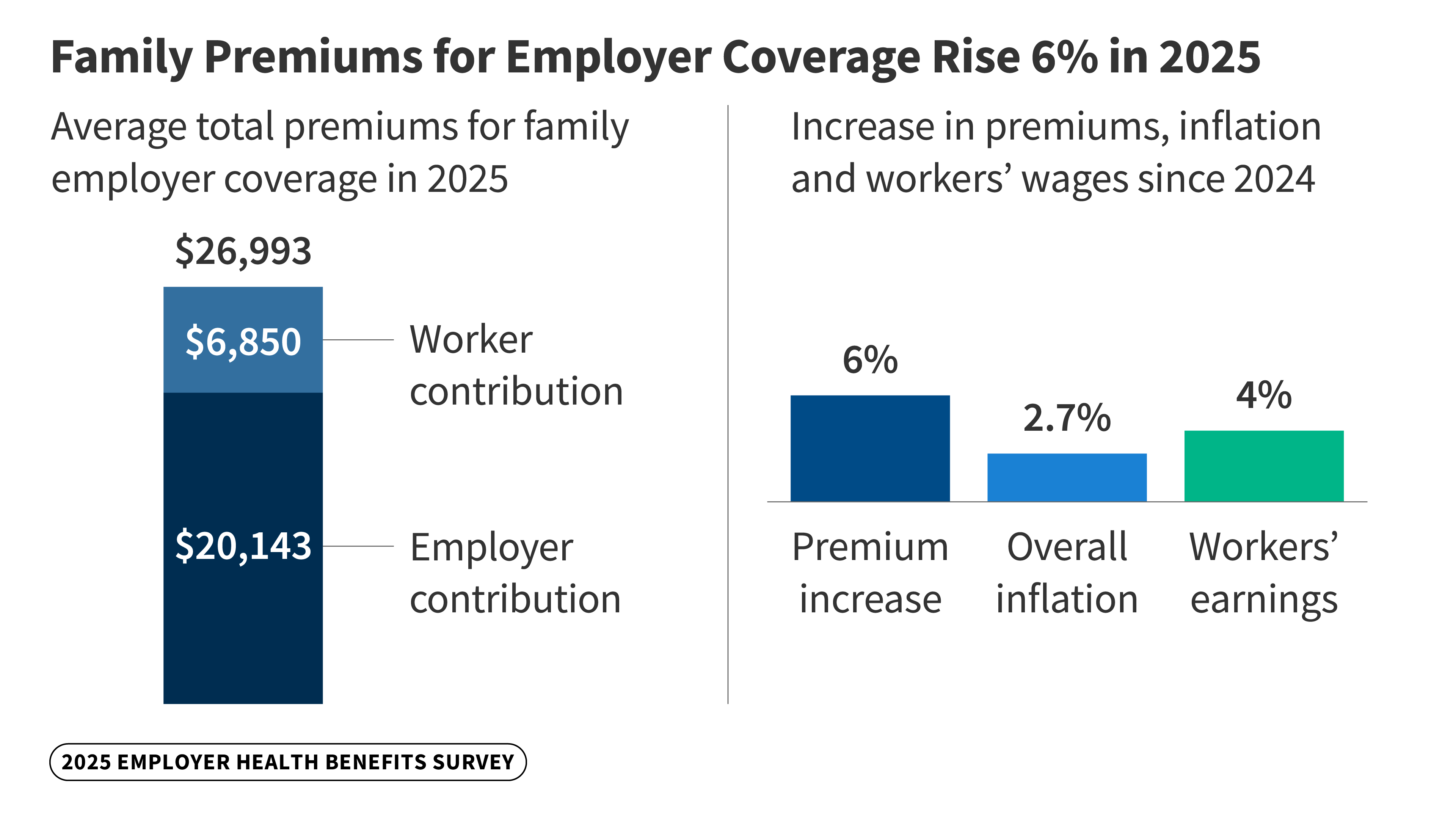

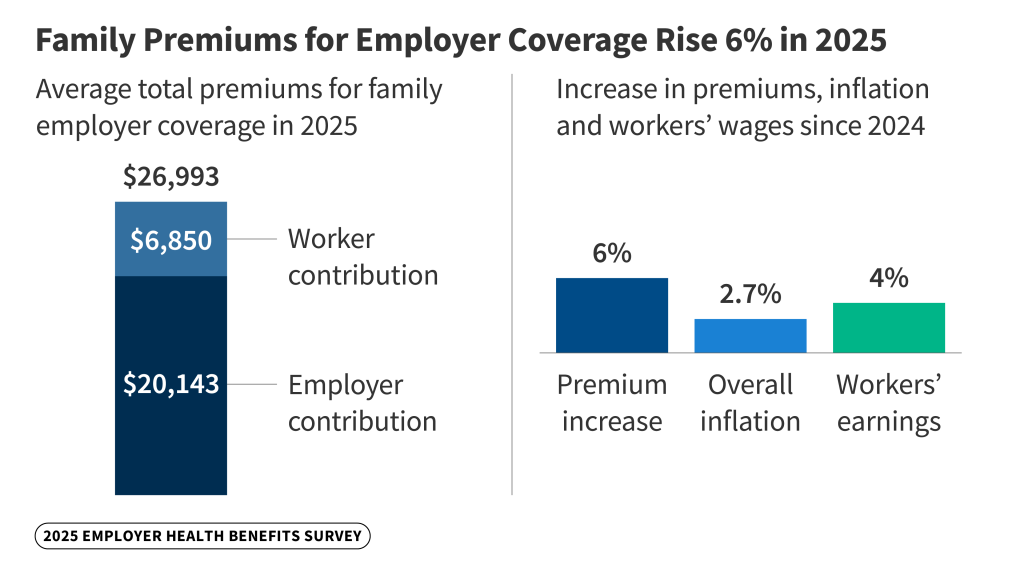

Household premiums for employer-sponsored medical insurance reached a median of $26,993 this yr, KFF’s annual benchmark health benefits survey of enormous and smaller employers finds. On common, employees contribute $6,850 yearly to the price of household protection, with employers paying the remaining.

Household premiums are up 6%, or $1,408, from final yr, much like the 7% enhance recorded in every of the earlier two years. This yr’s enhance compares to basic inflation of two.7% and wage progress of 4% over the identical interval.

Over the previous 5 years, the cumulative enhance in household premiums (26%) and in what employees pay towards household premiums (23%) is much like inflation (23.5%) and wage progress (28.6%).

Many employers could also be bracing for larger prices subsequent yr, with insurers requesting double-digit will increase within the small-group and particular person markets on common, presumably foreshadowing large will increase within the large-group markets as properly. Employers proceed to single out drug costs as an element contributing to larger premiums in recent times.

Amongst massive companies (at the very least 200 employees), who usually tend to know particulars of their medical insurance prices, greater than a 3rd (36%) say prescription drug costs contributed “an excellent deal” to larger premiums in recent times. Important shares say the identical about protection for brand spanking new pharmaceuticals (22%) in addition to the prevalence of power illness (30%), larger utilization of providers (26%), and hospital costs (22%).

“There’s a quiet alarm bell going off. With GLP-1s, will increase in hospital costs, tariffs and different elements, we count on employer premiums to rise extra sharply subsequent yr,” KFF President and CEO Drew Altman stated. “Employers don’t have anything new in their arsenal that may handle many of the drivers of their price will increase, and that would properly end in a rise in deductibles and different types of worker price sharing once more, a method that neither employers nor staff like however firms resort to in a pinch to maintain down premium will increase.”

About 154 million People beneath age 65 depend on employer-sponsored protection, and the twenty seventh annual survey of greater than 1,800 employers with at the very least 10 employees gives an in depth image of the tendencies affecting it.

Along with the full report and summary of findings launched immediately, Well being Affairs is publishing an article with select findings online. The article may also seem in its November challenge. And a new column from KFF’s Drew Altman discusses the restrictions employers face making an attempt to manage well being care prices and why extra sharply rising premiums anticipated subsequent yr may result in a brand new wave of rising deductibles.

