Medicare is the federal medical health insurance program for 69 million individuals ages 65 and over and youthful adults with long-term disabilities. This system helps to pay for a lot of medical care providers, together with hospitalizations, doctor visits, and pharmaceuticals, together with post-acute care, expert nursing facility care, house well being care, hospice care, and preventive providers.

Folks with Medicare might select to obtain their Medicare advantages via conventional Medicare or via a Medicare Advantage plan, comparable to a well being upkeep group (HMO) or most well-liked supplier group (PPO), administered by a non-public well being insurer. Individuals who select conventional Medicare can join a separate Medicare Half D prescription drug plan for protection of outpatient pharmaceuticals and might also think about buying a supplemental insurance coverage coverage (Medigap) to assist with out-of-pockets prices if they don’t have further protection from a former employer, union, or Medicaid. Individuals who go for Medicare Benefit can select amongst dozens of Medicare Benefit plans, which embrace all providers coated beneath Medicare Elements A and B, and sometimes embrace Half D prescription drug protection as properly.

Annually, Medicare beneficiaries have a possibility to make adjustments to how they obtain their Medicare protection throughout the practically 8-week annual open enrollment interval. This temporary solutions key questions in regards to the Medicare open enrollment interval and Medicare protection choices.

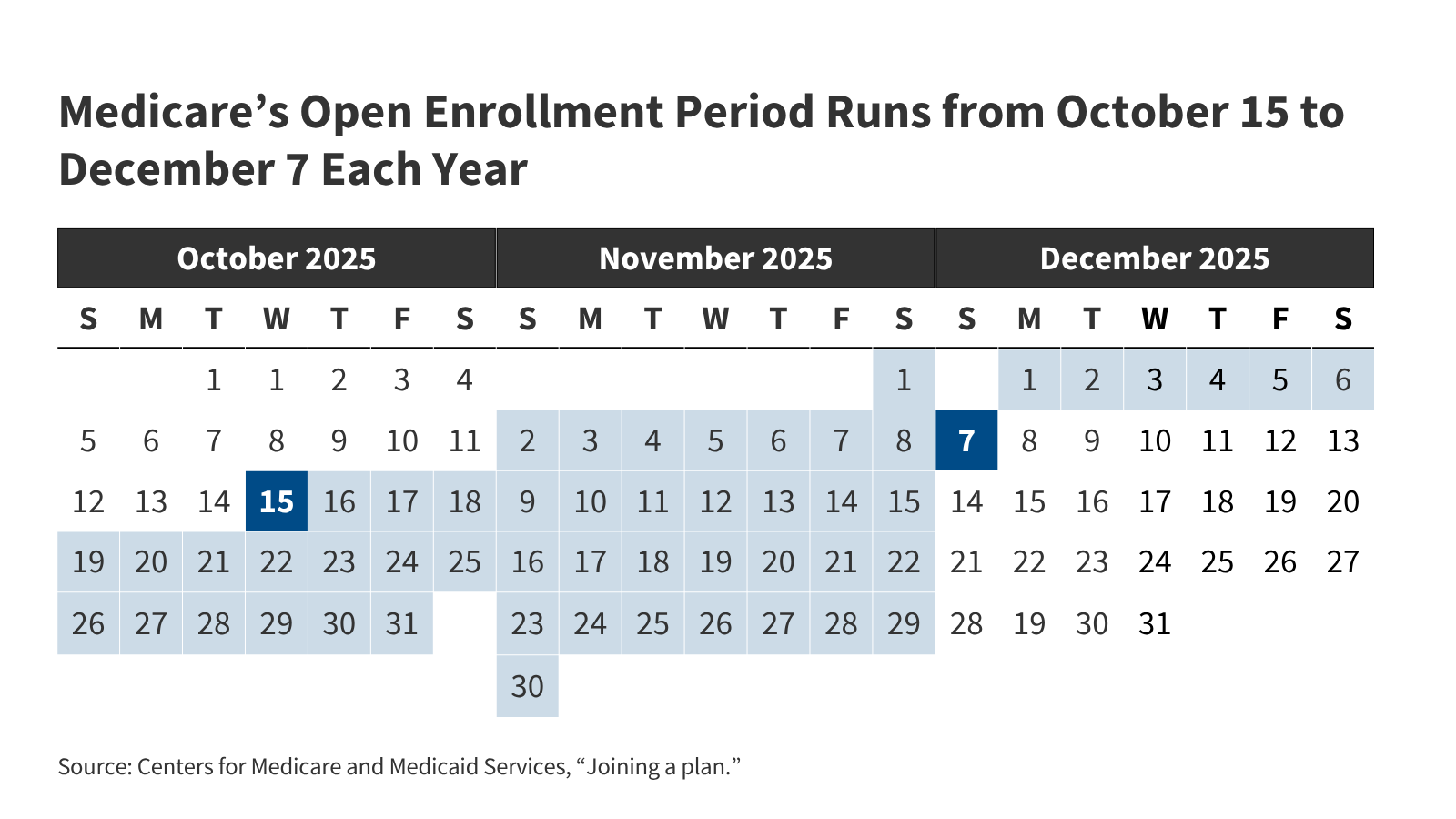

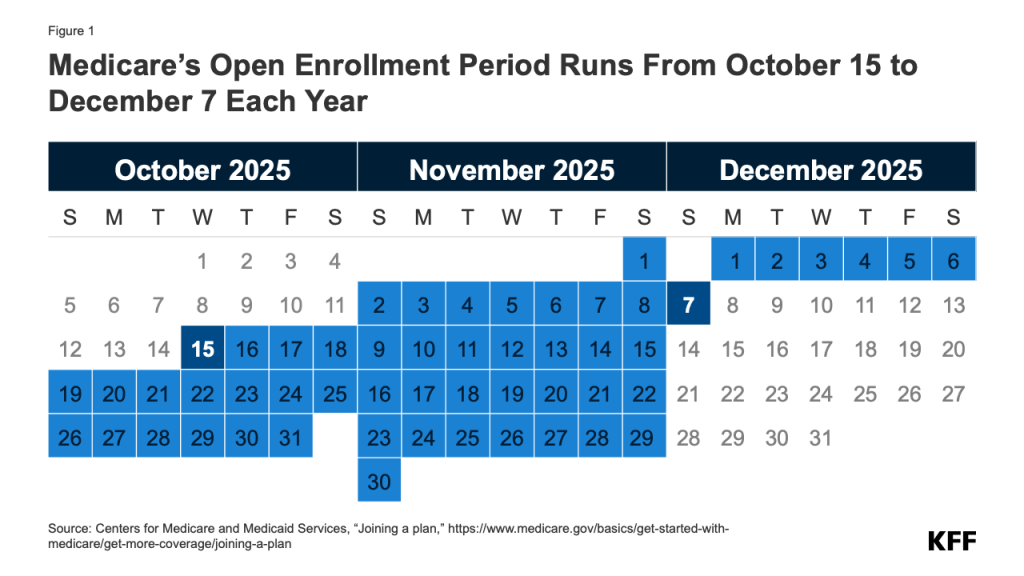

1. When is the Annual Medicare Open Enrollment Interval?

The annual Medicare open enrollment interval runs from October 15 to December 7 annually (Determine 1). Throughout this time, individuals with Medicare can evaluation options of Medicare plans provided of their space and make adjustments to their Medicare protection, which go into impact on January 1 of the next 12 months. These adjustments embrace switching from conventional Medicare to a Medicare Benefit plan (or vice versa), switching between Medicare Benefit plans, and electing or switching between Medicare Half D prescription drug plans.

2. What Adjustments Can Medicare Beneficiaries Make Throughout the Annual Open Enrollment Interval?

Folks in conventional Medicare can use the Medicare open enrollment interval to enroll in a Medicare Half D prescription drug plan or change between Half D plans. Conventional Medicare beneficiaries who didn’t join a Half D plan throughout their preliminary enrollment interval for Medicare can enroll in a Half D plan throughout the annual open enrollment interval, although they might be topic to a late enrollment penalty if they didn’t have comparable prescription drug protection from one other plan earlier than signing up for Half D. Conventional Medicare beneficiaries with Medicare Elements A and B may use this time to modify from conventional Medicare right into a Medicare Benefit plan, with or with out Half D protection.

