Editorial Word: This transient was initially printed on September 24, 2025 and was up to date on October 20, 2025 to incorporate the revised, greater value estimate from the Congressional Price range Workplace of the adjustments to the orphan drug exclusion within the 2025 tax and price range reconciliation legislation.

Modifications are coming to Medicare’s drug value negotiation program that might end in no less than $5 billion in further Medicare spending over time, if not more, and better out-of-pocket prices for folks with Medicare. Beneath the Medicare Drug Price Negotiation Program, the federal authorities is required to barter with drug firms for the worth of some high-spending medication which have been available on the market for a number of years with out competitors, with the objective of decreasing Medicare drug spending and serving to to cut back out-of-pocket prices for folks with Medicare. The legislation that established the negotiation program, the Inflation Reduction Act of 2022, excluded sure sorts of medication from negotiation, together with orphan drugs permitted to deal with a single uncommon illness or situation. The new tax and budget reconciliation law handed by Congressional Republicans and signed by President Trump in July 2025 modifies the orphan drug exclusion in methods that may result in greater Medicare spending – a further $8.8 billion, in accordance with a recently-updated Congressional Price range Workplace (CBO) estimate, up from its authentic estimate of $4.9 billion, which didn’t totally account for all of the medication that may doubtless be affected – and better prices for beneficiaries who take these medicines.

Takeaways

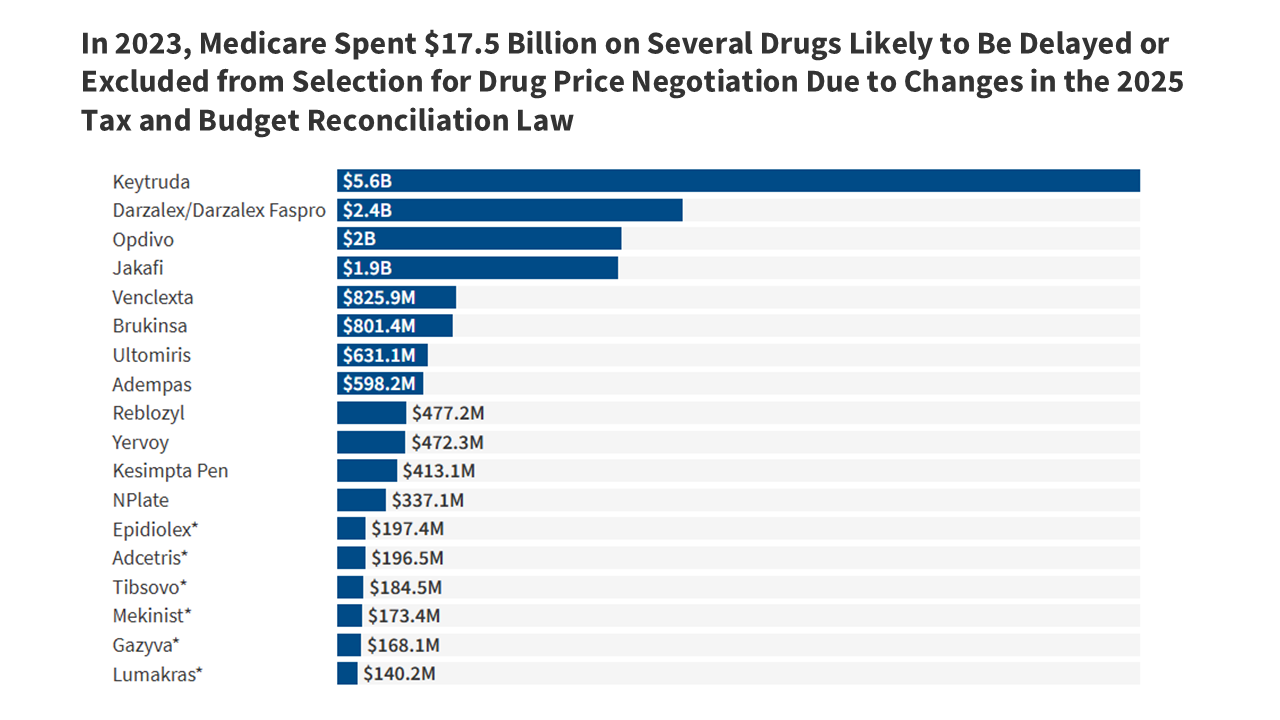

- The brand new tax and price range legislation will end in delayed eligibility or exclusion from Medicare drug value negotiation for a number of high-spending medication, together with plenty of most cancers medication and different medicines with $17.5 billion in complete spending by Medicare and beneficiaries in 2023. For instance, the adjustments in legislation are anticipated to delay choice of Keytruda and Opdivo, each available on the market since 2014, by no less than one 12 months. In 2023, Medicare and beneficiaries spent $5.6 billion on Keytruda and $2.0 billion on Opdivo. Several other drugs are additionally prone to be delayed of their eligibility to be chosen for negotiation or are now ineligible for negotiation except they obtain non-orphan approvals sooner or later.

