Quick-term, limited-duration (STLD) well being plans have lengthy been bought to people via the “non-group” (individually-purchased) personal insurance coverage market and thru business associations. STLDs had been designed for people who expertise a short lived hole in well being protection, resembling somebody who’s between jobs. Quick-term plans are sometimes marketed as less expensive alternate options to medical insurance bought on the Reasonably priced Care Act (ACA) Market. Nonetheless, STLDs present much less complete protection and have fewer client protections than Market plans. As Open Enrollment for Market plans nears, current actions taken by Congress and the Trump administration, and the potential expiration of enhanced premium tax credits, are more likely to lead to hundreds of thousands of individuals shedding protection or having to pay substantially higher premiums for Market protection. On the similar time, the Trump administration not too long ago announced that it will not prioritize enforcement actions for violations of Biden-era client protections for short-term plans, and that it intends to undertake rulemaking, which might roll again these rules. Taken collectively, these modifications could lead on extra customers to buy cheaper and fewer complete protection, resembling short-term plans, as a substitute of a extra complete ACA plan this Open Enrollment season.

KFF has analyzed short-term well being insurance policies bought on the web sites of 9 giant insurers in a significant metropolis in every of the 36 states the place short-term plans can be found. These insurers provide 30 distinct merchandise, with a complete of roughly 200 distinct plans. For extra particulars, see the Strategies part. This temporary gives an replace to and growth of an analogous 2018 KFF quantitative analysis, analyzing premiums, price sharing, coated advantages, and protection limitations of those short-term insurance policies, and evaluating their options to plans bought on the ACA Market.