People who find themselves enrolled in a Medicare Benefit plan can use the Medicare open enrollment interval to decide on a distinct Medicare Benefit plan or change to conventional Medicare. Medicare Benefit enrollees who change to conventional Medicare can enroll in a Half D plan if they need outpatient prescription drug protection, which isn’t coated beneath Medicare Elements A and B. (Beneficiaries could also be topic to late enrollment penalties in the event that they go with out Half D drug protection and don’t produce other creditable protection.) They could additionally think about buying a Medicare supplemental insurance coverage coverage (Medigap) if the choice is on the market to them (see query 4 for particulars about Medigap and potential limits on enrollment).

Medicare beneficiaries are inspired to evaluation their present supply of Medicare protection throughout the annual open enrollment interval and evaluate different choices which can be obtainable the place they stay. As a result of a person’s medical wants can change over the course of the 12 months, and from one 12 months to the subsequent, this may increasingly affect their priorities when selecting how they wish to get their Medicare advantages. Medicare Benefit and Medicare prescription drug plans sometimes change from one 12 months to the subsequent and should differ in lots of ways in which may have implications for an individual’s entry to suppliers and prices. Regardless of this, nearly 7 in 10 (69%) Medicare beneficiaries didn’t evaluate their Medicare protection choices throughout a current open enrollment interval.

3. Are There Different Alternatives for Medicare Beneficiaries to Make Protection Adjustments Exterior of the Open Enrollment Interval?

Medicare offers a number of completely different Special Enrollment Periods (SEPs) the place Medicare beneficiaries could make sure adjustments to their protection outdoors of the annual open enrollment interval beneath sure circumstances. For instance, beneficiaries who expertise disruptions to current protection (comparable to a cross-county transfer or a lack of employer- or union-sponsored protection) or lack of Medicaid eligibility might qualify for a SEP at any time of 12 months.

As of 2025, people who find themselves enrolled in each Medicare and Medicaid (i.e., dual-eligible people) or who qualify for the Medicare Part D Low-Income Subsidy program (also referred to as “Further Assist”), could make sure adjustments to their protection as soon as per thirty days. Beneficiaries in these teams might use this month-to-month SEP to disenroll from a Medicare Benefit plan into conventional Medicare, enroll in a stand-alone Half D drug plan, or change between Half D plans. Nevertheless, they might not use the month-to-month SEP to enroll in Medicare Benefit or change between Medicare Benefit plans, excluding people with full Medicaid advantages who’re switching to a Totally Built-in Dually Eligible Particular Wants Plan (FIDE SNP), a Extremely Built-in Dually Eligible Particular Wants Plan (HIDE SNP), or a coordination-only D-SNP that’s an Relevant Built-in Plan (AIP) that’s aligned with their Medicaid managed care enrollment. Folks residing in nursing houses and sure different services might change their Medicare Benefit or Medicare Half D protection as soon as per thirty days.

Medicare Benefit enrollees who want to change plans or change to conventional Medicare might accomplish that between January 1 via March 31 annually, throughout the Medicare Advantage Open Enrollment Period. (That is along with the open enrollment interval that runs from October 15 to December 7.) Moreover, those that have a Medicare Benefit or Medicare Half D plan with a 5-star high quality score obtainable of their space might switch into a 5-star plan between December 8 and November 30 of the next 12 months.

For 2026, individuals who choose a Medicare Benefit plan primarily based on inaccurate supplier listing data in Medicare Plan Finder might qualify for a brand new, momentary SEP that permits them to modify to a distinct Medicare Benefit plan or return to conventional Medicare in the event that they later uncover that their most well-liked supplier shouldn’t be included of their plan’s community. This momentary SEP is at present restricted to protection selections made for the 2026 plan 12 months and runs for 3 months after the efficient date of plan election. That is distinct from an current SEP that permits Medicare Benefit enrollees to make adjustments to their protection if their plan makes sure adjustments to its supplier community which can be deemed “vital,” comparable to terminating numerous in-network suppliers. (See Q6 for extra details about Medicare Benefit supplier networks.)