- Increasing the orphan drug exclusion to permit extra medication to be delayed or excluded from Medicare drug value negotiation, as underneath the brand new tax and price range legislation, will imply greater out-of-pocket prices for Medicare beneficiaries who use these medicines. Medicare’s negotiated drug costs may also help to decrease the quantity beneficiaries pay, notably in conditions the place they face a coinsurance requirement that’s calculated primarily based on the underlying value of the drug, corresponding to within the case of Half B medication and higher-cost Half D medication. By delaying or excluding further orphan medication from choice for value negotiation, the tax and price range legislation will preserve greater costs for these medication relative to the worth Medicare would have paid if the medication had been eligible and chosen for drug value negotiation, which can translate to greater out-of-pocket legal responsibility. For instance, if the federal government have been to barter a 22% low cost off the worth of Keytruda, on par with the common 22% net price discount from the first round of Medicare drug price negotiation, that will generate annual financial savings on cost-sharing legal responsibility of round $3,300 for Medicare beneficiaries who use Keytruda.

- Delaying or excluding orphan medication from Medicare drug value negotiation will value the federal authorities a number of billion {dollars} over the approaching decade – $8.8 billion according to CBO, or near 10% of the general 10-year $98.5 billion savings to Medicare that CBO projected from the Inflation Discount Act’s Medicare drug value negotiation program when that legislation handed in 2022. CBO’s new estimate is 80% greater than its authentic estimate of $4.9 billion, which didn’t totally account for all of the medication that may doubtless be affected, together with Keytruda, Opdivo, and Darzalex. The price to Medicare of adjustments to the orphan drug exclusion included within the 2025 reconciliation legislation may additionally develop over time primarily based on how the pharmaceutical trade responds, if it results in extra orphan medication coming to market and extra orphan indications (in addition to non-orphan indications) for orphan medication already available on the market to keep away from or delay being topic to cost negotiation.

What’s the orphan drug exclusion and the way does the brand new tax and price range legislation modify it?

Beneath the IRA, medication which can be designated for just one uncommon illness or situation with approvals underneath that one designation have been excluded from Medicare drug value negotiation. This exclusion helped to deal with pharmaceutical industry concerns concerning the potential dampening impact on orphan drug analysis and improvement if medication permitted to deal with a single uncommon illness have been topic to Medicare value negotiation. After enactment of the IRA, efforts to develop the orphan drug exclusion have been launched, primarily based on pharmaceutical industry and rare disease advocacy group issues concerning the potential influence on analysis and improvement for multi-orphan drugs. This echoes broader claims made by the trade concerning the influence on drug improvement related to different insurance policies to cut back drug costs, whilst excessive drug costs create affordability and entry challenges for sufferers. However, lobbying efforts culminated with the inclusion of adjustments to the IRA’s orphan drug exclusion supported by the pharmaceutical industry within the not too long ago enacted tax and price range legislation.

Modifications within the tax and price range legislation embody broadening the orphan drug exclusion to make orphan medication which can be designated for a number of uncommon ailments or situations, not only a single uncommon illness, ineligible for Medicare drug value negotiation, and delaying the beginning of the 7- or 11-year ready interval for choice for drug value negotiation for orphan medication that subsequently obtain FDA approval for a non-orphan indication. Beneath the IRA, small-molecule medication have to be 7 years previous FDA approval and biologics 11 years previous FDA licensure when medication are chosen for negotiation. Beneath the brand new tax and price range legislation, for orphan medication, this 7- or 11-year ready interval begins solely when the drug has obtained approval for a non-orphan indication.

Whereas these adjustments to Medicare’s drug value negotiation program would possibly look like comparatively minor, they are going to end in some very high-spending medication turning into eligible for negotiation later than they in any other case would have been and different medication might be excluded solely except they’re permitted for non-orphan makes use of sooner or later. Taken collectively, these adjustments have the potential to cut back financial savings to Medicare from the negotiation program and result in greater beneficiary out-of-pocket prices.