Key Takeaways

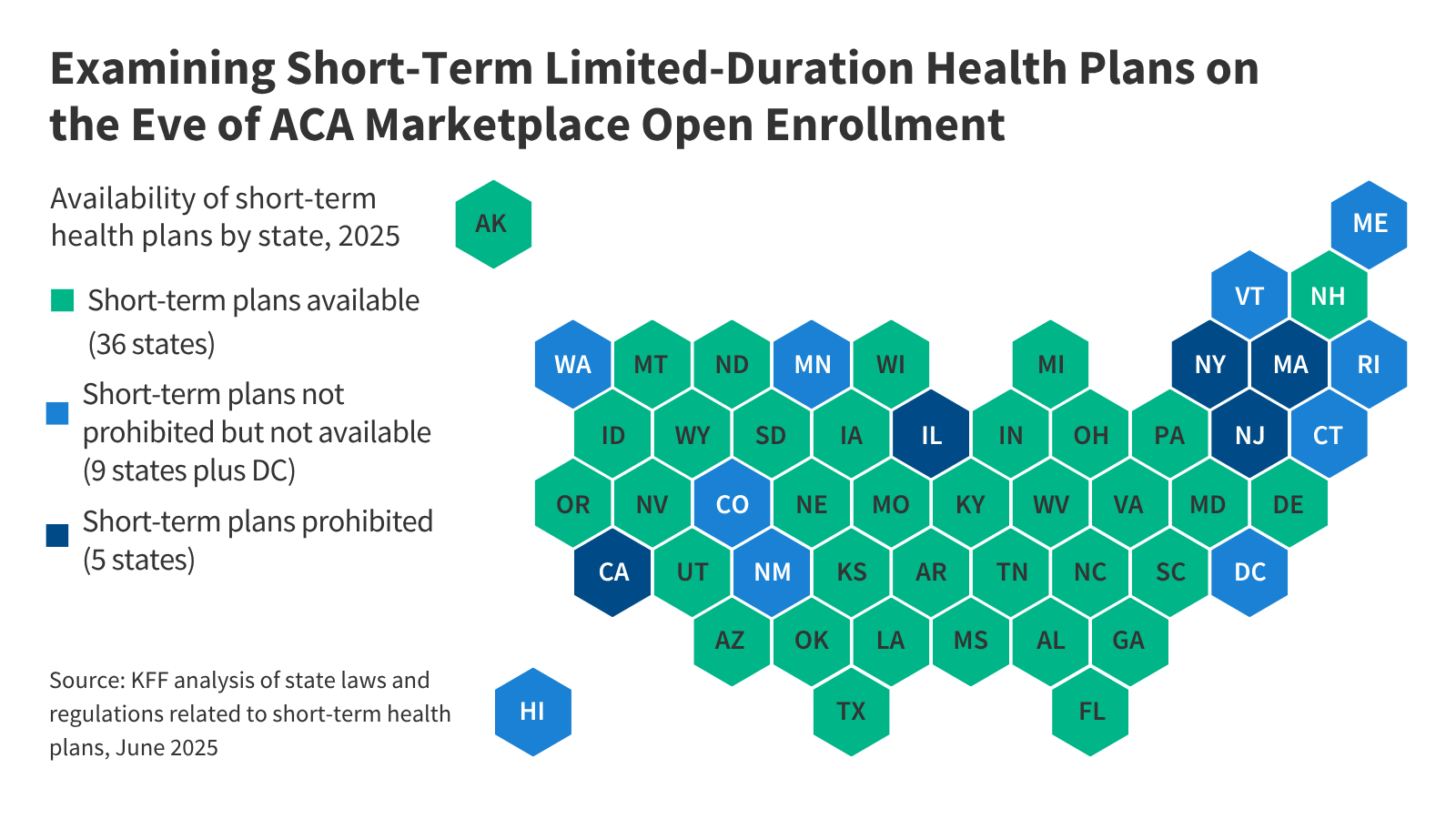

- Quick-term plans are bought in 36 states. 5 states prohibit the sale of short-term well being plans, and in 9 states plus the District of Columbia, short-term plans aren’t outright prohibited, however none can be found resulting from extra intensive state rules.

- Premiums for the lowest-cost short-term plans can price at two-thirds or lower than the lowest-cost unsubsidized Bronze plans bought on the ACA Market in the identical space. Nonetheless, the overwhelming majority of Market enrollees obtain premium tax credit, which may successfully lead to equally priced and even cheaper Market plans, all of which give extra complete protection than the best price short-term plan.

- Quick-term plans are inclined to have decrease premiums as a result of they’re medically underwritten and have pre-existing situation exclusions. For instance, a person with most cancers, weight problems, or who’s pregnant is more likely to be declined. Moreover, the lowest-cost short-term plan premium for a 40-year-old girl ranges from 6% to 19% larger than the lowest-cost premium for a person. These practices aren’t permitted in ACA-compliant plans.

- Quick-term plan deductibles for a person in choose U.S. cities vary from $500 to $25,000 in comparison with $0 to $9,200 for Bronze Market plans. Silver and Gold plans have decrease deductibles, but in addition larger premiums. In contrast to all ACA-compliant plans, most short-term plans would not have out-of-pocket (OOP) maximums or solely apply these maximums to sure OOP bills. The utmost profit limits for short-term plans bought in these ten cities are as little as $100,000 per coverage time period. ACA-compliant plans aren’t allowed to have annual or lifetime greenback limits.

- Amongst all of the short-term merchandise we reviewed, 40% don’t cowl psychological well being providers, 40% don’t cowl substance abuse remedy, 48% don’t cowl outpatient prescribed drugs, and virtually all exclude protection for grownup immunizations (94%) and maternity care (98%). All ACA-compliant plans should cowl these providers.

- Even when short-term plans do cowl these and different advantages, limitations and exclusions virtually all the time apply that may not be permitted beneath ACA-compliant plans, resembling separate profit limits, limits on the variety of main care visits the plan will cowl, and limits on the variety of days the plan will cowl inpatient hospital care.

Background

Shopper Protections

Because the identify suggests, short-term well being plans aren’t required to be renewable. Whereas federal legislation, since 1996, has required all different particular person medical insurance to be assured renewable on the policyholder’s possibility, protection beneath a short-term coverage terminates on the finish of the contract time period. Persevering with protection past that time period requires making use of for a brand new coverage. A person who buys a short-term coverage after which turns into critically ailing won’t be able to resume protection when the coverage ends.