The annual open enrollment interval and different alternatives to modify protection are distinct from the preliminary enrollment interval for people who find themselves newly enrolling in Medicare, which begins three months earlier than an individual’s 65th birthday and ends three months after it. For extra data on preliminary enrollment, see KFF’s Medicare Open Enrollment FAQ.

Many Medicare beneficiaries have some type of additional coverage, comparable to a Medicare Supplemental Insurance coverage coverage (Medigap) or protection provided by an employer or a union, that helps with Medicare’s cost-sharing necessities. Enrollment in these plans and applications shouldn’t be tied to the open enrollment interval, although beneficiaries might want to take them under consideration when contemplating their choices for Medicare protection.

Medigap. Folks in conventional Medicare with each Half A and Half B can apply for a Medigap coverage at any time of the 12 months. Medigap insurance policies are designed to assist beneficiaries in conventional Medicare with Medicare’s deductibles and cost-sharing necessities and have customary advantages to permit for apples-to-apples comparisons throughout insurers. Conventional Medicare beneficiaries with a Medigap plan that covers most deductible and cost-sharing necessities might have decrease out-of-pocket spending for Medicare-covered providers than individuals with different protection, together with a Medicare Benefit plan. Medigap insurance policies are designed to wrap round conventional Medicare, and don’t work with Medicare Benefit. Folks enrolled in Medicare Benefit do not need (and can’t buy) a Medigap coverage.

Whereas Medigap insurers are required to subject insurance policies to individuals age 65 or over, with out regard to well being standing or identified medical circumstances after they first enroll in Medicare, these with pre-existing circumstances may be denied a Medigap policy or face greater premiums in most states in the event that they apply for Medigap protection after their first six months of enrollment in Half B. Individuals who disenroll from Medicare Benefit inside 12 months of first enrolling in Medicare Benefit have a proper to buy a Medigap coverage with out regard to medical historical past, however after 12 months, they don’t seem to be assured Medigap protection and could also be denied a coverage as a consequence of a pre-existing situation or face greater Medigap premiums if they’re provided a coverage.

Medigap assured subject rights are completely different for individuals beneath age 65 who qualify for Medicare as a consequence of long-term incapacity. Federal regulation doesn’t require Medigap insurers to promote a coverage to individuals with Medicare beneath age 65, though several states do require insurers to offer at least one kind of Medigap policy to people under 65. Premiums for Medigap insurance policies bought to individuals beneath age 65 are sometimes greater than insurance policies bought to these age 65 or older. Folks beneath age 65 with disabilities who’re already enrolled in Medicare will qualify for the 6-month Medigap open enrollment interval after they flip 65 and change into age eligible for Medicare. At this level, they’ll purchase any Medigap coverage they need with out going through greater premiums or denials of protection primarily based on their current medical circumstances.

Employer-sponsored protection. Whereas employer-sponsored retiree well being advantages are on the decline, greater than 14.5 million people with Medicare have retiree well being protection (distinct from individuals with Medicare Half A solely who proceed to work and have medical health insurance via their present employer or a partner’s present employer). Retiree well being advantages could also be designed to complement both conventional Medicare or Medicare Benefit. Some employers that supply well being advantages to retirees on Medicare provide these advantages completely via a Medicare Benefit plan. Beneficiaries with retiree well being protection provided completely via a Medicare Benefit plan might lose these advantages in the event that they select to modify to conventional Medicare throughout the annual open enrollment interval. Equally, employers might solely provide a retiree well being profit that dietary supplements conventional Medicare. If an individual with such protection switches from conventional Medicare to Medicare Benefit throughout an open enrollment interval, they might lose their retiree well being advantages. In actual fact, if a Medicare beneficiary drops their employer or union-sponsored retiree well being advantages for any cause, they might not have the ability to get them again.

