CMS has simply launched details about Medicare Half D plans for 2026, together with plan availability and premiums for the approaching 12 months. As this 12 months’s Medicare open enrollment interval approaches, there’s some excellent news for Medicare Half D enrollees in terms of month-to-month PDP premiums – lower on average, according to CMS – whilst the full variety of PDPs accessible drops but once more.

The headline of CMS’s press release emphasized stability within the Half D market, however a fast evaluate of the information exhibits that the full variety of stand-alone drug plans accessible in 2026 will fall for the third 12 months in a row, as plan sponsors reduce their PDP choices (for instance, Centene is discontinuing one of many 3 Wellcare PDP choices; Well being Care Service Company is discontinuing one of many 3 Cigna PDP choices and withdrawing from a number of PDP areas) or exit the market completely (as within the case of Elevance’s Anthem PDPs). General, there will probably be fewer PDPs in 2026 than in 2025 – 360 plans nationwide, down from 464 in 2025.

Agency choices to exit the PDP market or reduce their PDP choices in recent times have been primarily based on evaluations in regards to the profitability and viability of the stand-alone drug plan market, significantly for insurers with a smaller footprint, accounting for increased prices related to a redesigned Part D benefit under the Inflation Reduction Act. The legislation added an out-of-pocket spending cap for Half D enrollees starting in 2025 and shifted extra of the share of high-drug price enrollees from the federal authorities to the plans themselves, which elevated plan legal responsibility general. As well as, many insurers that supply each PDP and MA-PD plans have said their interest in focusing resources on extra profitable Medicare Benefit markets.

Considerably extra sudden than the discount in plan availability for 2026 are the year-over-year premium adjustments for PDPs. A complete KFF evaluation will observe sooner or later, however it seems that substantial premium will increase for PDPs throughout the board didn’t materialize, even because the Trump administration scaled back the level of support for added PDP premium subsidies by the non permanent Part D premium stabilization demonstration established by the Biden administration in 2024. For 2026, the federal authorities is offering collaborating PDPs with an across-the-board month-to-month premium subsidy of as much as $10 (down from $15 in 2025) and limiting the month-to-month premium enhance for 2026 to $50 (up from $35 in 2025) – revised parameters which, after they have been introduced, appeared to level within the course of upper premiums for PDP protection in 2026.

