The Reasonably priced Care Act (ACA) presents premium tax credit to assist make medical insurance extra inexpensive. Below unique Reasonably priced Care Act provisions, an revenue cap for premium tax credit was set at 400% of the federal poverty degree. Above that threshold, federal monetary help was not accessible, making a “subsidy cliff.” The American Rescue Plan Act (ARPA) and later the Inflation Reduction Act (IRA) quickly expanded eligibility for tax credit to folks with incomes over 400% of poverty, along with offering extra beneficiant help for folks at decrease incomes.

Enhanced premium tax credit expire on the finish of this yr. Enrollees presently receiving premium tax credit at any degree of revenue will see their federal help lower or disappear if enhanced premium tax credit expire, with a median improve of 114% to what enrollees pay in premiums internet of tax credit. Since premium funds are capped based mostly on revenue and household dimension, there may be little geographic variation within the ensuing will increase in premium funds for enrollees with incomes under 400% of poverty. Out-of-pocket premiums for folks with incomes under 400% of poverty will increase by a whole bunch of {dollars} to over $1,500 per particular person on common.

Amongst these with incomes over 400% poverty who’re shedding the tax credit score altogether, the influence will likely be best for these whose unsubsidized premiums are highest: older Market enrollees and people dwelling in higher-premium locales. Amongst enrollees with incomes over 400% of poverty, simply over half are between ages 50 and 64, and can subsequently have excessive unsubsidized premiums.