5. How Does Extra Help for Low-Revenue Folks Issue into Medicare Protection Choices?

Low-income Medicare beneficiaries who meet their states’ Medicaid eligibility standards qualify for extra protection of providers via Medicaid that aren’t coated beneath Medicare, comparable to long-term providers and helps. Moreover, Medicare beneficiaries with modest incomes might qualify for assistance with Medicare premiums and out-of-pocket costs from the Medicare Financial savings Applications (MSP) and Half D Low-Revenue Subsidy (LIS) if their revenue and property are beneath sure quantities. Medicare beneficiaries who’re eligible for Medicaid, the Medicare Financial savings Applications (MSPs), or Medicare Half D Low-Revenue Subsidies (LIS), however not but enrolled in these applications, can enroll at any time of the 12 months. This extra protection and help might issue into how individuals select to obtain their Medicare advantages.

Medicaid. For individuals with Medicare who qualify for full Medicaid advantages, their selection of Medicare protection can impression how they obtain Medicaid advantages and the diploma to which these advantages are coordinated with Medicare. Basically, Medicaid wraps round Medicare protection, with Medicare as the first payer and Medicaid paying for prices and providers not coated by Medicare. People who find themselves eligible for each Medicare and Medicaid (dual-eligible people) can enroll in a Medicare Benefit plan designed for this inhabitants, comparable to a dual-eligible Special Needs Plan (SNP), and relying on the state and the plan, might expertise a better degree of coordination of their advantages. Starting in 2025, individuals who qualify for full Medicaid advantages could make sure adjustments to their Medicare protection outdoors of the open enrollment interval, as much as as soon as per thirty days (see Q3 for additional particulars).

Medicare Financial savings Applications. By the Medicare Financial savings Applications (MSP), state Medicaid applications pay Medicare premiums and, in lots of instances, price sharing for Medicare beneficiaries who’ve revenue and property beneath sure quantities (although some states have lifted their revenue and/or asset thresholds above the federal limits). Particularly, states cowl the Medicare Half B premium for individuals who qualify and might also present help with Medicare deductibles and different cost-sharing necessities. Individuals who obtain MSP help and are enrolled in a Medicare Benefit plan should still have price sharing related to non-Medicare coated providers provided by the plan. Individuals who qualify for MSP however not full Medicaid advantages (typically known as “partial Medicaid advantages”) may make sure adjustments to their protection outdoors of the open enrollment interval, as much as as soon as per thirty days.

Half D Low-Revenue Subsidy. Individuals who qualify for the Half D Low-Revenue Subsidy (LIS) obtain varying levels of assistance towards their Half D prescription drug protection premiums and price sharing, relying on their revenue and asset ranges. Twin-eligible people, individuals enrolled within the Medicare Financial savings Applications, and people who obtain Supplemental Safety Revenue funds from Social Safety robotically qualify for LIS advantages, and Medicare robotically enrolls them right into a stand-alone Half D drug plan of their space with a premium at or beneath a certain quantity (the Low-Revenue Subsidy benchmark) if they don’t select a plan on their very own. Different beneficiaries are topic to each an revenue and asset take a look at and wish to use for the LIS via both the Social Safety Administration or Medicaid. Individuals who obtain LIS help can choose any Half D plan provided of their space, but when they enroll in a plan that isn’t a so-called “benchmark plan” (that’s, plans obtainable and not using a premium to enrollees receiving full LIS), or their present plan loses benchmark standing, they might be required to pay some portion of their plan’s month-to-month premium, which might diminish the worth of the premium subsidy. Individuals who obtain LIS may make sure adjustments to their protection outdoors of the open enrollment interval, as much as as soon as per thirty days.

