States are going through a extra tenuous fiscal local weather as a consequence of slowing income progress and growing spending calls for in state fiscal 12 months (FY) 2026. Latest shifts in financial circumstances in addition to current federal actions, together with cuts to security internet packages and tax code modifications within the just lately handed reconciliation law (H.R.1), modifications to the Inexpensive Care Act (ACA) enhanced Marketplace subsidies, federal workforce cuts, and tariff modifications, contribute to additional fiscal uncertainty for states, although fiscal circumstances and the impression of federal modifications differ throughout states. For Medicaid, states are navigating the brand new “regular” for his or her packages following the expiration of pandemic-era insurance policies whereas contending with shifts in state fiscal circumstances and longer-term fiscal uncertainty. The Medicaid provisions in H.R.1 are estimated to scale back federal Medicaid spending by $911 billion (or by 14%) over a decade and improve the variety of uninsured individuals by 7.5 million, although the impacts differ by state with spending cuts starting from 4% to nearly one-fifth of all federal Medicaid spending in some states. Whereas many provisions within the new regulation, together with a number of the largest sources of federal Medicaid financial savings resembling work necessities and financing modifications, do not take effect till FY 2027 or later, many states famous they had been anticipating the brand new regulation’s implementation and impression. Wanting forward, the difficult fiscal local weather and the magnitude of federal Medicaid cuts will make it troublesome for states to soak up or offset the reductions.

