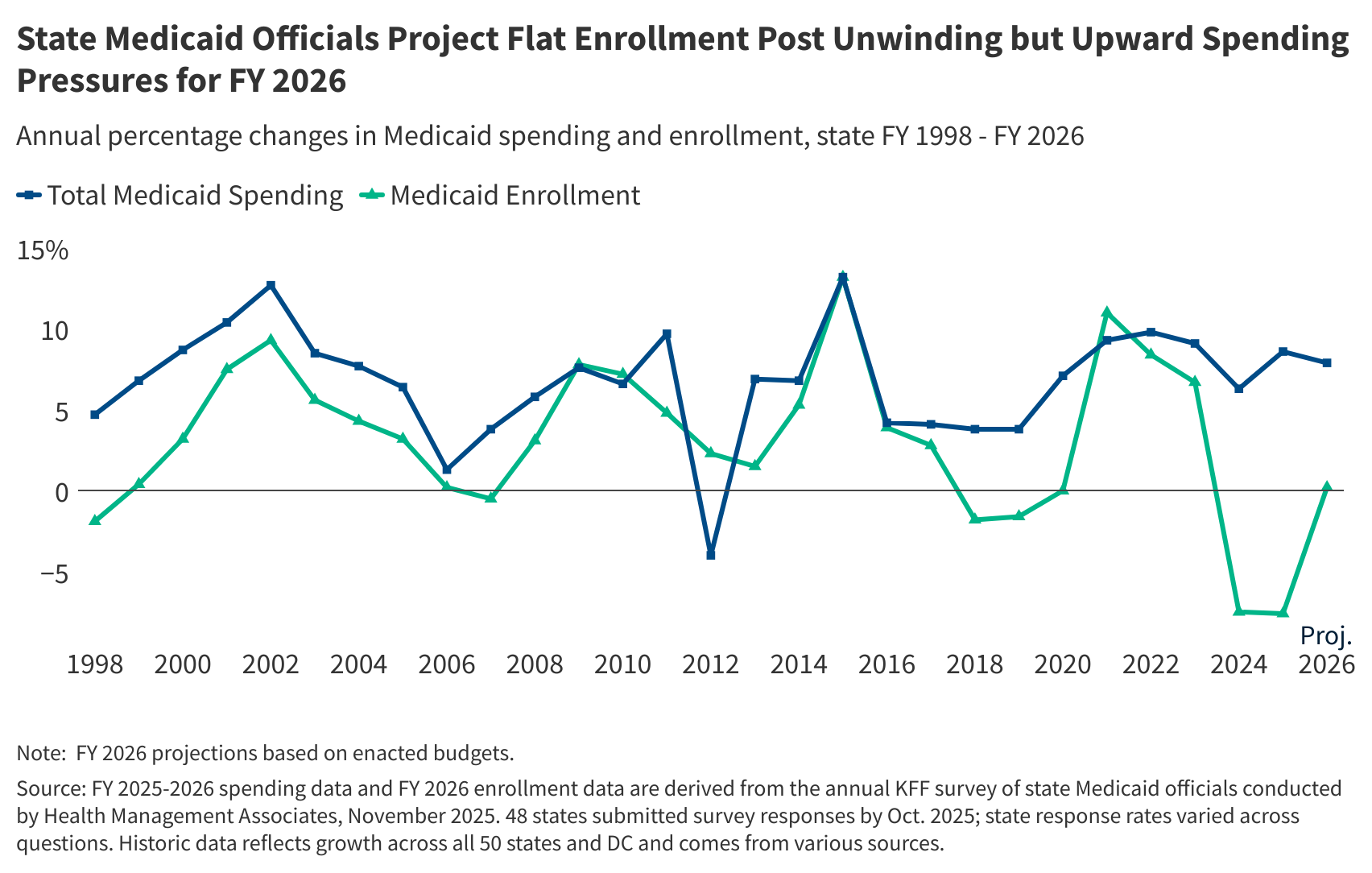

As states accomplished the “unwinding” of pandemic-era steady protection, Medicaid enrollment fell 7.6% in FY 2025 and is predicted to be largely flat in FY 2026, based on KFF’s 25th annual Medicaid Budget Survey. On the identical time, complete Medicaid spending grew by 8.6% in FY 2025 and is predicted to develop by 7.9% in FY 2026. States report that supplier charge will increase, larger enrollee well being care wants, and growing prices for long-term care, pharmacy advantages, and behavioral well being providers are probably the most important drivers of elevated prices.

Along with growing spending calls for, slower income development and heightened fiscal uncertainty have created a extra tenuous fiscal local weather for states in FY 2026. States are additionally making ready for $911 billion in federal Medicaid spending cuts enacted within the price range reconciliation legislation earlier this yr, together with new financing restrictions and work necessities, which can exacerbate current price range challenges. The difficult fiscal local weather and the magnitude of federal Medicaid cuts will make it troublesome for states to soak up or offset the reductions.

Virtually two-thirds of states say they face at the very least a “50-50” likelihood of a Medicaid price range shortfall in FY 2026 as states anticipate state Medicaid spending development of 8.5% in FY 2026 and tight fiscal situations. The reconciliation legislation prohibits all states from establishing new supplier taxes or from growing current taxes, which might enhance state price range pressures. Future necessities to scale back current supplier taxes for states which have adopted the ACA enlargement might lead to further price range pressures.

Regardless that many provisions within the reconciliation legislation don’t take impact till FY 2027 or later, states are already anticipating modifications and associated fiscal pressures. In line with KFF’s companion report, which highlights key coverage priorities and points state Medicaid packages centered on in FY 2025 and are prioritizing in FY 2026, the variety of states making reimbursement charge will increase for particular supplier varieties is slowing whereas there’s an uptick in charge restrictions. Supplier charge modifications typically replicate broader financial situations, and states have sometimes turned to supplier charge restrictions to include prices.

Most states additionally report new or expanded initiatives to include prescription drug prices. Specifically, curiosity in increasing Medicaid protection to incorporate GLP-1s for weight problems remedy is waning, and a few states are planning to limit current protection sooner or later. Sixteen state Medicaid packages reported overlaying GLP-1s for weight problems as of October 1, 2025. Protection of GLP-1 medicine for weight problems is non-compulsory for states, whereas protection is required for situations like diabetes and heart problems.

The survey was carried out in mid-summer of 2025 by KFF and Well being Administration Associates (HMA) in collaboration with the Nationwide Affiliation of Medicaid Administrators (NAMD). This yr’s estimates of Medicaid spending and enrollment replicate what’s assumed in states budgets typically, although projections at all times embrace some uncertainty.