Key Takeaways

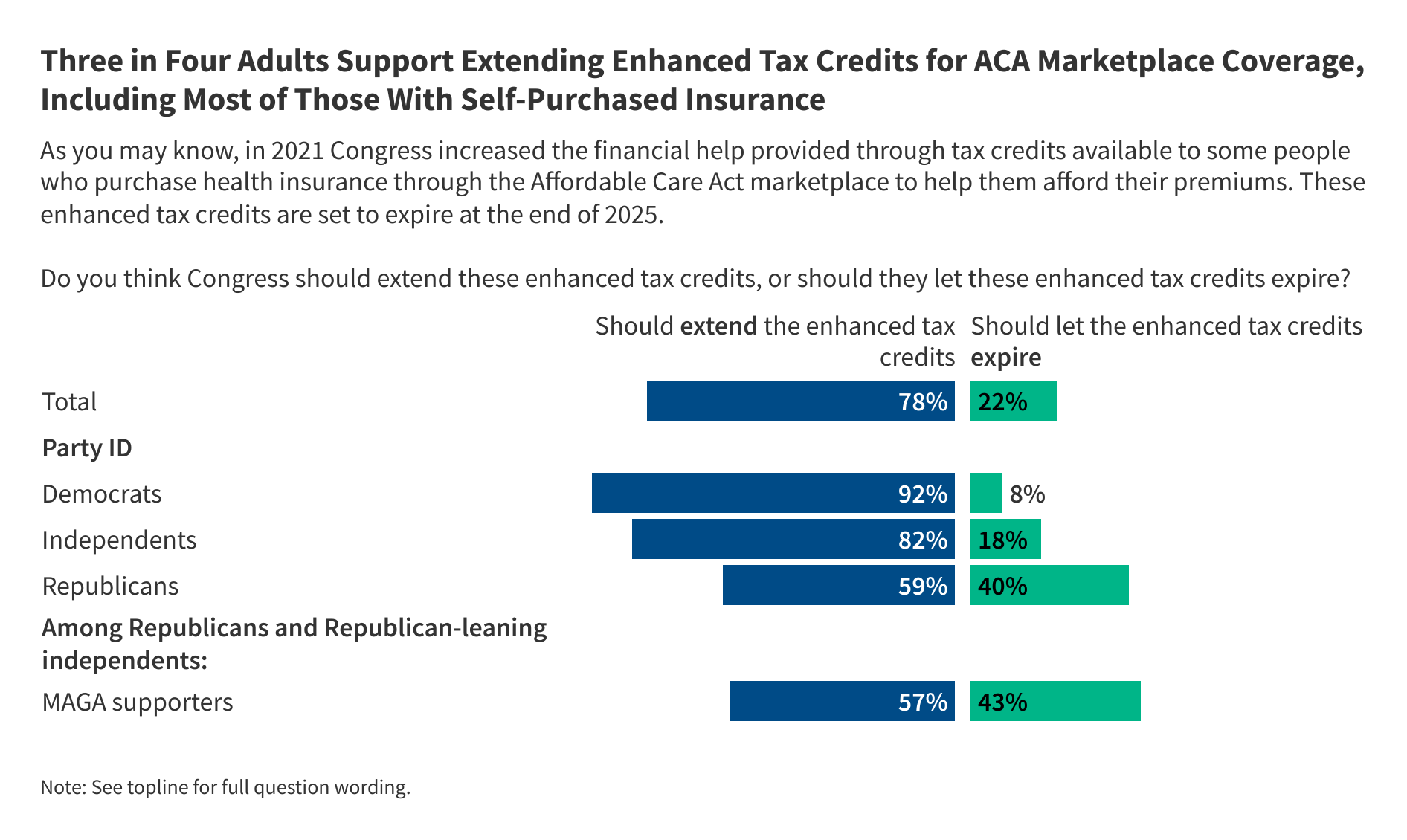

- As Congress debates federal well being care spending as a part of spending invoice negotiations, together with extending the improved premium tax credit, the newest KFF Well being Monitoring Ballot finds three-quarters (78%) of adults say Congress ought to lengthen the improved tax credit for individuals who purchase their very own insurance coverage by means of the ACA Market. That is greater than 3 times the share of the general public (22%) who say Congress ought to let the credit expire. Notably, majorities throughout political get together need Congress to increase the tax credit together with 9 in ten (92%) Democrats, eight in ten (82%) independents, and 6 in ten (59%) Republicans. A majority of Republicans who align with the MAGA motion (57%) additionally say Congress ought to lengthen these subsidies.