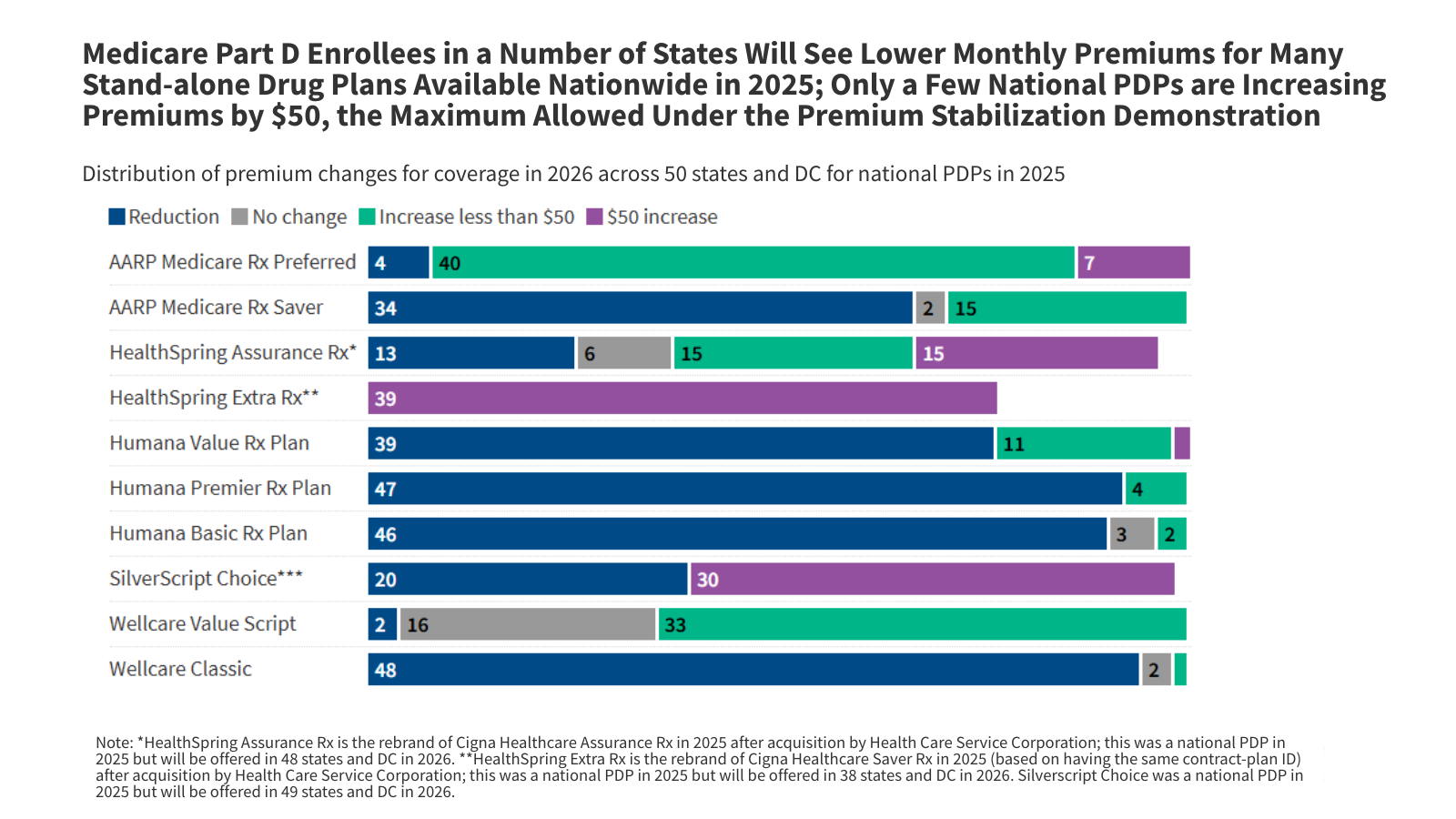

In truth, for all however one of many 10 PDPs that have been provided nationwide in 2025 and that can proceed to be provided on a nationwide or near-national foundation in 2026, Medicare Half D enrollees in quite a lot of states will see decrease month-to-month premiums in 2026 than in 2025. That is in line with CMS’s projection that the typical month-to-month PDP premium will decrease by a few dollars in 2026. Only some nationwide PDPs are growing month-to-month premiums by $50, the utmost allowed beneath the premium stabilization demonstration, and PDP enrollees might have as much as 6 PDPs accessible for $0 premium, relying on the place they stay.

Taking a look at premium adjustments for a number of of the extra in style plans exhibits a blended image, nevertheless, with large variation in month-to-month premiums throughout plans and the 50 states and DC (Determine 1):

- The month-to-month premium for the preferred PDP nationally, Wellcare Worth Script, is growing in additional states (33, together with DC) than the place it’s holding regular (16) or reducing (2), and can vary from $0 to $42.40 throughout states and DC in 2026 (Determine 2).

- Enrollees within the second hottest PDP, Wellcare Basic, will see a premium discount in 48 states (together with DC), no change in 2, and a rise of lower than $50 in 1. Month-to-month premiums will vary from $0 to $45.70 throughout states and DC in 2026.

- Enrollees within the third hottest PDP, SilverScript Alternative, will face the utmost $50 enhance of their month-to-month premium in 30 states (together with DC), however a premium discount in 20 different states. The month-to-month premium will range throughout states and DC from $14.70 to $116.

In response to CMS, virtually all PDP enrollees are in plans sponsored by insurers that opted to take part within the voluntary demonstration for 2026. Within the absence of this demonstration and CMS’s actions through the bidding cycle for 2026 to negotiate and even reject plan bids, PDP premium will increase would probably have been bigger. And with 58% of all Part D enrollees in Medicare Advantage drug plans in 2025 and 42% in stand-alone PDPs, most Half D enrollees are usually not more likely to face premium will increase of any magnitude. It’s because Medicare Benefit plans can use rebate dollars from the federal government to reduce premiums for prescription drug protection. In response to CMS, Medicare Benefit drug plan premiums for 2026 are holding regular at considerably lower levels than stand-alone drug plans, on common, with many plans charging zero premium for drug protection in 2026, as in earlier years.

Even when the month-to-month premium for a given Half D plan isn’t growing, or is even reducing, premiums are just one a part of the story in terms of Half D protection. As is usually suggested throughout open enrollment, Medicare beneficiaries might wish to look beneath the hood to see what different Half D plan options could also be altering, together with what medication are and aren’t coated on the plan’s formulary, tier placement of coated medication, deductibles, and cost-sharing necessities. The tradeoff with a discount in premiums is that drug protection could also be getting much less beneficiant, which might imply fewer medication coated, increased cost-sharing necessities, or better utilization administration restrictions – or probably some mixture of all three.