In anticipation of the Medicare annual open enrollment interval, which runs from October 15 to December 7, the Facilities for Medicare and Medicaid Providers (CMS) not too long ago launched details about Medicare Benefit plans for the approaching 12 months. Information articles following the discharge of plan data report that Medicare Benefit insurers are scaling back their choices in response to adjustments in federal funds and since sudden will increase in using well being providers have led to rising prices and falling income.

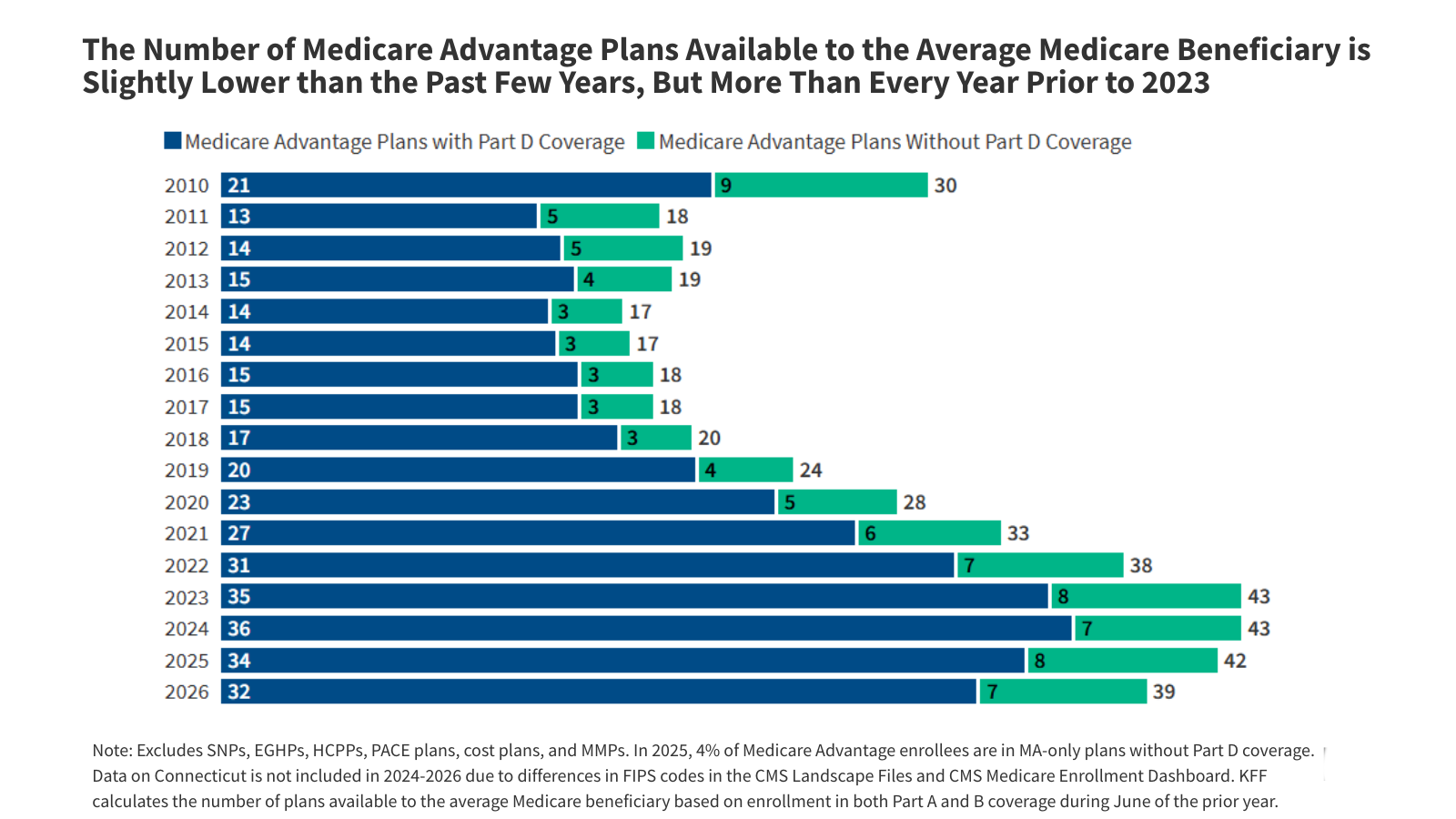

KFF’s evaluation of plan choices exhibits that Medicare beneficiaries can have the choice of 32 Medicare Benefit prescription drug (MA-PD) plans in 2026, two fewer than the 34 options accessible in 2025 (excluding employer plans and particular wants plans). The variety of MA-PD choices has grown steadily since 2010, peaking in 2024 when the typical Medicare beneficiary had 36 choices. Regardless of the decline in choices over the past two years, the variety of choices accessible for 2026 can be greater than the quantity accessible in 2022 (31) and yearly earlier than (Determine 1).