The brand new tax and price range legislation may influence which high-spending medication are chosen for negotiation within the coming 12 months

A number of drugs that have been anticipated to be chosen for Medicare drug value negotiation within the close to future primarily based on assembly the criteria for selection – together with complete Medicare spending of greater than $200 million, lack of generic or biosimilar equivalents, and a adequate variety of years since FDA approval – at the moment are prone to be off the desk, both delayed of their eligibility to be chosen for negotiation or no longer eligible. Amongst them are a number of high-spending most cancers medication, together with Keytruda, Darzalex, Opdivo, and Jakafi, together with several other medications used to deal with numerous sorts of most cancers and different medical situations (Table 1).

In 2023, spending by Medicare and beneficiaries on these medication totaled $17.5 billion, an 83% improve since 2019 ($9.5 billion), primarily based on Medicare Part B and Part D drug spending data from the Facilities for Medicare & Medicaid Providers (Determine 1, Table 2). These estimates embody Half D spending underneath each conventional Medicare and Medicare Benefit however Half B drug spending in conventional Medicare solely, since Medicare Benefit spending knowledge are unavailable. Of those medicines, Keytruda alone accounts for 32% of the entire, with $5.6 billion in spending in 2023, up from $2.7 billion in 2019. Of the 734 drug and biologic merchandise included in CMS’s Medicare Half B drug spending knowledge for 2023, Keytruda ranked primary when it comes to complete spending by Medicare and beneficiaries, excluding any spending by enrollees in Medicare Benefit.

The change in legislation is anticipated to delay choice of Keytruda and Opdivo for value negotiation by no less than one 12 months, with an extended delay or exclusion from negotiation making use of to different medicines

Modifications to the orphan drug exclusion will take impact starting with the third spherical of drug value negotiation in 2026, with the choice of medication required to be introduced no later than February 1, 2026, and Medicare’s negotiated costs for these medication taking impact on January 1, 2028. The adjustments are prone to have a right away influence on which medication are chosen for Medicare value negotiation in 2026 by delaying the choice of Keytruda and Opdivo, which have been prone to be chosen for negotiation subsequent 12 months primarily based on their complete spending ranges and assembly different statutory standards.

- Keytruda, manufactured by Merck, was first permitted as an orphan drug to deal with melanoma in September 2014 and was subsequently permitted for a non-orphan indication for non-small cell lung most cancers in October 2015, adopted by several other approvals for additional indications, broadening its use past the unique uncommon illness approval. Beneath the IRA, Keytruda would have been eligible to be chosen for value negotiation in February 2026, since that might be greater than 11 years after its preliminary FDA approval, and Medicare’s negotiated value would have been accessible in 2028 if it had been chosen subsequent 12 months. However underneath the brand new tax and price range legislation, Keytruda’s eligibility to be chosen for negotiation might be delayed a 12 months to 2027, with Medicare’s negotiated value accessible in 2029 whether it is chosen for negotiation. It is because the 13-month interval that Keytruda was available on the market as an orphan-only drug won’t depend in the direction of the 11-year ready interval following preliminary FDA approval that determines when biologic medication doubtlessly turn out to be eligible for choice.

- An analogous delay doubtless applies to Opdivo, manufactured by Bristol Myers Squibb, which was first permitted as an orphan drug to deal with melanoma in December 2014 however was subsequently permitted for a non-orphan indication for non-small cell lung most cancers in March 2015. Opdivo’s eligibility to be chosen for negotiation might be delayed a 12 months from 2026 to 2027, assuming the drug continues to satisfy different standards for choice.

An extended delay doubtless applies to different orphan medication, together with Yervoy, manufactured by Bristol Myers Squibb, which was first permitted as an orphan drug to deal with melanoma in March 2011 however was subsequently permitted for non-orphan indications for kidney most cancers in April 2018 and colorectal most cancers in July 2018. Eligibility for Yervoy to be chosen for negotiation will doubtless be delayed by 4 years, from 2026 to 2030.