- Each events may face political fallout if the improved tax credit are usually not prolonged, although the general public says they are going to place a lot of the blame on these at present in cost. About 4 in ten (39%) adults who need to see the tax credit prolonged say that if Congress doesn’t lengthen these enhanced tax credit, President Trump deserves a lot of the blame, whereas one other 4 in ten (37%) say the identical about Republicans in Congress. About two in ten (22%) say that Democrats in Congress deserve a lot of the blame. Democrats are almost certainly to put blame on President Trump (56%) adopted by Republicans in Congress (42%), whereas six in ten Republicans (61%) say they might place the blame on Democrats in Congress. Amongst those that purchase their very own protection (practically half of whom determine as Republican or Republican-leaning), Republicans in Congress and President Trump obtain nearly all of the blame (42% and 37%, respectively).

- Seven in ten adults who purchase their very own medical insurance say that if the quantity they paid for medical insurance every month practically doubled, they may not pay the upper premiums with out considerably disrupting their family funds. As well as, 4 in ten (42%) say they might go with out medical insurance protection if the quantity they needed to pay for medical insurance every month practically doubled. A couple of third (37%) say they might proceed to pay for his or her present medical insurance, whereas two in ten (22%) would get insurance coverage from one other supply, like an employer or a partner’s employer.

- Majorities throughout partisanship additionally report that they might be involved in the event that they heard about one thing of the outcomes for each letting the tax credit expire, in addition to if Congress prolonged the tax cuts – granted to a lesser diploma. Majorities say they might be involved in the event that they heard that medical insurance can be unaffordable for many individuals who purchase their very own protection (86%), that 4 million folks would lose their medical insurance protection (86%), or in the event that they heard that individuals who work at small companies or are self-employed can be instantly impacted (85%). On the opposite aspect, if Congress does lengthen these enhanced tax credit, two-thirds of the general public (63%) say they might be involved in the event that they heard that it could require important federal spending that will be largely paid for by taxpayers.

- Three months after the passing of the tax and finances laws, the invoice nonetheless stays largely unfavorable among the many public total – lagging far behind each the Reasonably priced Care Act and the ACA Marketplaces in total recognition. Many are nonetheless uncertain of how the laws will affect them personally however 4 in ten (43%) suppose it’s almost certainly to harm them and their households.

Public Nonetheless Largely Unaware That ACA Enhanced Tax Credit Are Expiring, Sturdy Help for Congress Extending Them

On October 1st the U.S. federal authorities shut down as Congress was unable to move a stopgap spending invoice. As a part of the discussions across the federal finances, Democrats are looking for to incorporate the extension of the improved premium tax credit (ePTCs) for individuals who buy their very own medical insurance by means of the ACA Market which might be set to run out on the finish of the yr.

About six in ten adults say they’ve heard “a bit of” (30%) or “nothing in any respect” (31%) concerning the expiring ACA subsidies, displaying widespread ignorance on the price of protection for over 24 million people in the U.S. 4 in ten say (39%) they’ve heard “rather a lot” or “some” – up from 27% in June of this yr. Even among the many group whose price of protection is predicted to double subsequent yr – those that buy their very own insurance policy – about six in ten (58%) say they’ve heard simply “a bit of” or “nothing in any respect” concerning the expiration of tax credit for individuals who self-purchased insurance coverage.

Democrats appear to be extra conscious of the pending expiration, with about half of Democrats (50%) saying they’ve heard not less than “some” about this, in comparison with a few third of independents (35%) and Republicans (34%).

As soon as the general public is instructed that the expiration date for subsidies is looming, about three-quarters (78%) of adults say Congress ought to lengthen the improved tax credit for individuals who purchase their very own insurance coverage by means of the ACA Market, greater than 3 times the share (22%) who say Congress ought to let the credit expire. Over eight in ten (84%) of those that purchase their very own insurance coverage say that Congress ought to lengthen the improved tax credit.

Though Republicans are extra doubtless than Democrats and independents to say that Congress ought to let the credit expire, majorities throughout political get together need Congress to increase the tax credit together with 9 in ten (92%) Democrats, eight in ten (82%) independents, and 6 in ten (59%) Republicans, together with 57% of Republicans who align with the MAGA motion.

Previous KFF polling has proven that attitudes in the direction of the credit shift barely after listening to counterarguments each for and towards the extension of the credit. This month’s ballot exhibits that enormous majorities of the general public, together with majorities of Democrats, independents, Republicans, and MAGA supporters are involved about most of the potential penalties of letting these enhanced tax credit expire. Moreover, majorities of independents and Republicans and about half of Democrats are involved concerning the penalties for extending them.