Throughout all Medicare Benefit plans for particular person enrollment, together with these with and with out prescription drug protection, the typical Medicare beneficiary has the choice to decide on amongst 39 plans in 2026, compared to 42 options in 2025. Much like the pattern for MA-PDs, the entire variety of Medicare Benefit plans accessible to the typical beneficiary is greater than the typical variety of plans accessible in 2022 (38), and every year since 2010. Whereas Medicare Benefit plans are required to cowl all Medicare Half A and Half B advantages, plans determine whether or not to incorporate Half D prescription drug protection as a part of the profit package deal. Enrollees might pay a separate premium for Half D protection, or plans can use the rebate portion of their fee from the federal authorities to cowl these prices. Most Medicare Benefit enrollees are in plans that embrace prescription drug protection.

The variety of Medicare Benefit plans with prescription drug protection accessible to the typical beneficiary varies throughout states, as does the change within the variety of plans in comparison with 2025 (Determine 2). In 35 states, DC and Puerto Rico, the typical beneficiary has a selection of fewer plans on common in 2026 than in 2025. The states with the biggest drop within the variety of plans accessible have been New Hampshire (13 fewer plans) and Minnesota (11 fewer plans). In Minnesota, UCare, the second largest Medicare Benefit insurer within the state, exited the market altogether, whereas UnitedHealthcare and Humana decreased their choices, particularly in additional rural counties with decrease enrollment. Nevertheless, in 6 states (AL, HI, KS, MO, UT, and WV), the typical beneficiary has entry to extra plans in 2026 than in 2025, on common. Within the remaining 8 states, the variety of plans accessible to the typical beneficiary stayed the identical. This contains Alaska, which had no plans accessible in 2026, as in 2025 (Alaska has traditionally had few or no Medicare Benefit plans accessible for normal enrollment). Connecticut will not be included on this calculation due to variations in how counties are reported throughout CMS enrollment and plan recordsdata.

Whereas the typical Medicare beneficiary can have greater than 30 Medicare Benefit plans with prescription drug protection to select from, in sure states the variety of choices is considerably decrease. Medicare beneficiaries can have fewer than 5 choices, on common, in 4 states: Alaska (0), South Dakota (4), Wyoming (3), and Vermont (1). Inside states, the variety of plans additionally varies throughout counties (knowledge not included). Traditionally, fewer Medicare Benefit plans have been supplied in probably the most rural areas, and a larger share of Medicare beneficiaries in probably the most rural areas get Medicare protection from conventional Medicare.

The modest lower within the common of Medicare Benefit plans signifies that some Medicare beneficiaries will discover that their present protection is now not an choice for subsequent 12 months. Normally, these beneficiaries reside in counties the place they may proceed to have dozens of different Medicare Benefit plan choices accessible for 2026, in addition to conventional Medicare. Some beneficiaries in plans which have exited the market can have the choice to enroll in a plan supplied by the identical insurer, and in lots of instances, enrollees can be moved into a brand new plan supplied by the identical insurer mechanically if the contract contains one other plan of the identical kind (i.e., HMO or PPO) in the identical county. Others must make an lively selection about their Medicare protection in the event that they want to enroll in one other Medicare Benefit plan, or can be mechanically lined by conventional Medicare.

Yearly, Medicare Benefit plans change in ways in which might be vital to enrollees, together with the scope and generosity of additional advantages, price sharing for Medicare-covered advantages, guidelines for utilizing lined providers (akin to referral necessities and prior authorization), drug formularies, and supplier networks. Regardless of these adjustments, most Medicare beneficiaries report that they don’t examine protection choices on an annual foundation. Additional, prior Medicare focus groups point out that Medicare enrollees are sometimes overwhelmed by the variety of Medicare Benefit decisions and have issue sorting by all plan choices. With greater than 30 Medicare Benefit plans with prescription drug protection accessible in 2026, on common, understanding how plans differ, and why it might matter, might stay a problem.