The ACA prohibits medical insurance plans bought on the non-group market from practices resembling medical underwriting, pre-existing situation exclusions, and lifelong and annual limits. ACA-compliant plans are required to supply minimal protection requirements and restrict out-of-pocket price sharing ($9,200 for a person in 2025). Since short-term plans aren’t regulated as particular person market insurance coverage beneath federal legislation, these market guidelines do not apply to short-term plans, which, against this, can:

- base premiums, with out restrict, on well being standing, gender, and age;

- require software charges or enrollment in a particular affiliation to be eligible for protection;

- deny protection for folks with pre-existing circumstances, or exclude protection for these circumstances;

- exclude protection for important well being advantages, together with maternity care, prescribed drugs, psychological well being care, and preventive care, and restrict protection in different methods;

- impose lifetime and annual greenback limits on coated providers;

- not have an out-of-pocket most on affected person price sharing; and

- exclude different ACA client protections, resembling charge overview or minimal medical loss ratios.

Quick-term insurance policies aren’t thought-about “minimal important protection,” the time period used to explain well being protection that meets the ACA requirement that people have well being protection, and which determines eligibility for Particular Enrollment Durations. Due to this fact, lack of short-term protection doesn’t qualify a person for a Particular Enrollment Interval within the ACA Market, so that they must wait till the following Open Enrollment interval to enroll in an ACA Market plan.

There is no such thing as a present or complete knowledge on the variety of customers enrolled in an STLD. Most accessible estimates are a considerable undercount as a result of they don’t account for STLDs bought via associations, which is probably going the majority. Essentially the most complete estimate might come from a 2020 Congressional investigation, which estimated that roughly 3 million folks had been enrolled in a short-term plan in some unspecified time in the future throughout 2019.

Federal Legal guidelines and Rules

At present, short-term plans are sometimes accessible for one to 6 months, with some issuers providing protection for as much as 12 months and one providing “three-packs” of short-term insurance policies, enabling customers to purchase as much as three years of short-term protection at a time. The length and renewability of STLD plans have been the topic of fixing federal rules, as proven in Desk 1.

To deal with reviews of misleading marketing and deceptive sales tactics, present federal regulations additionally require short-term plans to conspicuously notify customers that short-term plans are “NOT complete protection” and to incorporate standardized language describing STLD plans’ protection limitations compared to insurance coverage bought on HealthCare.gov.

The Trump administration’s 2018 regulation increasing the permitted length of short-term plans was challenged in district courtroom, with a 2019 ruling in favor of the federal government. The Biden administration as soon as once more imposed limits on using short-term plans. In August 2025, the Trump administration announced that it will not prioritize enforcement of Biden-era rules on short-term plans and that it intends to undertake corresponding rulemaking. Amendments to those provisions might, once more, immediate lawsuits. In the meantime, a lawsuit difficult the 2024 rules is working its manner via the courts.

State Legal guidelines and Rules

Quick-term well being plans can be found in 36 states (Determine 1). 5 states (CA, IL, MA, NJ, and NY) have legal guidelines prohibiting the sale of short-term well being plans. In 9 states plus the District of Columbia, short-term plans aren’t prohibited, however none can be found resulting from extra intensive state rules that require these plans to supply extra client protections than they do in different states (e.g., no pre-existing situation exclusions, protection of sure advantages, shorter durations).

How Quick-Time period Plans Examine to Bronze-Stage ACA Market Plans

Premiums

Resulting from protection limitations and fewer client protections, short-term insurance policies, unsurprisingly, sometimes have decrease premiums than unsubsidized Bronze plans, a development that’s just like our 2018 analysis. (Word, nonetheless, that the methodology used for this evaluation differs from that utilized in 2018, and a number of the states we reported knowledge for in 2018 not have short-term plans on the market.) Our price evaluation of roughly 200 short-term plans bought by 9 main insurers within the 36 states the place short-term plans can be found discovered that most of the most cost-effective short-term plans for a 40-year-old non-smoker had been priced at two-thirds or much less of the premium for the lowest-cost ACA-compliant, unsubsidized Bronze plan in the identical space (Desk 2). Nonetheless, premiums for the highest-price short-term plans, which generally have decrease price sharing, are larger than the highest-cost Bronze plan in 4 of the ten cities proven within the desk for males and 5 of the cities for females. All Bronze plans present extra complete protection than even the highest-cost short-term plans.