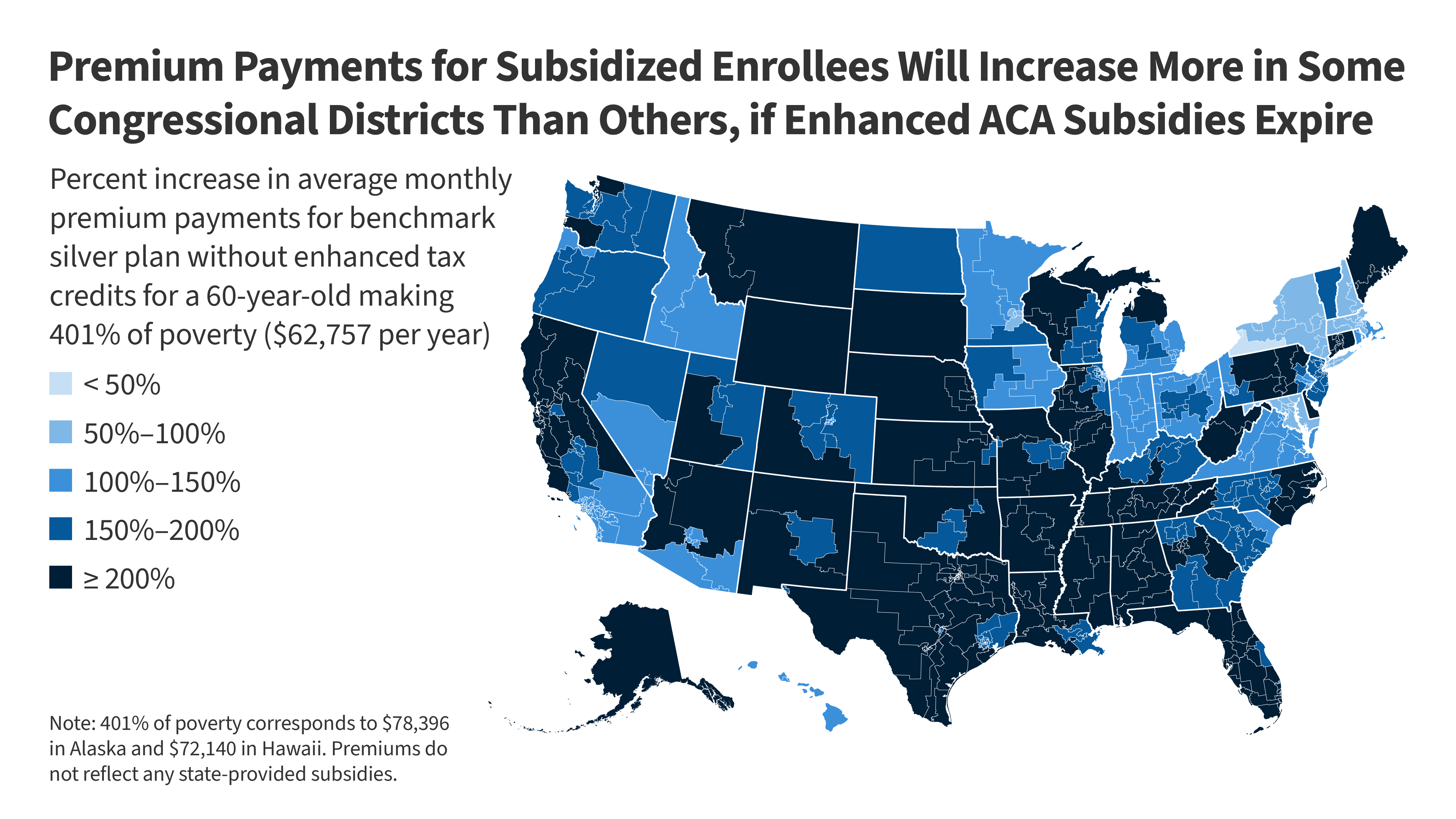

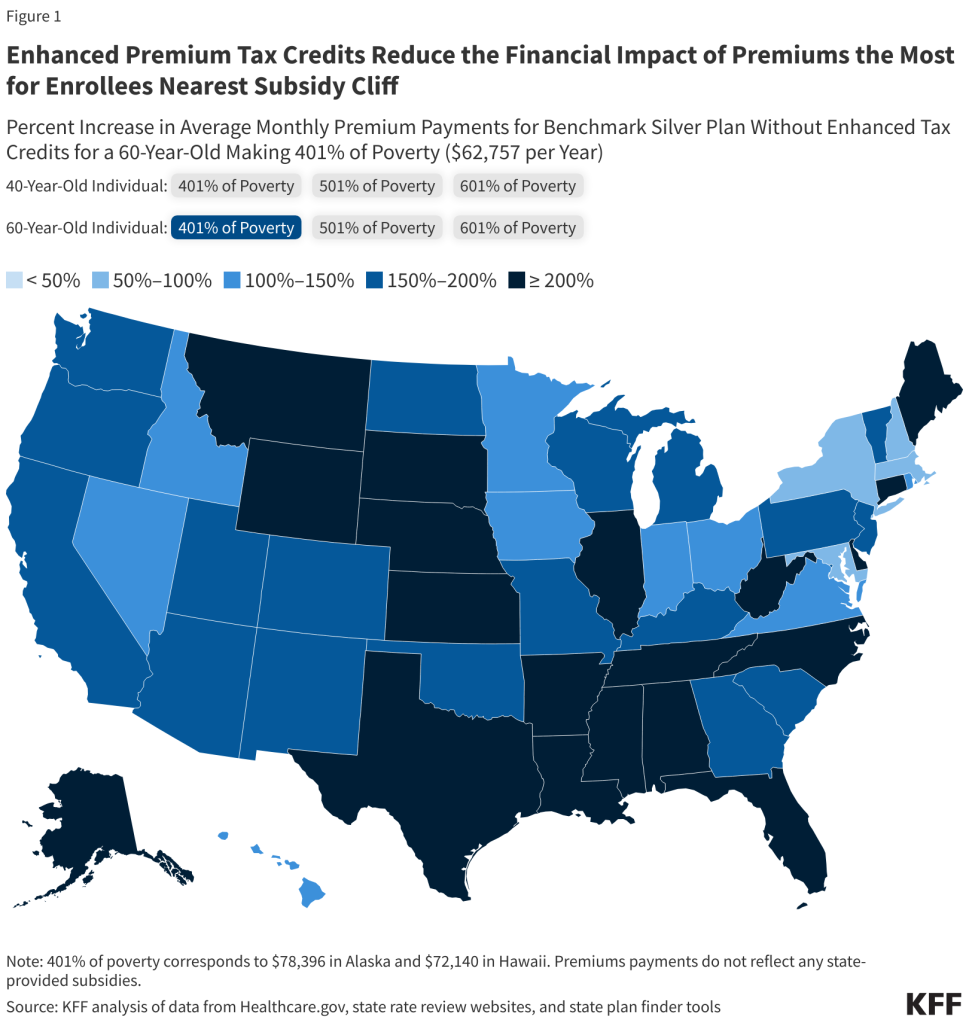

The maps under present how a lot common premium funds would improve for 2026 benchmark silver plans with the expiration of enhanced premium tax credit at three revenue ranges above an revenue cap of 400% of federal poverty for a 40-year-old and 60-year-old particular person, particularly 401%, 501% and 601%.