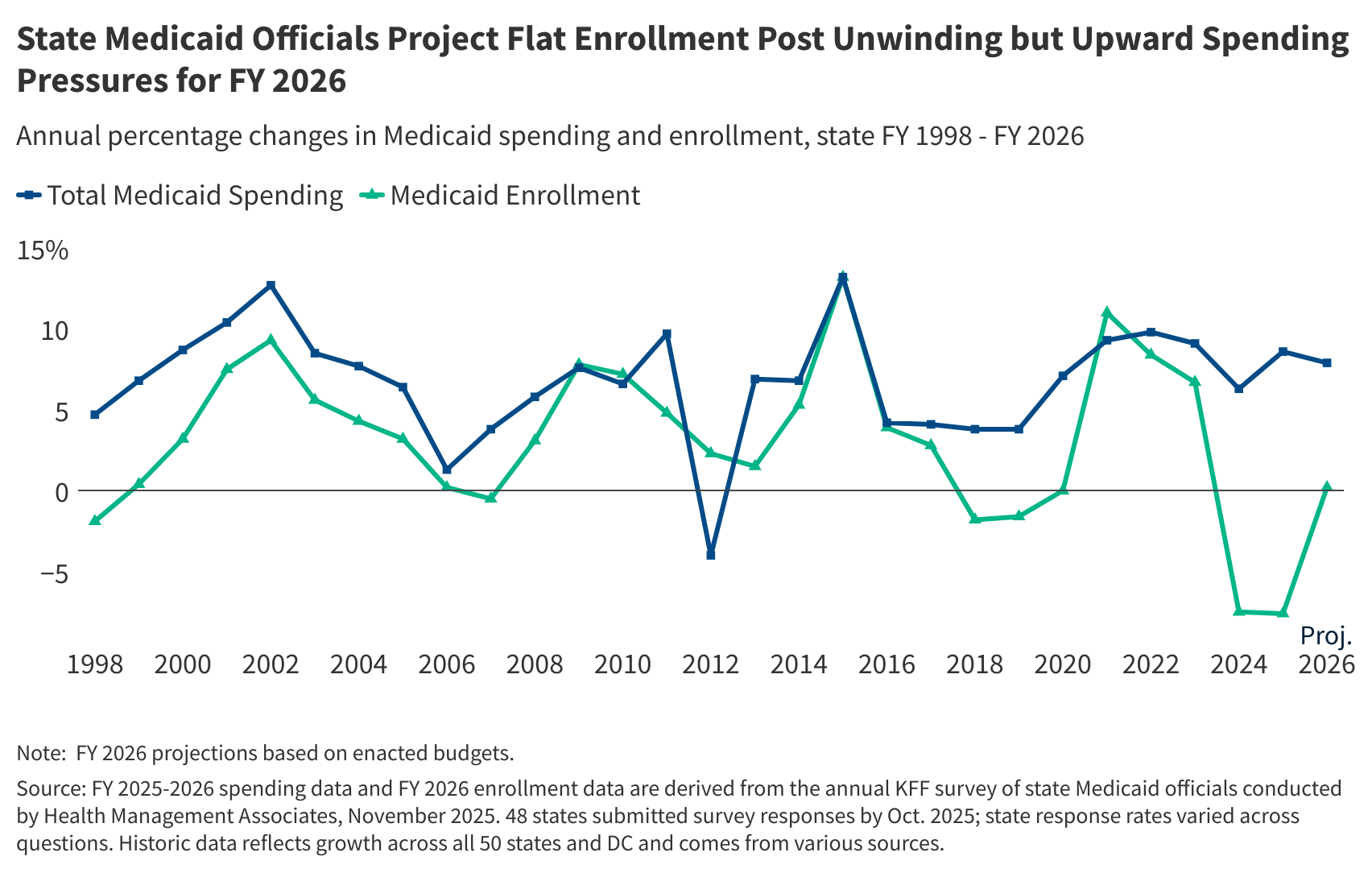

Main as much as FY 2026, states skilled vital modifications in Medicaid spending and enrollment traits (Determine 1). For a three-year interval following the onset of the COVID-19 pandemic, states offered steady Medicaid enrollment in trade for enhanced federal funding, leading to document high Medicaid enrollment, declines within the uninsured charge, and shifts in Medicaid spending. Most states started the method of “unwinding” the continual enrollment provision in late state fiscal 12 months (FY) 2023, and the improved federal funding phased down by means of the tip of 2023 (half method by means of FY 2024). Over the unwinding interval, millions of individuals had been disenrolled from Medicaid and enrollment and spending traits shifted as soon as once more. By halfway by means of FY 2025, most states had accomplished unwinding and returned to extra typical renewal operations.

This temporary analyzes Medicaid enrollment and spending traits for FY 2025 and FY 2026, primarily based on knowledge offered by state Medicaid administrators as a part of the 25th annual survey of Medicaid directors. 48 states (together with the District of Columbia) responded to the 2025 survey, though response charges for particular questions assorted. Extra data on response charges and methodology may be discovered on the finish of the temporary. Most officers indicated that their spending projections mirror what’s assumed of their states’ adopted budgets and don’t account for the just lately handed reconciliation regulation. Key survey findings embrace the next:

- Medicaid enrollment declined by 7.6% in FY 2025, pushed primarily by the unwinding of the continual enrollment provision. The completion of unwinding renewals in addition to competing upward and downward enrollment pressures are anticipated to end in flat Medicaid enrollment progress (0.2%) in FY 2026.

- Complete Medicaid spending progress was 8.6% in FY 2025 and is anticipated to gradual barely (7.9%) in FY 2026. States are experiencing a number of vital upward expenditure pressures that outweigh the downward strain from Medicaid enrollment traits, together with charge will increase, greater well being care wants amongst enrollees post-unwinding, and growing long-term care, pharmacy, and behavioral well being care prices.

- State Medicaid spending progress was 12.2% in FY 2025 and is projected to gradual to eight.5% in FY 2026, much like complete spending progress ranges and marking the tip of shifts brought on by pandemic-era enhanced federal funding. Whereas many of the state (or non-federal) share of Medicaid spending comes from state basic funds, there’s appreciable variation in how a lot states depend on different non-federal share funding sources and the way they account for these different funding sources.

- Virtually two-thirds of responding states on the time of the survey thought the prospect of a Medicaid finances shortfall in FY 2026 was “50-50”, “seemingly”, or “nearly sure.” Just a few states are implementing Medicaid spending cuts to handle current finances challenges, and different states might observe as they deal with potential Medicaid finances gaps and stay up for the implementation of the Medicaid modifications in H.R.1.

