Inexpensive Care Act (ACA) enhanced premium tax credit are set to run out on the finish of this 12 months. Enhanced premium tax credit had been launched in 2021 and later prolonged by way of the top of 2025 by the Inflation Discount Act. The improved tax credit each elevated the quantity of monetary help already eligible ACA Market enrollees acquired in addition to made middle-income enrollees with earnings above 400% of federal poverty tips newly eligible for premium tax credit.

Because the introduction of the improved premium tax credit, enrollment within the Market has more than doubled from about 11 to over 24 million individuals, the vast majority of whom obtain an enhanced premium tax credit score. If enhanced tax credit expire, many Market enrollees will proceed to qualify for a smaller tax credit score, whereas others will lose eligibility altogether and be hit by a “double whammy” of shedding their total tax credit score and being on the hook for rising premiums.

Since 2014, the ACA has capped how a lot sponsored enrollees pay for his or her medical health insurance premiums at a sure p.c of their earnings, on a sliding scale, with the federal authorities overlaying the rest within the type of a tax credit score. Enhanced tax credit work by additional decreasing the share of income ACA Market enrollees pay for a plan. For instance, with the improved tax credit in place, a person making $28,000 can pay not more than round 1% ($325) of their annual earnings in the direction of a benchmark plan. If the improved tax credit expire, this identical particular person would pay almost 6% of their earnings ($1,562 yearly) in the direction of a benchmark plan in 2026. In different phrases, if the improved tax credit expire, this particular person would expertise a rise of $1,238 of their annual premium funds web of the tax credit score.

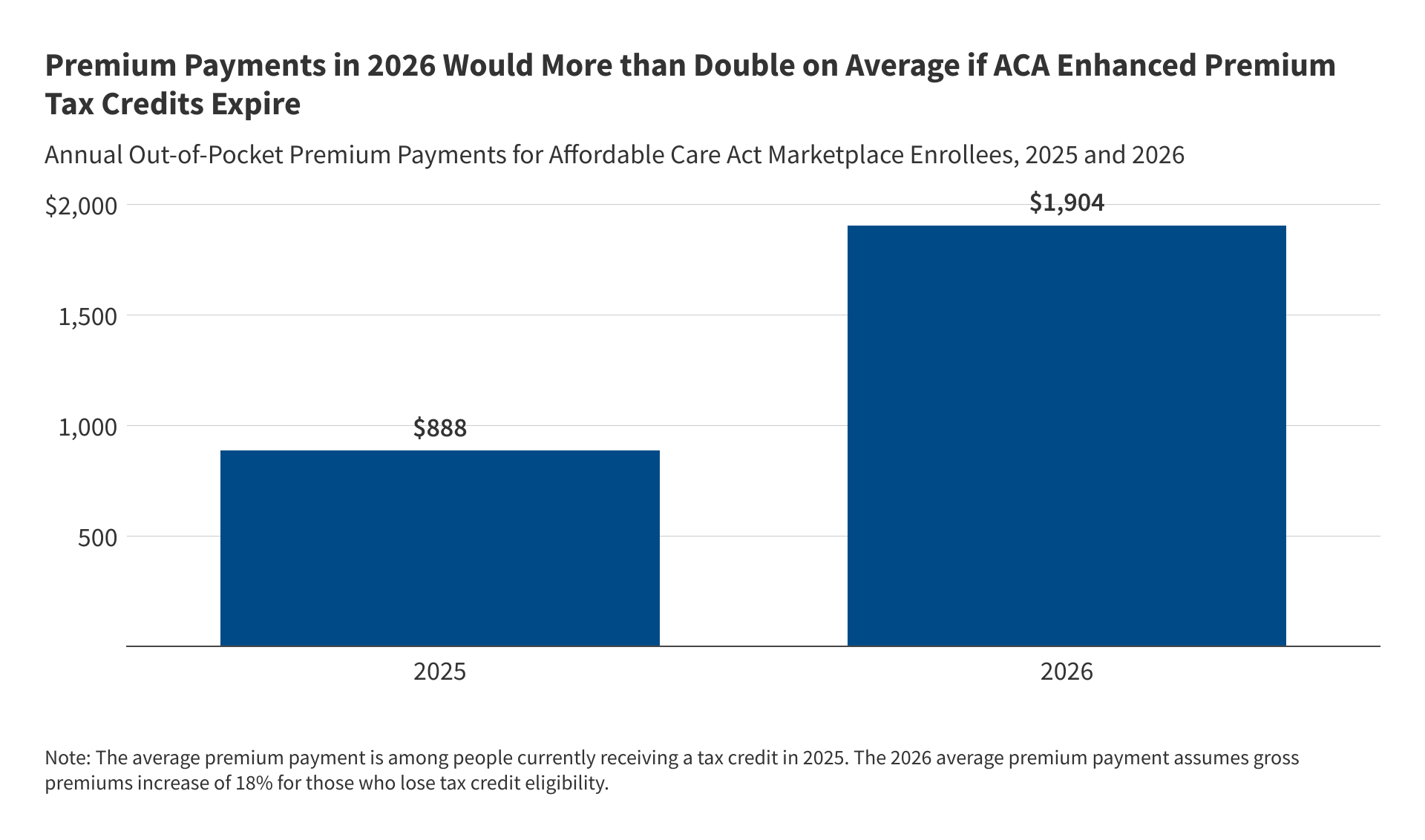

A earlier KFF evaluation, based mostly on information launched by the federal authorities, showed the improved premium tax credit saved sponsored enrollees a median of $705 yearly in 2024, bringing their annual premium fee all the way down to $888. With out the improved premium tax credit, annual premium funds in 2024 would have averaged $1,593 (over 75% increased than the precise $888). More moderen information haven’t been launched.