6. How Do the Options of Conventional Medicare Examine to These of Medicare Benefit?

Conventional Medicare and Medicare Benefit each present protection of all providers included in Medicare Half A and Half B, however sure options, comparable to out-of-pocket prices, supplier networks, and entry to additional advantages differ between these two sorts of Medicare protection. When deciding between conventional Medicare and Medicare Benefit, Medicare beneficiaries might wish to think about a wide range of elements, comparable to their very own well being and monetary circumstances, preferences for the way they get their medical care, which suppliers they see, and their prescription drug wants. These selections might contain cautious consideration of premiums, deductibles, price sharing and out-of-pocket spending; additional advantages provided by Medicare Benefit plans; how the selection of protection possibility might have an effect on entry to sure physicians, specialists, hospitals and pharmacies; guidelines associated to prior authorization and referral necessities; and variations in protection and prices for pharmaceuticals.

Folks might choose conventional Medicare if they need the broadest doable entry to medical doctors, hospitals and different well being care suppliers. Conventional Medicare beneficiaries may even see any supplier that accepts Medicare and, if they’re new to the supplier, accepts new sufferers. Folks with conventional Medicare should not required to acquire a referral for specialists or psychological well being suppliers. Moreover, prior authorization is never required in conventional Medicare and solely applies to a limited set of services. With conventional Medicare, individuals have the power to decide on amongst stand-alone prescription drug plans provided of their space, which are likely to differ extensively when it comes to which medication are coated and at what price. (Starting in 2026, a pilot initiative referred to as the Wasteful and Inappropriate Services Reduction (WISeR) model will take a look at the usage of prior authorization in conventional Medicare for a small set of outpatient providers in six states. The WISeR mannequin is proscribed to conventional Medicare, although most Medicare Benefit plans already require prior authorization for some providers.)

Folks might choose Medicare Benefit if they need additional advantages, comparable to protection of some dental and imaginative and prescient providers, and lowered price sharing provided by these plans, typically for no further premium (aside from the Half B premium). Moreover, Medicare Benefit plans are required to incorporate a cap on out-of-pocket spending, offering some safety from catastrophic medical bills. Medicare Benefit plans additionally provide the good thing about one-stop buying (i.e., individuals who enroll have protection beneath one plan and don’t want to join a separate Half D prescription drug plan or a Medigap coverage to complement conventional Medicare).

7. How do Medicare Benefit Plans Fluctuate?

The typical Medicare beneficiary can select from 39 Medicare Benefit plans in 2026, together with 32 Medicare Benefit plans with Half D protection, although the typical variety of plan choices varies widely across states (Determine 2). These plans differ throughout many dimensions, together with premiums and out-of-pocket spending, supplier networks, additional advantages, prior authorization and referral requirements, and prescription drug protection. Consequently, enrollees face completely different out-of-pocket prices, entry to suppliers and pharmacies, and protection of non-Medicare advantages (comparable to dental, imaginative and prescient and listening to) primarily based on the Medicare Benefit plan they select.

Premiums and out-of-pocket spending. Medicare Benefit enrollees could also be charged a separate month-to-month premium (along with the Half B premium). In 2025, the typical enrollment-weighted premium for Medicare Benefit plans was $13 per month, although three quarters (76%) of enrollees have been in plans that charged no further premium (aside from the Half B premium).

Medicare Benefit plans are typically prohibited from charging greater than conventional Medicare, however differ within the deductibles, co-pays and co-insurance they require. For instance, plans sometimes cost a each day co-pay for hospital stays, which differ each within the quantity and the variety of days for which they apply.

Medicare Benefit plans are required to incorporate a cap on out-of-pocket bills. In 2025, this cover might not exceed $9,350 for in-network services or $14,000 for all covered services. Most plans have an out-of-pocket restrict beneath this cover, averaging $5,320 for in-network providers and $9,547 for in-network and out-of-network providers mixed. Out-of-pocket limits solely apply to providers coated beneath Medicare Elements A and B.