Context

Medicaid is the primary program offering complete well being and long-term care to one in five individuals residing within the U.S. and accounts for practically $1 out of every $5 spent on well being care (and over half of all spending on long-term care). Medicaid is run by states inside broad federal guidelines and collectively funded by states and the federal authorities by means of a federal matching program with no cap. Medicaid is commonly central to state fiscal choices as it’s concurrently a big spending merchandise in addition to the largest supply of federal revenues for states.

The pandemic, and the following federal and state responses, led to vital modifications in Medicaid enrollment and spending. Medicaid enrollment and spending typically improve throughout recessions, and, as in previous financial downturns, Congress enacted laws through the pandemic that briefly elevated the federal share of Medicaid spending (or “FMAP”) to assist states keep their Medicaid packages. In trade, states had been required to maintain people constantly enrolled in this system, leading to document high Medicaid enrollment. Positive factors in Medicaid in addition to ACA Market protection contributed to vital declines within the uninsured charge. Following the tip of the continual enrollment provision on March 31, 2023 (late FY 2023 for many states), states started the method of “unwinding” (i.e., resuming traditionally typical eligibility redeterminations and disenrolling people discovered to be not eligible for Medicaid), leading to millions being disenrolled from Medicaid. Most states had accomplished unwinding by halfway by means of FY 2025, and complete Medicaid and CHIP enrollment as of June 2025 was 77.7 million, a 18% decline from complete enrollment in March 2023 however nonetheless 9% greater than enrollment ranges in February 2020, previous to the pandemic. As well as, the improved FMAP phased down by means of finish of 2023 (half method by means of FY 2024). In federal fiscal 12 months (FFY) 2024, complete Medicaid spending was $919 billion, with 65% financed by states and 35% paid by the federal authorities.

State fiscal circumstances have additionally seen substantial shifts because the pandemic started. State financial circumstances worsened quickly when the pandemic hit however recovered quickly, resulting in a interval of record-breaking income and expenditure progress for states. Favorable state fiscal circumstances mixed with federal fiscal aid allowed states to construct up wet day funds and make investments and expansions, together with to Medicaid programs. Given robust income progress and finances surpluses, states additionally adopted a number of the largest tax cuts on document, with all almost all states enacting some type of tax minimize since 2021. Nonetheless, these tax cuts mixed with a weaker inventory market efficiency and changes in inflation and shopper consumption patterns led to flat state revenue growth by FY 2023 and FY 2024. Income progress continued to slow in FY 2025, although income did exceed preliminary estimates in most states and state fiscal circumstances remained typically stable.

For FY 2026, states are facing one other 12 months of slow income progress and uncertainty of their longer-term fiscal outlook. Enacted FY 2026 state budgets total embrace modest will increase in state basic fund spending and complete state spending. Nonetheless, there’s variation throughout states, with some state budgets together with slight declines in complete state spending and more finances administration strategies like spending cuts or different price containment measures. States are additionally contending with growing spending calls for from Medicaid, worker well being care, training, housing, and catastrophe response. Latest changes in financial circumstances in addition to current federal actions, together with cuts to security internet packages and tax code changes within the just lately handed reconciliation law, modifications to the ACA enhanced Marketplace subsidies, federal workforce cuts, and tariff changes, have generated extra uncertainty, with some states revising income forecasts downward. State wet day fund capability can also be starting to decline following all-time highs, although funds stay stronger than earlier than the pandemic. Total, states seem like in stable fiscal situation however are going through tighter finances circumstances and longer-term fiscal uncertainty.