The overwhelming majority (93%) of ACA Market enrollees obtain a premium tax credit score tied to their earnings, lowering each the value they pay for a Market plan and the value distinction between the bottom price short-term plan and the bottom price Bronze plan. In some circumstances, the lowest-cost sponsored Bronze plan is cheaper than the lowest-cost short-term plan bought within the space. For instance, the most affordable Bronze plan for a 40-year-old particular person residing in Houston, TX, who earns $45,140 per yr (the median particular person earnings within the U.S. in 2024) and receives a premium tax credit score, can be 5% much less for a male and 23% much less for a feminine than the associated fee for the lowest-cost short-term plan. Moreover, in 9 of the ten cities in Desk 2, the highest-cost sponsored Bronze plan for a person incomes $45,140 per yr is decrease than the highest-cost short-term plan, generally by lots of of {dollars}. Premiums for Silver plans, with the tax credit score, can be larger, but in addition include decrease deductibles.

ACA-compliant plans aren’t permitted to cost ladies larger premiums than males. There aren’t any equal federal necessities for short-term plans, and as such, short-term plans can and do cost ladies greater than males. Among the many ten main cities proven, the lowest-cost short-term plan premium for a 40-year-old girl ranges 6% to 19% larger than the lowest-cost premium for a person. ACA-compliant plans might cost larger premiums for older customers than youthful customers, however solely inside specified limits. These limits don’t apply to short-term plans. For instance, in Phoenix, AZ, the lowest-cost Bronze plan for a 60-year-old particular person is 112% larger than for a 40-year-old, whereas the lowest-cost short-term plan prices 311% extra for a 60-year-old male and 228% extra for a 60-year-old feminine.

Along with month-to-month premiums, most short-term merchandise require one-time software charges, which generally vary in value from $20 to $35. Moreover, all of the nationwide insurers require enrollment in a particular affiliation to be eligible for protection in most states (e.g., one affiliation serves as a supply of knowledge on client points and gives its members services in a wide range of areas); three of those insurers require enrollees to pay an additional month-to-month charge for the affiliation membership, starting from $15 to $25 per thirty days. Taken collectively, these charges can flip a three-month short-term coverage with a $70 month-to-month premium right into a coverage that really prices over $100/month. Plans bought on the ACA Market don’t cost software charges or require affiliation memberships.

Price Sharing

Along with premiums, price sharing is one other consideration when evaluating the affordability of short-term plans to ACA-compliant plans. An insurer might provide a number of plans with variable cost-sharing constructions inside every product sort. Price sharing doesn’t sometimes differ by the enrollee’s age or intercourse. A deductible is the quantity an enrollee has to pay out-of-pocket within the plan yr (or coverage time period) earlier than insurance coverage will start paying for many coated providers. Normally, medical insurance plans which have decrease premiums are inclined to have larger deductibles and vice versa.

Among the many ten main cities analyzed for this a part of the evaluation, deductibles for Bronze Market plans vary from $0 (an HMO in Milwaukee, WI) to $9,200 (most cities); in 2025, no ACA-compliant plans can have a deductible exceeding this quantity (Desk 2). As compared, deductibles for short-term plans in these cities vary from $500 (Houston, TX) to $25,000 (all cities), practically thrice larger than the best deductible for a Bronze plan. Some customers enrolled in a short-term plan with a shorter length (resembling three or 4 months) and the next deductible might by no means meet the deductible throughout the coverage time period and should find yourself paying for care completely out-of-pocket.

Within the particular person market, plans will need to have an out-of-pocket (OOP) most on enrollee price sharing (together with deductibles, coinsurance, and copayments) for coated providers offered by an in-network supplier. For the 2025 plan yr, the OOP max can’t be larger than $9,200 for single protection. If an enrollee meets the OOP most, the plan should pay for coated providers in full (that means no enrollee price sharing) for the rest of the plan yr. Quick-term plans, alternatively, aren’t required to have an OOP most beneath federal legislation, and many don’t, that means there isn’t a restrict to the quantity an enrollee should pay out of pocket for coated providers throughout the coverage time period. When a short-term plan does have an OOP most, generally the deductible and coinsurance rely towards the OOP max (not copayments, price sharing for providers with a profit restrict that has been exceeded, or facility charges). Within the main cities proven, OOP maximums for a Bronze Market plan vary from $7,100 (Portland, OR) to $9,200 (all cities). Whereas the bottom OOP max for a short-term plan in these cities is $2,000 (most cities), short-term plans that don’t have any OOP most can be found in all however one metropolis (Portland, OR). Amongst short-term plans that do have an OOP most, OOP maximums are as excessive as $32,500 in most cities, roughly three and a half instances larger than the best OOP most for a Bronze plan.