Greater than eight in ten adults say they might be involved, together with not less than half who say they might be “very involved,” in the event that they heard that medical insurance can be unaffordable for many individuals who purchase their very own protection (86%), that 4 million folks would lose their medical insurance protection (86%), or in the event that they heard that individuals who work at small companies or are self-employed can be instantly impacted (85%).

Concern over the potential penalties is excessive throughout get together strains with massive majorities of Democrats and independents saying they might be involved about every of those potential outcomes, in addition to three-quarters of Republicans and MAGA supporters.

On the opposite aspect, if Congress does lengthen these enhanced tax credit, two-thirds (63%) of the general public say they might be involved in the event that they heard that it could require important federal spending that will be largely paid for by taxpayers, together with 1 / 4 (27%) who can be “very involved.” That is predictably divided alongside partisan strains. Greater than eight in ten (83%) Republicans say they might be involved about federal spending, however notably so do greater than six in ten independents (61%) and practically half of Democrats (49%). Republicans who help the MAGA motion are among the many most fearful about this situation, with nearly half (47%) saying they might be “very involved.”

The ballot finds extra folks say they might blame President Trump or Republicans in Congress than Democrats if tax credit are usually not prolonged. About 4 in ten (39%) adults who need to see the tax credit prolonged say that if Congress doesn’t lengthen these enhanced tax credit, President Trump deserves a lot of the blame, whereas one other 4 in ten (37%) say the identical about Republicans in Congress. About two in ten (22%) say that Democrats in Congress deserve a lot of the blame, pushed closely by Republicans. Six in ten (61%) Republicans who need to see the tax credit prolonged say they might blame Democrats in Congress, together with seven in ten MAGA Republicans, in comparison with one in six (17%) independents.

Over half of Democrats (56%) who need to see the tax credit prolonged say that if they don’t seem to be prolonged, President Trump deserves a lot of the blame, although 4 in ten (42%) blame Republicans in Congress. Independents are largely cut up, with about 4 in ten saying they are going to blame Republicans in Congress (42%) or President Trump (39%).

Adults who bought their very own insurance coverage, most of whom achieve this by means of the ACA Market, are equally cut up, with 4 in ten (42%) inserting the blame if Congress doesn’t lengthen the improved tax credit on Republicans in Congress and 4 in ten (37%) on President Trump. Two in ten (21%) of this group would blame Democrats in Congress if the subsidies expire. Notably, a previous KFF poll discovered that just about half of adults enrolled in ACA Market plans determine as Republican or lean Republican.

Market Enrollees Uncertain The best way to Afford Protection if Enhanced Tax Credit Expire

Six in ten adults who purchase their very own medical insurance protection suppose the price of their private medical insurance would improve not less than “some” if the tax credit are usually not prolonged, whereas a few quarter say they suppose it’s going to improve “a bit of” (24%), or that their prices gained’t improve in any respect (15%). Estimates are that the quantity enrollees pay for premiums for ACA Market plans will greater than double on common and practically 4 million folks may ultimately be uninsured. Notably, greater than half of adults with Medicaid (54%) additionally say they suppose that if the improved tax credit expire the price of their very own protection can even improve not less than “some,” as do about 4 in ten folks with Medicare age 65 and older and about half of individuals with employer-sponsored insurance coverage. It is very important word that the expiration of enhanced tax credit solely instantly affect individuals who purchase their very own protection on the ACA Market.

Amongst those that have insurance coverage by means of the ACA Market, seven in ten say that if the quantity they paid for medical insurance every month practically doubled, they may not pay the upper premiums with out considerably disrupting their family funds. Simply three in ten estimate that they may pay the upper premiums.

About 4 in ten (42%) Market enrollees say they might go with out medical insurance protection if the quantity they needed to pay for medical insurance every month practically doubled. Simply over a 3rd (37%) say they might proceed to pay for his or her present medical insurance, whereas a few quarter (22%) would get insurance coverage from one other supply, like an employer or a partner’s employer.