Exclusion from negotiation will now apply to a number of different orphan medication primarily based on the brand new tax and price range legislation’s adjustments to the IRA’s orphan drug exclusion provision. For instance, Jakafi (manufactured by Incyte), Venclexta (manufactured by AbbVie), and Darzalex (manufactured by Janssen Biotech) are orphan medication with a number of orphan designations and approvals however no non-orphan approvals, which beforehand made them eligible to be chosen for negotiation underneath the IRA, however they’re not eligible underneath the brand new tax and price range legislation, except they obtain approval for wider makes use of sooner or later.

The excessive value of those medication has contributed to their comparatively excessive annual Medicare spending per consumer

Whole spending by Medicare and beneficiaries on a single declare for every of those medication in 2023 exceeded a number of thousand {dollars} – in lots of circumstances, $10,000 or extra – which translated to annual complete spending per consumer of tens of hundreds of {dollars}. For instance, spending on the blood most cancers drug Jakafi underneath Medicare Half D was $16,700 per declare and $138,200 per consumer in 2023; spending on Keytruda underneath Medicare Half B was $12,600 per declare and $76,100 per consumer in 2023, and for Opdivo, Half B spending was $10,500 per declare and $69,800 per consumer (Determine 2). Whereas the entire variety of Medicare beneficiaries utilizing any considered one of these medicines is comparatively low in comparison with extra generally used medication – round 70,000 for Keytruda in 2023 and fewer than 30,000 for the opposite medicines (Table 2) – their excessive costs translate to comparatively excessive annual spending underneath Medicare.

Coinsurance necessities for high-cost Half B and Half D medication translate to excessive out-of-pocket prices for Medicare beneficiaries

For top-priced medication lined underneath Half B or Half D, beneficiary cost-sharing necessities within the type of coinsurance (a proportion of the drug’s complete value) can translate to a number of hundred {dollars}, if not $1,000 or extra, every time they fill a prescription or are administered the drug.

- Beneath Medicare Half B, which primarily covers physician-administered medicines like Keytruda, Darzalex, and Opdivo, beneficiaries in conventional Medicare face a 20% coinsurance requirement. Most however not all conventional Medicare beneficiaries have some kind of additional coverage to assist with their Medicare cost-sharing necessities, corresponding to employer-sponsored protection, Medigap, or Medicaid. By law, beneficiary cost-sharing legal responsibility for a Half B drug or different service supplied in a hospital outpatient setting on a single day can not exceed the quantity of the Half A hospital inpatient deductible, which is $1,676 in 2025. However this cover doesn’t apply to Half B medication administered in a doctor’s workplace, and there’s no restrict on complete annual out-of-pocket legal responsibility for companies lined underneath Half A or Half B in conventional Medicare.

- Beneath Medicare Benefit, plans can cost not more than 20% for Half B medication administered by an in-network supplier and are required to have a most out-of-pocket restrict, not like conventional Medicare. In 2025, the restrict averages $5,320 for in-network services and $9,547 for in-network and out-of-network services combined.

- Beneath Medicare Half D, coinsurance for high-priced medication positioned on the specialty tier, like Jakafi and Venclexta, ranges from 25% to 33%. Beneath the Half D profit, an annual out-of-pocket spending cap of $2,000 in 2025 (rising to $2,100 in 2026) limits an enrollee’s value publicity, and one other characteristic permits enrollees to spread out their out-of-pocket costs over the course of the calendar 12 months, serving to to restrict the monetary burden of excessive month-to-month cost-sharing necessities.

Primarily based on these cost-sharing necessities, Medicare beneficiaries will face comparatively excessive coinsurance for these orphan medication every time the drug is run or once they fill a prescription. For Half B medication, out-of-pocket legal responsibility per declare can quantity to $1,000 or extra for medication administered in a doctor’s workplace or maxes out on the quantity of the Half A inpatient deductible for medication administered in hospital outpatient departments. For Half D medication, beneficiaries in 2026 would doubtless hit the $2,100 out-of-pocket cap with a single prescription fill.

For instance, primarily based on the $12,600 complete value per declare for Keytruda in 2023, 20% coinsurance underneath Half B quantities to round $2,500, or roughly $15,000 for the 12 months (primarily based on six claims for every Keytruda consumer in 2023, on common). For Opdivo, coinsurance of 20% primarily based on a $10,500 value per declare quantities to $2,100 beneficiary legal responsibility per declare, or roughly $14,000 yearly (primarily based on 6.6 claims for every Opdivo consumer in 2023) (Determine 3). For Jakafi, the $16,700 complete value per declare would imply a Half D enrollee would hit the $2,100 annual out-of-pocket cap in 2026 with one fill, primarily based on a specialty tier coinsurance requirement of 25% to 33%.