All short-term plans have a complete greenback restrict that they may pay for coated care throughout the time period of the plan, or generally over the enrollee’s lifetime. The utmost profit limits among the many ten are as little as $100,000 per coverage time period. Which means that if the plan spends $100,000 on coated providers for an enrollee, the plan won’t pay for any extra coated providers the enrollee receives throughout the coverage time period. This quantity is decrease than in 2018, when the bottom protection restrict was $250,000. ACA-compliant plans are prohibited from imposing greenback limits on how a lot they may pay for coated providers throughout the plan yr (until these providers aren’t a part of the ACA’s essential health benefits).

Coated Advantages

All plans bought on the ACA-Market should cowl these 10 important well being advantages: hospitalization, ambulatory providers, emergency providers, maternity and new child care, mental well being and substance abuse remedy, prescription medication, laboratory providers, pediatric providers, rehabilitative and habilitative providers and gadgets, and preventive care (many of those preventive providers should even be coated with out price sharing). In distinction, there aren’t any federal necessities for short-term plans to cowl the important well being advantages, although most short-term plans present no less than some degree of protection for a few of these advantages, and a few states have their very own protection necessities for sure providers.

This a part of the evaluation examines particular advantages coated by 30 distinct short-term merchandise from 9 main insurers within the 36 states the place short-term plans can be found. This info is predicated on purchasing instruments and plan paperwork accessible on the insurers’ web sites, together with state variations when offered. Desk 3 exhibits the share of short-term merchandise by main metropolis that cowl no less than some providers in 5 profit classes: psychological well being providers, substance use providers, prescribed drugs, grownup immunizations, and maternity providers. Word that short-term plans that cowl these profit classes usually apply limits and exclusions on these providers, which aren’t mirrored on this desk, however are mentioned in additional element beneath.

Of the short-term merchandise reviewed, simply 60% cowl psychological well being providers, 60% cowl providers for substance abuse remedy, 52% cowl prescribed drugs, 6% cowl grownup immunizations, and simply 2% cowl maternity care. In two states (AK and MD), psychological well being providers aren’t coated by any short-term product, and in six different states, fewer than half cowl them. There aren’t any short-term merchandise in Maryland that cowl substance use remedy, and in six different states, fewer than half cowl remedy. Two states (MD and SD) would not have any short-term merchandise that cowl prescribed drugs, and in three different states, fewer than half cowl them. Ten states don’t have any short-term merchandise that cowl grownup immunizations. Solely two states (MT and NH) have merchandise that cowl maternity providers. See the Strategies part for a way we outlined a product as overlaying these advantages.

Profit Limitations

Even when short-term plans do cowl these advantages, limitations and exclusions virtually all the time apply that may not be permitted beneath ACA plans. For instance, 13 of the fourteen merchandise that cowl prescribed drugs apply a most greenback restrict on the profit, all starting from $1,000 to $5,000 per coverage time period, apart from one product with a $10,000 pharmacy profit restrict. Some short-term plans that cowl prescribed drugs additionally restrict the forms of medication they may cowl. For instance, they might not cowl contraceptives or might solely cowl them if the first goal they’re being prescribed for is not to stop being pregnant. Moreover, many merchandise that cowl prescribed drugs don’t cowl specialty medication, and a few solely cowl “upkeep” drugs for sure continual circumstances. Quick-term merchandise that cowl psychological well being and substance abuse remedy impose important limits on the advantages. Examples of protection limitations for these profit classes embrace a $50 most profit for outpatient visits, a 31-day most for inpatient care, and a profit restrict of $3,000 per coverage time period. Moreover, short-term merchandise that cowl remedy for substance use problems often don’t cowl sicknesses or accidents ensuing from being inebriated, unlawful substances, or managed substances until they had been prescribed to that particular person.