Supplier networks. Medicare Benefit plans are permitted to restrict their supplier networks, the dimensions of which might differ significantly for each physicians and hospitals, relying on the plan and the county the place it’s provided. Medicare Benefit plans that embrace prescription drug protection might also set up pharmacy networks or designate most well-liked pharmacies, the place enrollees may have decrease out-of-pocket prices. If a Medicare Benefit plan offers protection of out-of-network suppliers, it could require greater price sharing from enrollees for these providers. For the 2026 plan 12 months, the Medicare Plan Finder device will incorporate searchable supplier directories for Medicare Benefit plans. Whereas these directories will initially embrace plan community data sourced from a third-party vendor, insurers can be required to supply common updates to this data from January 2026 onward, together with notifications inside 30 days of any adjustments to a plan’s community and annual attestations that the listed directories are updated.

Further advantages. Medicare Benefit plans might select to supply additional advantages not coated by conventional Medicare, comparable to some protection of dental, imaginative and prescient, and listening to providers. Just about all Medicare Benefit enrollees are in a plan that offers extra benefits, together with some protection of eye exams and/or eyeglasses (greater than 99%), dental care (98%), listening to exams and/or aids (95%), and a health profit (94%). Moreover, a majority of Medicare Benefit enrollees are in plans that present an allowance for over-the-counter objects (79%) and meals following a hospital keep (70%). Whereas additional advantages are frequent, the scope of protection varies extensively from plan to plan. For instance, in 2021, greater than half (59%) of Medicare Benefit enrollees have been in a plan with a maximum dental benefit of $1,000 or much less, whereas practically one-third (30%) have been in a plan with a restrict between $2,000 and $5,000.

Prior authorization and referral necessities. Medicare Benefit plans might require enrollees to obtain prior authorization earlier than a service can be coated. In 2023, nearly 50 million prior authorization requests have been submitted to insurers on behalf of Medicare Benefit enrollees, and in 2025, just about all Medicare Benefit enrollees are in plans that require prior authorization for some providers, comparable to inpatient hospital stays, diagnostic checks and procedures, or stays in a talented nursing facility. Prior authorization might also be required for some providers included in a plan’s additional advantages, comparable to listening to and eye exams or complete dental providers. As well as, Medicare Benefit plans might require enrollees to acquire a referral from a major care supplier to be able to see a specialist or mental health provider.

Starting in 2026, Medicare Benefit plans can be required to observe further necessities when making prior authorization selections. These embrace issuing selections inside a set timeframe (7 calendar days for normal requests or 72 hours for expedited requests), informing beneficiaries and suppliers of the precise cause a request is denied, and reporting sure details about their prior authorization processes on their public web sites by March 31 annually, such because the share of requests that have been accepted, denied, or accepted after enchantment within the prior calendar 12 months.

Prescription drug protection. Medicare Benefit enrollees who need prescription drug protection should select a plan that provides this protection, as they don’t seem to be permitted to enroll in a stand-alone prescription drug plan whereas enrolled in Medicare Benefit. Medicare Benefit plans that embrace prescription drug protection might also cost a drug deductible. Drug protection in Medicare Benefit plans varies alongside the identical dimensions as drug protection in stand-alone Half D plans (described beneath).

8. How Do Half D Plans Fluctuate?

Medicare beneficiaries have between 8 and 12 stand-alone Part D plans to select from for 2026 (Determine 3) (along with numerous Medicare Benefit drug plans, in the event that they wish to think about Medicare Benefit for all of their Medicare-covered advantages). For conventional Medicare beneficiaries who wish to add Half D protection, stand-alone Half D plans differ when it comes to premiums, deductibles and price sharing, the medication which can be coated and any utilization administration restrictions that apply, and pharmacy networks. These variations can have an effect on enrollees’ entry to pharmaceuticals and out-of-pocket prices.

Premiums. Folks in conventional Medicare who’re enrolled in a separate stand-alone Half D plan typically pay a month-to-month Half D premium except they qualify for advantages via the Half D Low-Revenue Subsidy (LIS) program and are enrolled in a premium-free (benchmark) plan. In 2025, the typical enrollment-weighted premium for stand-alone Half D plans was $39 per month. Changes to the Part D benefit within the Inflation Discount Act, such because the cap on out-of-pocket drug spending for Half D enrollees ($2,100 in 2026), imply decrease out-of-pocket prices for a lot of Medicare beneficiaries however greater prices for Half D plan sponsors (see Q9 for additional dialogue of the Inflation Discount Act).