Amongst these three revenue ranges, enhanced tax credit present essentially the most monetary help for these at 401% of poverty, which represents an annual wage of $62,757 for a person within the contiguous United States. As a result of the price of dwelling is increased in Alaska and Hawaii, 401% of federal poverty is $78,396 and $72,140 for people there, respectively. In 46 states and the District of Columbia, a 60-year-old at 401% of poverty will see their common annual premium cost for a benchmark silver plan at the least double with out enhanced tax credit. In 19 states, this particular person would see their premium cost at the least triple on common for a benchmark silver plan, consuming greater than 25% of annual revenue. States with the best premium cost will increase as a consequence of expired enhanced tax credit for a 60-year-old at 401% of poverty buying a benchmark silver plan are Wyoming ($22,452 improve per yr), West Virginia ($22,006), and Alaska ($19,636). The smallest will increase attributable to the lack of enhanced tax credit for what enrollees pay yearly for the benchmark silver plan are in New York ($4,469), Massachusetts ($4,728) and New Hampshire ($4,877).

At 501% of poverty ($78,407 within the contiguous U.S., $97,946 in Alaska, $90,130 in Hawaii), expiration of enhanced premium tax credit would at the least double common premium funds for a benchmark silver plan in 37 states and the District of Columbia for a 60-year-old; at 601% of poverty ($94,057 within the contiguous U.S., $117,496 in Alaska, $108,120 in Hawaii), 19 states would see the typical benchmark silver premium funds at the least double for a 60-year-old if enhanced tax credit expire. The influence on a 40-year-old is extra modest in any respect revenue ranges.

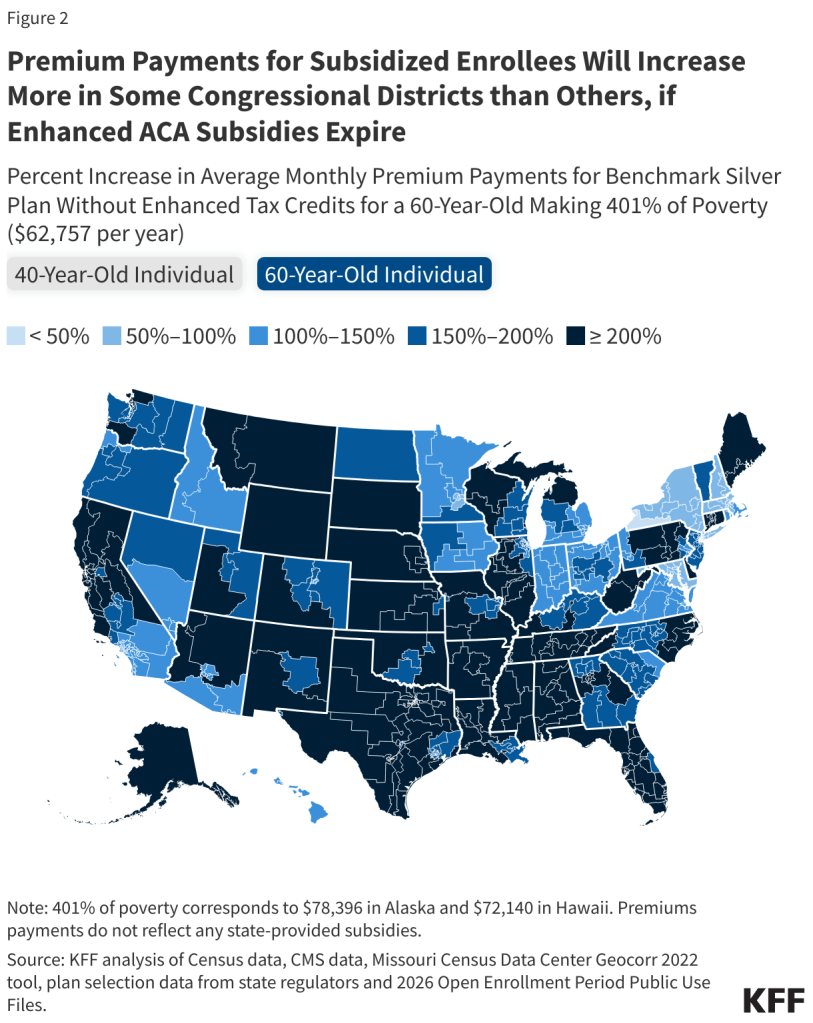

Present premium variations result in variation in premium funds with the expiration of the improved premium tax credit on the congressional district degree as nicely. For folks with incomes over 400% of poverty, there will likely be smaller premium cost adjustments for 40-year-old enrollees and bigger adjustments for 60-year-old enrollees, for whom plans are more expensive.