Tendencies in Enrollment Development

Medicaid enrollment declined by 7.6% in FY 2025 however is anticipated to flatten, rising by solely 0.2%, in FY 2026 (Determine 2). Following the onset of the COVID-19 pandemic and begin of the Medicaid steady enrollment provision, enrollment rose sharply in FY 2021 and continued to develop, although extra slowly, by means of FY 2023. As soon as the continual enrollment provision ended and states started unwinding-related eligibility redeterminations, Medicaid enrollment declined in FY 2024 and once more in FY 2025. Most states both accomplished unwinding redeterminations by FY 2024 (two-thirds of states) or by halfway by means of FY 2025 (one other one-sixth of states), with the rest noting their redeterminations continued by means of the second half of FY 2025 or would proceed into FY 2026. Medicaid enrollment progress is projected to be flat in FY 2026, although Medicaid enrollment stays above pre-pandemic ranges in many states. Notably, there was little variation in state reported enrollment progress charges for FY 2026 (see Strategies), with most states reporting little to no progress in enrollment.

Whereas the unwinding continued to be the biggest driver of declining enrollment in FY 2025, the completion of unwinding renewals in addition to competing upward and downward progress pressures are anticipated to end in flat enrollment progress in FY 2026. Whereas about two-thirds of responding states reported that the unwinding was essentially the most vital driver of Medicaid enrollment declines in FY 2025, nearly half of responding states additionally talked about current eligibility expansions, together with children’s continuous eligibility modifications and Medicaid postpartum coverage modifications, had been placing an upward strain on enrollment. A few quarter of responding states additionally reported will increase within the populations using long-term care, with some particularly pointing to an growing older inhabitants of their state. For FY 2026, the completion of unwinding renewals throughout most states is anticipated to end in flat enrollment progress, although a couple of states reported continued downward strain from unwinding. Some states additionally famous continued upward strain from eligibility expansions and long-term care enrollment. Throughout each FY 2025 and FY 2026, a couple of states talked about a robust financial system as a big downward strain on Medicaid enrollment, whereas a couple of different states famous worsening financial circumstances of their state as an upward strain, signaling the variation and uncertainty in state fiscal circumstances right now. Lastly, a few quarter of responding states talked about they had been anticipating current federal modifications, together with H.R.1, to have a downward impression on enrollment in future years as provisions go into impact.

Tendencies in Spending Development

Complete Medicaid spending progress was 8.6% in FY 2025 and is anticipated to gradual barely to 7.9% in FY 2026 (Determine 2). Complete spending progress elevated when the pandemic and steady enrollment interval started earlier than peaking in FY 2022 and beginning to gradual in FY 2023 and FY 2024 as states accomplished unwinding-related eligibility redeterminations. Regardless of unwinding-related Medicaid enrollment declines, complete Medicaid spending progress was 8.6% in FY 2025 and is projected to gradual barely to 7.9% in FY 2026. FY 2025 and FY 2026 Medicaid spending progress charges had been calculated as weighted averages throughout all states to supply a snapshot of total traits (see Strategies), however there was appreciable variation in state reported annual progress charges. Most responding states reported that Medicaid spending projections for FY 2026 mirror the assumptions used within the state’s adopted finances. Most states additionally famous that FY 2026 projections didn’t mirror any federal coverage modifications underneath the just lately handed reconciliation regulation, as most states enacted their FY 2026 budgets earlier than the regulation’s passage and most of the Medicaid provisions do not take effect till FY 2027 or later.

States reported a number of elements driving progress in complete Medicaid spending, together with charge will increase, greater well being care wants amongst enrollees post-unwinding, and growing long-term care, pharmacy, and behavioral well being care prices. Many responding states famous that enrollment traits had been a big downward strain in FY 2025 and FY 2026. Past enrollment, states didn’t point out many downward pressures in FY 2025 or FY 2026, although a couple of states famous downward strain from pharmacy rebates. Nonetheless, states are concurrently experiencing a number of vital upward expenditure pressures that outweigh the downward strain from enrollment traits, inflicting will increase in complete Medicaid spending (and consequently, spending per enrollee):

- Over half of responding states cited managed care or supplier charge will increase as an upward strain on complete spending in FY 2025, FY 2026, or each.

- Virtually half of states famous that the enrollees that retained protection throughout unwinding have greater well being care wants (or greater acuity) and make the most of extra companies than these disenrolled.