Based mostly on the sooner federal information and more moderen different publicly obtainable info, KFF now estimates that, if Congress extends enhanced premium tax credit, sponsored enrollees would save $1,016 in premium funds over the 12 months in 2026 on common. In different phrases, expiration of the improved premium tax credit is estimated to greater than double what sponsored enrollees at present pay yearly for premiums—a 114% enhance from a median of $888 in 2025 to $1,904 in 2026. (The common premium fee web of tax credit amongst sponsored enrollees held regular at $888 yearly in 2024 and 2025 as a result of enhanced premium tax credit).

The rise in premium funds with expiration of the improved premium tax credit is even increased than beforehand estimated for 2 causes:

- Trump administration modifications to tax credit score calculations, and

- Rising 2026 premiums.

The Trump administration made modifications to the best way tax credit are calculated, which had been finalized within the ACA Market Integrity and Affordability rule. The required contribution levels that might be in place for 2026 if the improved tax credit are usually not renewed might be increased relative to the required contribution ranges calculated underneath the unique methodology based mostly on guidelines in impact on the time. Which means enrollees are anticipated to pay the next share of their earnings in the direction of a benchmark premium plan in 2026 than they in any other case would have. Moreover, inflation in non-public insurance coverage premiums has led to increased premium contribution ranges than beforehand anticipated.

Moreover, insurers within the ACA Market are proposing to boost their charges by a median of 18%. Fueled by rising well being care prices and the expiration of the improved premium tax credit, insurers are proposing the biggest fee will increase in 2026 since 2018, the final time uncertainty over federal coverage modifications contributed to sharp premium will increase. As premiums enhance, the improved tax credit present extra financial savings to enrollees that obtain them. Which means middle-income enrollees, whose fee for a benchmark plan is at present capped at 8.5% of their earnings and can lose monetary help altogether, should cowl the price of premium will increase along with the quantity their tax credit would have beforehand coated to maintain their identical plan.

Enrollees throughout the earnings spectrum can count on huge will increase in premium funds

Enrollees with incomes above 400% of poverty might be topic to massive will increase in premium funds if enhanced premium tax credit expire. On common, a 60-year-old couple making $85,000 (or 402% FPL) would see yearly premium funds rise by over $22,600 in 2026, after accounting for an annual premium enhance of 18%. This could deliver the price of a benchmark plan to a couple of quarter of this couple’s annual earnings, up from 8.5%. In the meantime, a 45-year-old incomes $20,000 (or 128% FPL) in a non-Medicaid enlargement state would see their premium funds for a benchmark plan rise from $0 to $420 per 12 months, on common, from the lack of enhanced premium tax credit. About half (45%) of ACA Market enrollees have incomes between 100-150% of poverty, a couple of fourth (28%) have incomes between 150-250% of poverty, and roughly 1 in 10 have incomes above 400% of poverty.

Strategies

The common financial savings by earnings group for 2024 had been taken from the 2024 Open Enrollment report. The common yearly premium financial savings from enhanced premium tax credit (ePTC) for enrollees underneath 400% FPL had been outlined because the sum of the variations between the required contribution quantities with and with out ePTC, utilizing the estimated p.c of plan choices with ePTC by earnings class and assuming a uniform earnings distribution inside every class. To extrapolate to 2026, earnings was inflated by the ratio of the 2025 federal poverty tips to the 2023 federal poverty tips for a person within the continental US. For every earnings class, the financial savings had been assumed to develop because the ratio of the financial savings between 2026 and 2024. Attributable to a provision within the reconciliation invoice associated to sponsored ACA Market eligibility for immigrants, no enrollees underneath 100% FPL are assumed to obtain premium tax credit in 2026 and are thus not included within the calculation of common financial savings. For enrollees at or above 400% FPL, financial savings had been outlined as distinction between the typical unsubsidized premium and eight.5% of the typical particular person earnings, the required contribution underneath the improved tax credit for enrollees on this earnings class. For 2026, the typical unsubsidized premium was assumed to be 18% increased than the 2025 common unsubsidized premium, based mostly on evaluation of rate filings. Calculations assume that there aren’t any modifications in plan choice, household composition, earnings relative to FPL, and geography between 2024 and 2026. The annual premium fee for 2026 contains the estimated financial savings from enhanced tax credit in 2026 and the typical premium fee amongst sponsored enrollees in 2025 obtained from the 2025 Open Enrollment State-Stage Public Use File. State-funded subsidies may offset some will increase of premiums however are usually not accounted for within the estimation. Numbers from the Open Enrollment report for estimated shopper APTC financial savings as a result of ARP and IRA by earnings class (Desk 8) had been reported as entire numbers; a Monte Carlo methodology was used to account for this rounding, preserving all observations that rounded to the grand imply listed within the report.