Largest Employers Add GLP-1 Protection for Weight Loss, However Fret about Their Prices

About one in 5 (19%) of enormous companies providing well being advantages say they cowl pricey GLP-1 medicine comparable to Wegovy for weight reduction in 2025. A majority (57%) say they don’t cowl such medicine for weight reduction, whereas a couple of quarter (24%) are uncertain if their largest plan cowl them.

Among the many largest companies (these with at the very least 5,000 employees), 43% now say they cowl GLP-1 medicine for weight reduction of their largest plan, up from 28% in 2024.

Many employers situation their protection of those medicines, and a few require that enrollees take further steps to handle their weight. For instance, a couple of third (34%) of enormous companies providing these medicine for weight reduction require that enrollees meet with a dietician, therapist or different skilled, or take part in a way of life program, for the medicine to be coated.

Even with such restrictions, the excessive price of those medicine worries many employers. Most (59%) of the most important employers (at the very least 5,000 employees) providing the medicine for weight reduction say their price has exceeded expectations, and two-thirds (66%) say that that they had a “important” impression on their well being plan’s prescription drug spending.

Such elements could lead on some employers to scale back or eradicate protection or add further restrictions. And whereas most massive employers (44%) say overlaying GLP-1 medicine is both essential or essential to their staff, simply 1% of these not already providing protection say they’re “very probably” to take action subsequent yr.

A companion report for the Peterson-KFF Health System Tracker based mostly on focus-group conversations highlights how the excessive prices of overlaying GLP-1 medicine is main some employers to alter how they cowl the medicine, comparable to tightening utilization controls. Some employers report proscribing protection for enrollees with diabetes.

“Massive employers know these new high-priced weight-loss medicine are an essential profit for his or her employees, however their prices usually exceed their expectations,” KFF Senior Vice President and research creator Gary Claxton stated. “It’s not a shock that some are rethinking entry to the medicine for weight reduction.”

Extra Staff Are in HSA-Certified Plans as Common Deductible Reaches $1,886

The survey finds almost three in 10 coated employees (29%) are actually enrolled in high-deductible well being plans that may very well be used with a tax-preferred Well being Financial savings Account.

Amongst employees who face an annual deductible for single protection, the common this yr stands at $1,886, which compares to $1,773 final yr. Deductibles are up 17% since 2020 when the common was $1,617.

On common, employees with a deductible at small companies (beneath 200 employees) face a lot bigger deductibles than employees at bigger companies ($2,631 vs. $1,670). Greater than half (53%) of coated employees at small companies now face a deductible of at the very least $2,000, and greater than a 3rd (36%) face a median single deductible of at the very least $3,000.

In 2025, almost three-quarters (72%) face an out-of-pocket most of greater than $3,000 for single protection, together with one in 5 (21%) who face an out-of-pocket most of greater than $6,000.

Protection for Half-Time and Low-Wage Staff Lags; Medicaid Can Fill Gaps

The survey additionally highlights some challenges dealing with part-time and low-wage employees in acquiring well being protection.

Half-time employees typically will not be eligible for his or her employer’s well being advantages, with solely 27% of enormous companies and 18% of small companies providing protection to part-time employees.

A a lot smaller share of employees is roofed by their employer’s well being advantages at companies with many low-wage employees (43%) than at companies with few low-wage employees (64%). One third (34%) of small employers that don’t supply well being advantages say that Medicaid is a “essential” supply of protection for his or her employees, and one other one in 5 (22%) say Medicaid is “considerably essential.”

The survey additionally finds that Particular person Protection Well being Reimbursement Preparations (ICHRAs) — a much-hyped possibility to assist employees buy protection via the Reasonably priced Care Act (ACA) Marketplaces or elsewhere on the person market —haven’t taken off.

Amongst small companies that don’t supply well being advantages, 9% report providing funds to at the very least one employee to buy their very own protection, much like the share who stated so final yr (11%). Among the many remainder of non-offering small companies, simply 2% say they had been “very probably” to supply such help to any employees within the subsequent two years. A companion report for the Peterson-KFF Health System Tracker highlights employers’ expertise with ICHRA and the way this nascent market is taking form.