Extra delays and exclusions from Medicare drug value negotiation supplied underneath the brand new tax and price range legislation will doubtless imply greater out-of-pocket prices for Medicare beneficiaries who use these medicines

Medicare’s negotiated drug costs may also help to decrease the quantity beneficiaries pay, notably in conditions the place they face a coinsurance requirement that’s calculated primarily based on the underlying value of the drug, corresponding to within the case of Half B medication and higher-cost Half D medication. By delaying value negotiation for sure orphan medication or excluding them from eligibility for negotiation, the tax and price range legislation maintains greater costs relative to the worth Medicare would have paid if the medication had been eligible for drug value negotiation. The consequence might be greater out-of-pocket legal responsibility for Medicare beneficiaries, which may give rise to cost-related entry issues and decrease utilization.

Estimating the precise magnitude of upper cost-sharing legal responsibility would rely partly on how a lot decrease Medicare’s negotiated costs would fall beneath establishment costs for medication that will have been chosen for negotiation however for the adjustments in legislation, and the way for much longer the upper costs apply. Within the absence of those extra precise estimates, the next examples of potential financial savings from Medicare drug value negotiation assist for instance the potential foregone financial savings for beneficiaries of delaying or totally exempting orphan medication from value negotiation.

- If the federal government have been to barter a 22% low cost off the worth of Keytruda, on par with the common 22% net price discount from the first round of Medicare drug price negotiation, that will generate financial savings of round $550 per declare for Medicare beneficiaries, lowering out-of-pocket legal responsibility to only underneath $2,000. Annual financial savings would quantity to round $3,300, primarily based on a mean of six claims per consumer in 2023.

- Equally, for Opdivo, a 22% negotiated value low cost would generate financial savings of round $460 per declare, lowering out-of-pocket legal responsibility to round $1,600. Annual financial savings would quantity to round $3,000, primarily based on a mean of 6.6 claims per Opdivo consumer in 2023.

These illustrative examples recommend that the continuation of upper costs for sure medication caused by the brand new tax and price range legislation may place further monetary pressure on beneficiaries within the type of greater out-of-pocket legal responsibility, with potential out-of-pocket financial savings from value negotiation for these high-cost medication of a number of hundred {dollars}. On the similar time, even decreased cost-sharing legal responsibility for these costly medicines would possibly proceed to characterize a considerable monetary burden for some Medicare beneficiaries, particularly for these in conventional Medicare with out further protection and people in Medicare Benefit previous to reaching their most out-of-pocket restrict.

Delaying or excluding further orphan medication from choice for Medicare drug value negotiation will value the federal authorities a number of billion {dollars} over the approaching decade

Based on a brand new estimate from the Congressional Price range Workplace (CBO), adjustments to the orphan drug exclusion within the 2025 reconciliation legislation will improve Medicare spending by $8.8 billion between 2025 and 2034. That is an 80% improve from CBO’s authentic estimate of $4.9 billion, which didn’t totally account for sure medication which can be prone to be affected by the adjustments, together with Keytruda, Opdivo, and Darzalex. This greater spending erodes near 10% of the general 10-year $98.5 billion savings to Medicare that CBO projected from the Inflation Discount Act’s Medicare drug value negotiation program when that legislation was enacted in 2022. The price to Medicare of adjustments to the orphan drug exclusion included within the 2025 reconciliation legislation may additionally develop over time primarily based on how the pharmaceutical trade responds, if it results in extra orphan medication coming to market and extra orphan indications (in addition to non-orphan indications) for orphan medication already available on the market to keep away from or delay being topic to cost negotiation.

With several blockbuster drugs anticipated to be delayed or excluded from choice for negotiation as a result of adjustments within the new tax and price range legislation, CMS might be required to skip over these higher-spending medication when it selects the record of medicine for negotiation sooner or later. Whereas the adjustments to the IRA’s orphan drug exclusion have been made in response to claims concerning the potential for much less innovation associated to medication for uncommon ailments underneath the unique provision, the adjustments are anticipated to cut back the potential financial savings from Medicare’s drug value negotiation program and lengthen greater out-of-pocket legal responsibility for Medicare sufferers who use these medication.

This work was supported partly by Arnold Ventures. KFF maintains full editorial management over all of its coverage evaluation, polling, and journalism actions.