- Over one-third of states reported will increase in long-term care enrollment and/or will increase in utilization of long-term care as an upward strain on complete spending in FY 2025, FY 2026, or each.

- Over one-third of states additionally reported rising pharmacy prices as an element driving modifications in complete spending, with some states noting price strain notably as a consequence of rising high-cost specialty medicine.

- A few quarter of states reported growing behavioral well being prices, together with rising use of intensive or specialty behavioral well being companies or licensed neighborhood behavioral well being clinics (CCBHCs) expansions, as one other issue contributing to will increase in spending.

- Lastly, a few quarter of states famous inflation or basic will increase in well being care prices as an upward strain on complete spending. KFF’s annual employer health benefits survey discovered premiums for employer protection elevated in 2025 and are anticipated to extend additional in 2026, with employers noting related price pressures resembling new prescribed drugs, prevalence of continual illness, and better utilization of companies.

- States additionally reported that these current price pressures had been making it difficult for states to set managed care capitation charges in FY 2026.

State Medicaid spending progress was 12.2% in FY 2025 and is projected to gradual to eight.5% in FY 2026, reaching complete spending progress ranges and marking the tip of shifts brought on by the pandemic-era enhanced FMAP (Determine 3). The state (or non-federal) share of Medicaid spending sometimes grows at the same charge as complete Medicaid spending progress until there’s a change within the FMAP. In the course of the Nice Recession, state Medicaid spending declined as a consequence of fiscal aid from a brief FMAP improve offered within the American Restoration and Reinvestment Act (ARRA) however elevated sharply when that fiscal aid ended. This sample repeated through the COVID-19 pandemic, when state Medicaid spending declined in FY 2020 and FY 2021 then elevated at a slower charge than complete spending in FY 2022 as a result of pandemic-era enhanced FMAP. State spending progress elevated in FY 2023 and peaked in FY 2024 as the improved FMAP was phased down. Following the expiration of the improved FMAP, state Medicaid spending slowed in FY 2025 and is anticipated to proceed to gradual in FY 2026 to match complete Medicaid spending progress.

Whereas many of the state (or non-federal) share of Medicaid spending comes from state basic funds, there’s appreciable variation in how a lot states depend on different non-federal share funding sources and the way they account for these different funding sources. With out adjusting for accounting variations throughout states, states reported that basic funds accounted for a median of 70% of the non-federal share in FY 2026 enacted budgets, whereas provider taxes accounted for 18% and funds from native governments or different sources accounted for six% (that is comparatively much like 2018 knowledge on non-federal share funding sources reported by the Authorities Accountability Workplace (GAO) and 2024 data on basic fund spending from the Nationwide Affiliation of State Funds Officers (NASBO)). Nonetheless, there was substantial variation within the extent to which states relied on numerous funding sources in addition to appreciable variation in state accounting procedures and the way states categorized particular non-federal share income sources. For instance, a couple of states famous that supplier taxes and/or native authorities funds went immediately into the final fund, making it troublesome to parse out the person funding sources. The reconciliation regulation consists of new limits on supplier taxes, prohibiting all states from establishing new supplier taxes or from growing current taxes and decreasing current supplier taxes for states which have adopted the ACA growth. As these modifications prohibit a key supply of state Medicaid funding, how states finance the non-federal share will seemingly shift within the coming years.

Virtually two-thirds of responding states on the time of the survey thought the prospect of a Medicaid finances shortfall in FY 2026 was “50-50”, “seemingly”, or “nearly sure.” This can be a slight improve from last year’s survey that discovered over half of states had been going through a Medicaid finances shortfall, highlighting the growing uncertainty in state fiscal circumstances. Just a few states have additionally begun implementing finances administration methods like spending cuts or price containment measures. States are going through uncertainty of their longer-term fiscal outlook as a consequence of slowing revenues, growing price pressures, shifting financial circumstances, and up to date federal modifications. Extra states might think about Medicaid cuts as they deal with present Medicaid finances gaps and stay up for the implementation of the Medicaid modifications within the reconciliation regulation.