Public Views of Main Well being Care Laws

On July 4, 2025, President Trump signed a sweeping legislative package deal often known as the “Massive Lovely Invoice,” that included important adjustments to the nation’s Medicaid program and the Reasonably priced Care Act (ACA) Marketplaces. The package deal, which handed on a party-line vote, with no Democrats in favor, has been described as the most important rollback of the nation’s well being care applications in fashionable historical past. Now, as a part of federal finances negotiations, Democrats in Congress, are looking for to minimize a few of these medical insurance rollbacks. The most recent KFF Well being Monitoring Ballot exhibits each events are taking part in to their bases, with Republicans strongly supporting the “Massive Lovely Invoice” (BBB) laws and Democrats largely opposed.

Total, about 4 in ten (38%) adults maintain favorable views of the tax and finances laws handed earlier this yr, together with three-quarters of Republicans (75%) and eight in ten (82%) Republicans or Republican-leaning independents who help the MAGA motion. Democrats and independents, then again, largely maintain unfavorable views of the laws, together with practically 9 in ten (88%) Democrats and two-thirds (68%) of independents who say they view the regulation unfavorably.

The share of the general public who say they’ve a positive opinion of the tax and finances laws has stayed comparatively secure, at near 4 in ten (38%), just like 36% in July and 35% in June.

Total favorability of the 2010 well being care regulation often known as the Reasonably priced Care Act (ACA) continues to be at traditionally excessive ranges, with about two-thirds (64%) of the general public viewing the regulation positively. That is largely pushed by Democrats and independents, with over 9 in ten (94%) Democrats and two-thirds (64%) of independents viewing the regulation favorably, whereas two-thirds (64%) of Republicans have an unfavorable view. Click on here to discover greater than ten years of polling on the ACA.

Majorities Throughout Partisans View ACA Marketplaces Favorably

The ACA Marketplaces the place folks and small companies can store for medical insurance are much more standard than the ACA itself, with seven in ten (70%) adults having a positive view. The ACA Marketplaces have constantly been a more popular provision of the ACA, even earlier than Congress handed the American Rescue Plan Act (ARPA) in 2021, which offered quickly enhanced tax credit to adults who bought their very own medical insurance by means of the Marketplaces. Although views of the ACA Market are divided by partisanship, majorities throughout get together strains view the ACA Market positively, with eight in ten (84%) Democrats, seven in ten (69%) independents, and 6 in ten (59%) Republicans holding a positive view. This additionally consists of MAGA Republicans and Republican-leaning independents, amongst whom over half (56%) maintain a positive opinion of the Market.

Amongst those that buy their well being care plan themselves, lots of whom purchased by means of the ACA Market, seven in ten have a positive opinion of the ACA medical insurance exchanges or Marketplaces.

Many Nonetheless Uncertain How the “Massive Lovely Invoice” Will Impression Them

Three months after the passing of President Trump’s main legislative achievement, the “Massive Lovely Invoice,” most individuals stay unaware of how the results of the tax and finances laws will affect them. Six in ten adults say they don’t have sufficient data as to how the laws will affect them personally, whereas 4 in ten report that they do have sufficient data.

Democrats (50%) are extra doubtless than Republicans (36%) and independents (37%) to say they’ve sufficient details about how the BBB will affect them personally. About 4 in ten (41%) Republicans and Republican-leaning independents who determine with the MAGA motion say they’ve sufficient details about the affect of the laws, although majorities (59%) nonetheless don’t.

The BBB laws has made adjustments to the ACA Marketplaces together with limiting some eligibility and shortening the open enrollment interval. Amongst those that buy their very own medical insurance, two-thirds (63%) say they do not have sufficient details about how the laws will affect them.

Whereas many say they don’t have sufficient details about how the tax and finances laws will have an effect on them, partisanship as soon as once more performs a significant function in public notion of the regulation’s affect. About 4 in ten (43%) say the latest laws will usually harm them and their households, which is twice the share who say the laws will usually assist them. Greater than a 3rd of the general public (36%) say the regulation gained’t make a distinction to them and their households.

Two-thirds (68%) of Democrats say the tax and finances laws will usually harm them and their households, as do about half (48%) of independents. Republicans are cut up between considering the regulation will assist them and considering it gained’t make a distinction, with related shares saying the regulation will assist them and their households (43%) and saying they don’t suppose the regulation will make a distinction for them (46%). Almost half of Republicans and leaners who help the MAGA motion say the regulation will assist them (48%) whereas 4 in ten say it gained’t make a distinction for them. Only a few MAGA supporters (11%) say the regulation will harm them.

Amongst those that buy their very own insurance coverage, many by means of the ACA Market, 4 in ten (42%) anticipate the laws will usually harm them and their household, whereas related share (37%) expects it to not make a lot of a distinction and only one in 5 (19%) say it’s going to assist.