PDs, the place plan availability and enrollment have grown steadily in recent times. The widespread availability of low or zero-premium MA-PDs, whereas PDPs cost considerably larger premiums on common, might tilt enrollment much more in the direction of Medicare Benefit plans sooner or later.

As of Might 2025, 13.9 million Part D enrollees obtain premium and cost-sharing help via the LIS program. As with total Half D enrollment, extra LIS enrollees are in MA-PDs than PDPs. Beneficiaries who’re dual-eligible people, these enrolled in Medicare Financial savings Applications (QMBs, SLMBs, QIs), and people who obtain Supplemental Safety Revenue funds from Social Safety routinely qualify for the extra help, and they’re routinely enrolled in PDPs with premiums at or beneath the regional Low-Revenue Subsidy benchmark premium quantity if they don’t select a plan on their very own. Different beneficiaries can apply for the Low-Revenue Subsidy via both the Social Safety Administration or Medicaid and are topic to each an earnings and asset check.

Half D Spending and Financing

Half D Spending

Medicare’s actuaries estimate that spending on Half D advantages (web of premiums paid by enrollees) will complete $141 billion in 2026, representing 11% of complete Medicare advantages spending.

Basically, Half D spending relies on a number of elements, together with the full variety of Half D enrollees, their well being standing and the amount and sort of medication used, the variety of high-cost enrollees (these with drug spending above the catastrophic threshold), the variety of enrollees receiving the Low-Revenue Subsidy, the value of medication lined by Half D and the flexibility of plan sponsors to barter reductions (rebates) with drug corporations and most well-liked pricing preparations with pharmacies, and to handle use (e.g., selling use of generic medicine, prior authorization, step remedy, amount limits, and mail order). Half D spending can also be affected by the extent of worth reductions that the federal authorities negotiates beneath the Medicare Drug Value Negotiation Program, in addition to the impact of the inflation rebate provision of the IRA on worth development for current medicine and launch costs for brand spanking new medicine.

Half D Financing

Financing for Part D comes from federal authorities contributions (75%), beneficiary premiums (13%), and state contributions (12%). Medicare subsidizes 74.5% of primary Half D profit prices via a month-to-month capitated fee to Half D plans for every enrollee, based mostly on a mean of bids submitted by plans for his or her anticipated primary profit prices, although this share could also be larger with the Inflation Discount Act’s 6% base beneficiary premium cap and the momentary Half D premium stabilization program in impact. Enrollee premiums for primary advantages have been initially set to cowl 25.5% of the price of customary (primary) drug protection, however with premium stabilization measures in impact, enrollees are paying a decrease share of prices total. Increased-income Half D enrollees pay a bigger share of ordinary Half D prices, starting from 35% to 85%, relying on earnings.

Funds to Plans

For 2026, Medicare’s actuaries estimate that Half D plans will obtain direct subsidy funds from the federal authorities for the price of primary Half D advantages (plus administrative bills and income) that common $1,710 per enrollee total, $522 in reinsurance funds for very high-cost enrollees, and $1,337 in subsidy funds for enrollees receiving the LIS. Employers are anticipated to obtain, on common, $561 in federal subsidies for retirees in employer-subsidy Half D plans. Half D plans additionally obtain extra risk-adjusted funds based mostly on the well being standing of their enrollees, and plans’ potential complete losses or positive factors are restricted by risk-sharing preparations with the federal authorities (“threat corridors”).

As of 2025, Medicare’s reinsurance funds to plans for complete spending incurred by Half D enrollees above the catastrophic protection threshold subsidize 20% of brand-name drug spending and 40% of generic drug spending, down from 80% in earlier years, resulting from a provision within the Inflation Discount Act. With this modification in impact, Medicare’s combination reinsurance funds to Half D plans are projected to account for 18% of complete Half D spending in 2026, based mostly on KFF evaluation of knowledge from the 2025 Medicare Trustees report. It is a substantial discount from 2024, when reinsurance spending had grown to account for near half of complete Half D spending (46%) (Determine 7). At present, the most important portion of complete Half D spending is accounted for by direct subsidy funds to plans (59% of complete spending in 2026).