Quick-term merchandise have a number of different limitations on coated advantages. For instance, whereas practically all promote protection for preventive care, most providers require price sharing or greenback limits that may not be permitted in ACA-compliant plans. Different frequent examples of per coverage time period limitations and extra prices embrace protection of just one workplace, protection of not more than three emergency room visits, a further $750 deductible for inpatient care, and a $15,000 profit restrict for all coated outpatient care.

The entire short-term merchandise reviewed exclude protection for pre-existing well being circumstances, and most have ready durations for no less than some providers, rendering protection of sure coated advantages much less significant than they might appear at first look. For instance, practically eight in ten merchandise promote protection for most cancers remedy, however anybody who has been identified with most cancers earlier than enrolling can be denied protection after they apply. Even when there had been no most cancers analysis earlier than enrolling within the plan, if the enrollee is first identified with most cancers whereas enrolled within the short-term plan, the plan might deny protection for remedy if the signs ought to have brought about an “ordinarily prudent particular person” to hunt medical care, or the plan might terminate protection altogether. Moreover, for a lot of cancers, a course of remedy would take for much longer than short-term protection would final. Against this, ACA-compliant well being plans are prohibited from having pre-existing situation exclusions or dropping protection if the enrollee will get sick. Different common health conditions which can be sometimes thought-about “declinable” by short-term plans embrace having a historical past of ulcers or Crohn’s illness, diabetes, melancholy, coronary heart illness, and weight problems; current being pregnant can also be thought-about a pre-existing well being situation by short-term plans.

Trying Ahead

With the ACA enhanced premium tax credit slated to expire on the finish of this yr and new federal insurance policies on the horizon which can be anticipated to lead to hundreds of thousands of individuals shedding protection, extra people might take into account buying cheaper and fewer complete protection, resembling short-term well being plans. With out federal enforcement of Biden-era client protections, short-term well being plans already can be found for longer durations, and whereas all short-term merchandise we reviewed do embrace the patron warning presently required, insurers might decide to exclude or modify it in future plan years. Shoppers, who, as talked about above, have been the goal of aggressive and, at instances, deceptive advertising and marketing of short-term plans, might find yourself enrolled in plans that cowl lower than they thought and depart them on the hook for larger out-of-pocket prices than are permitted beneath Market plans. Relatedly, the Trump administration has already taken action to develop entry to catastrophic plans bought on the Market, starting with the approaching Open Enrollment interval. Though these plans should meet all the necessities of metal-level Market plans (described above), they’ve a lot larger price sharing.

Moreover, to the extent that wholesome people go for short-term plans as a substitute of ACA-compliant plans, this adversarial choice might contribute to instability within the non-group market and lift the price of complete protection, significantly for individuals who aren’t eligible for premium tax credit. Moreover, short-term plans are only one loosely regulated different to ACA plans. Different forms of protection that buyers could possibly be steered to by entrepreneurs and insurers embrace mounted indemnity plans, cancer-only plans, hospital-only plans, and different forms of supplemental protection.

If the Trump administration points rules rolling again the 2024 rules limiting the length of short-term plans and requiring a standardized client warning on these merchandise, which it goals to do by the end of 2026, extra lawsuits are probably. In contrast to earlier litigation, nonetheless, authorized challenges to new rules wouldn’t face the identical standard of judicial review that upheld the 2018 Trump rules.

Contemplating the numerous consideration targeted on points like high drug prices, the opioid epidemic, and mental health, it’s notable that short-term plans usually exclude or severely restrict protection for psychological well being, substance use, and prescribed drugs. As a result of short-term plans present much less complete protection and fewer client protections than ACA-compliant plans, individuals who purchase short-term insurance policies in an effort to cut back their month-to-month premiums threat that in the event that they do want medical care, they could possibly be left with important medical payments.

KFF acknowledges Karen Pollitz for her contributions to this evaluation, together with insights into the information and suggestions on the draft.