Deductibles and price sharing. Deductibles and cost-sharing necessities for prescription drug protection differ throughout plans. In 2026, the usual deductible for Half D protection is $615, however some plans cost a decrease or no deductible. Plans typically impose a tier construction to outline the cost-sharing quantities charged for various kinds of medication. Plans sometimes cost decrease cost-sharing quantities for generic medication and most well-liked manufacturers and better quantities for non-preferred and specialty medication, and cost a mixture of flat greenback copayments and coinsurance (primarily based on a proportion of a drug’s record worth) for coated medication. Separate cost-sharing rules now apply to insulin, the place copays are capped at $35 per thirty days, and grownup vaccines coated beneath Half D, the place no price sharing will be charged, primarily based on provisions within the Inflation Discount Act of 2022.

Medication coated and utilization administration restrictions. Half D plans embrace an inventory of medicine they cowl (additionally known as a plan’s formulary). As well as, plans impose utilization administration restrictions on some coated pharmaceuticals, together with prior authorization, amount limits, and step remedy, which might have an effect on beneficiaries’ entry to drugs. In 2025, Half D plans utilized utilization administration necessities to round half of all drugs coated on a plan’s formulary.

Pharmacy networks. Half D prescription drug plans might set up pharmacy networks or designate most well-liked pharmacies, the place enrollees may have decrease out-of-pocket prices.

9. What Adjustments Have Been Made to Medicare Eligibility Based mostly on Immigration Standing?

Previous to the tax and budget reconciliation law enacted in 2025, residents of the U.S. ages 65 or older, together with residents, everlasting residents, and lawfully-present immigrants, have been eligible for premium-free Medicare Half A if they’d labored a minimum of 40 quarters (10 years) in jobs the place they or their spouses paid Medicare payroll taxes. Lawfully-present immigrants ages 65 or older with out this work historical past may buy Medicare Half A after residing legally within the U.S. for 5 steady years. Lawfully-present immigrants beneath age 65 with long-term disabilities may additionally qualify for Medicare, offered they met the identical eligibility necessities for Social Safety Incapacity Insurance coverage (SSDI) that apply to residents. These necessities are primarily based on work historical past, cost of Social Safety taxes on revenue, and having sufficient years of Social Safety taxes accrued to equal between 20 and 40 work credit (5-10 years).

Beginning in July 2025, Medicare eligibility is proscribed to U.S. residents, everlasting residents (i.e., inexperienced card holders), Cuban-Haitian entrants, and other people residing beneath the Compacts of Free Affiliation. Lawfully-present immigrants who don’t meet these standards, comparable to refugees, asylees, and other people with Non permanent Protected Standing, will now not eligible for Medicare no matter age or work historical past. People with present Medicare protection who don’t fall in any of those classes may have their protection terminated no later than January 2027.

10. What Assets are Out there to Help Medicare Beneficiaries in Understanding Their Protection Choices?

Folks with Medicare can be taught extra about Medicare protection choices and the options of various plan choices by reviewing the Medicare & You handbook. As well as, individuals can evaluation and evaluate the Medicare choices obtainable of their space through the use of the Medicare Plan Compare web site, a searchable device on the Medicare.gov web site, by calling 1-800-MEDICARE (1-800-633-4227), or by contacting their native State Health Insurance Assistance Program (SHIP). SHIPs provide native, customized counseling and assistance to individuals with Medicare and their households. Contact data for state SHIPs will be discovered by calling 877-839-2675 or by checking the itemizing offered on the Medicare.gov website.

Moreover, many individuals use insurance coverage brokers and brokers to navigate their protection choices. Whereas impartial brokers and brokers will be useful, they’re sometimes financially compensated by non-public insurers for enrolling individuals of their plans, and often receive higher commissions if individuals select a Medicare Benefit plan somewhat than remaining in conventional Medicare and buying a supplemental Medigap coverage and stand-alone Half D plan.